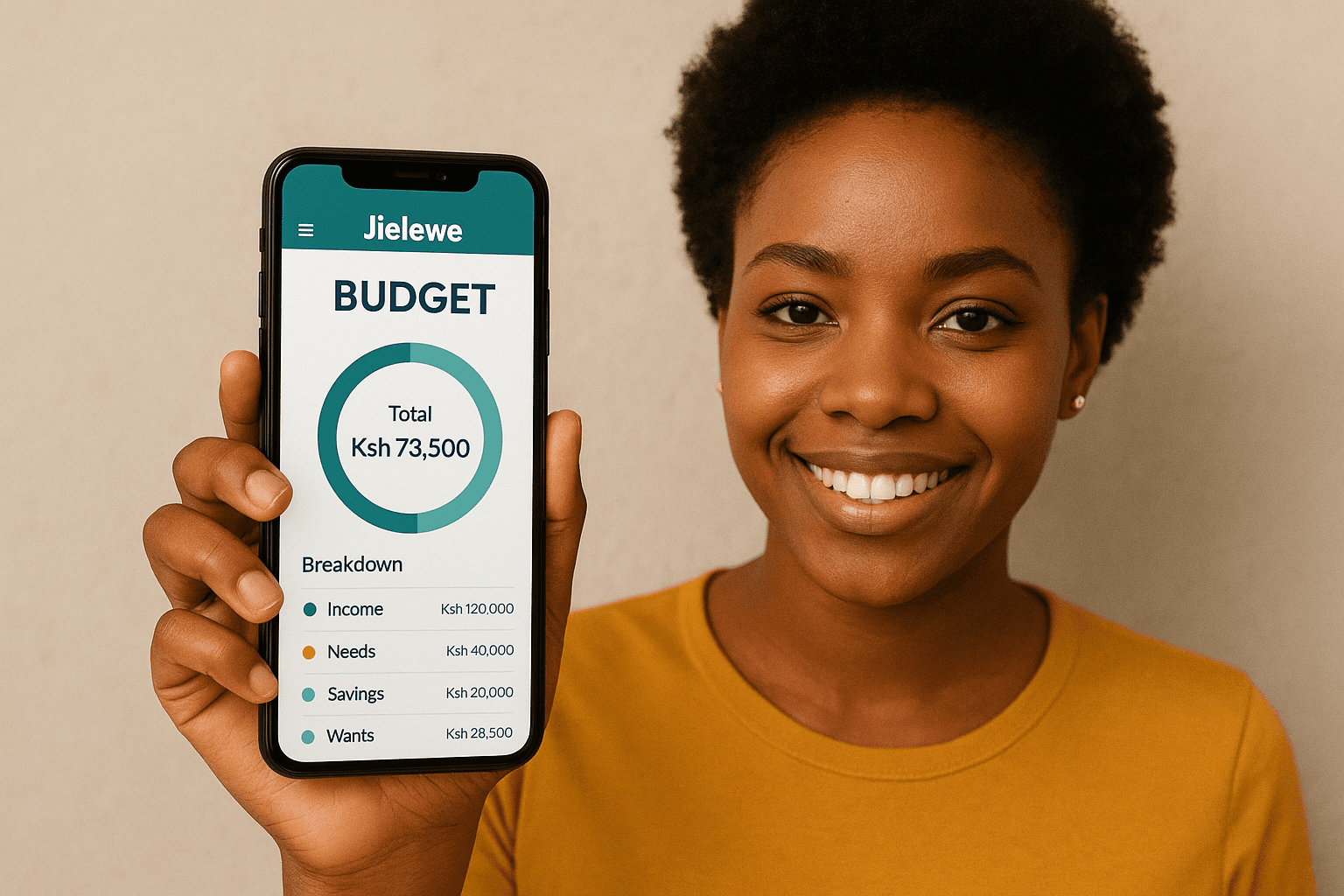

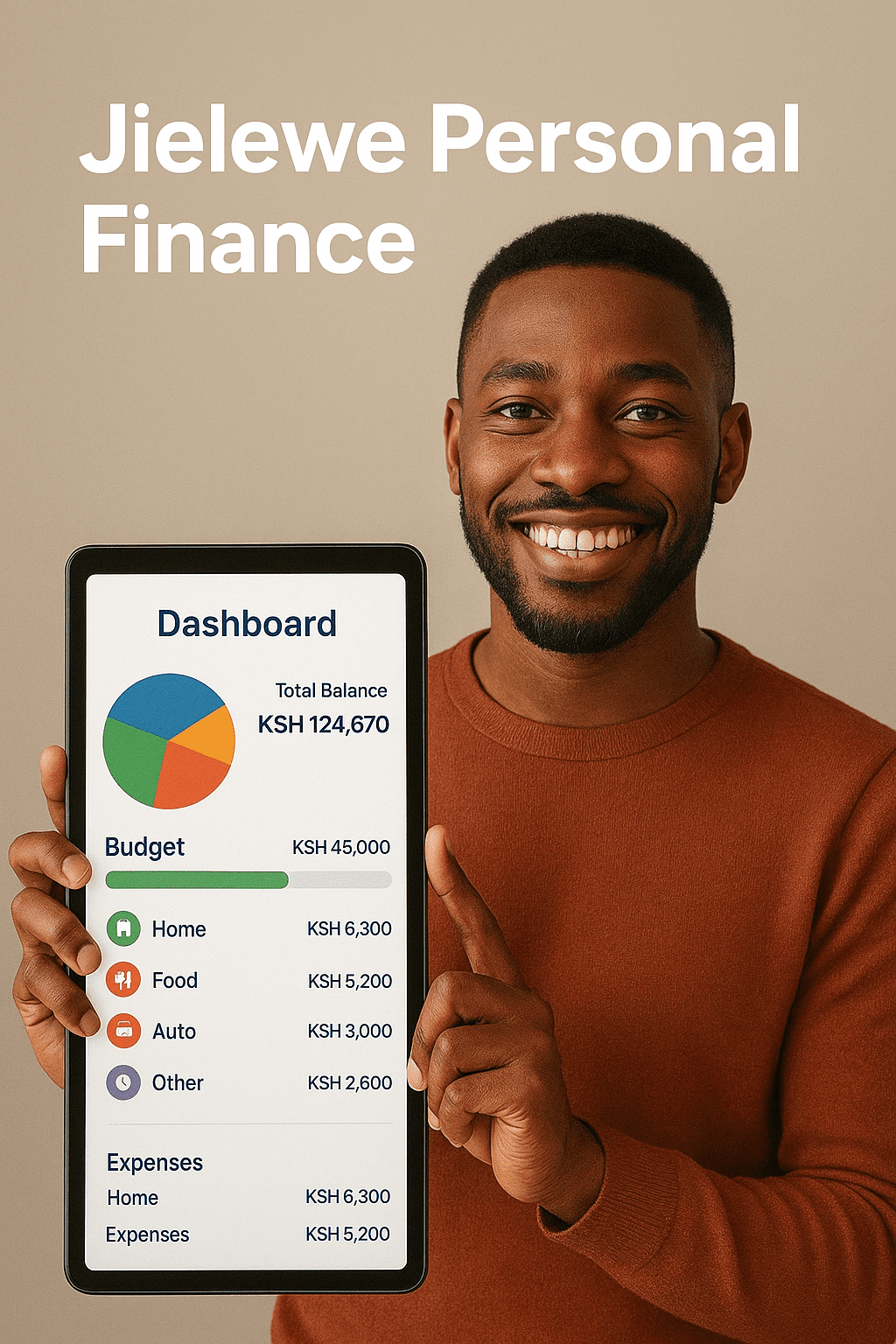

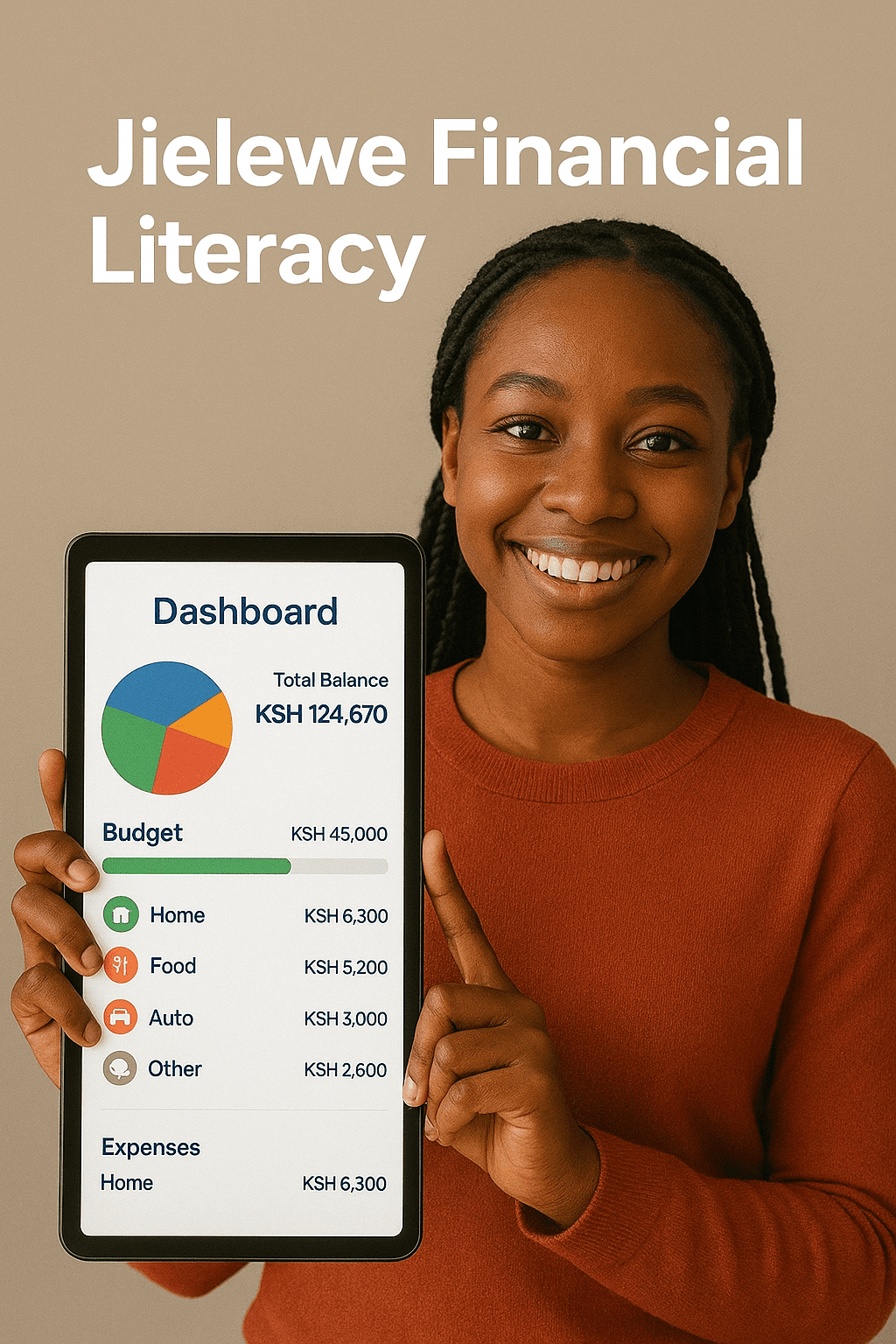

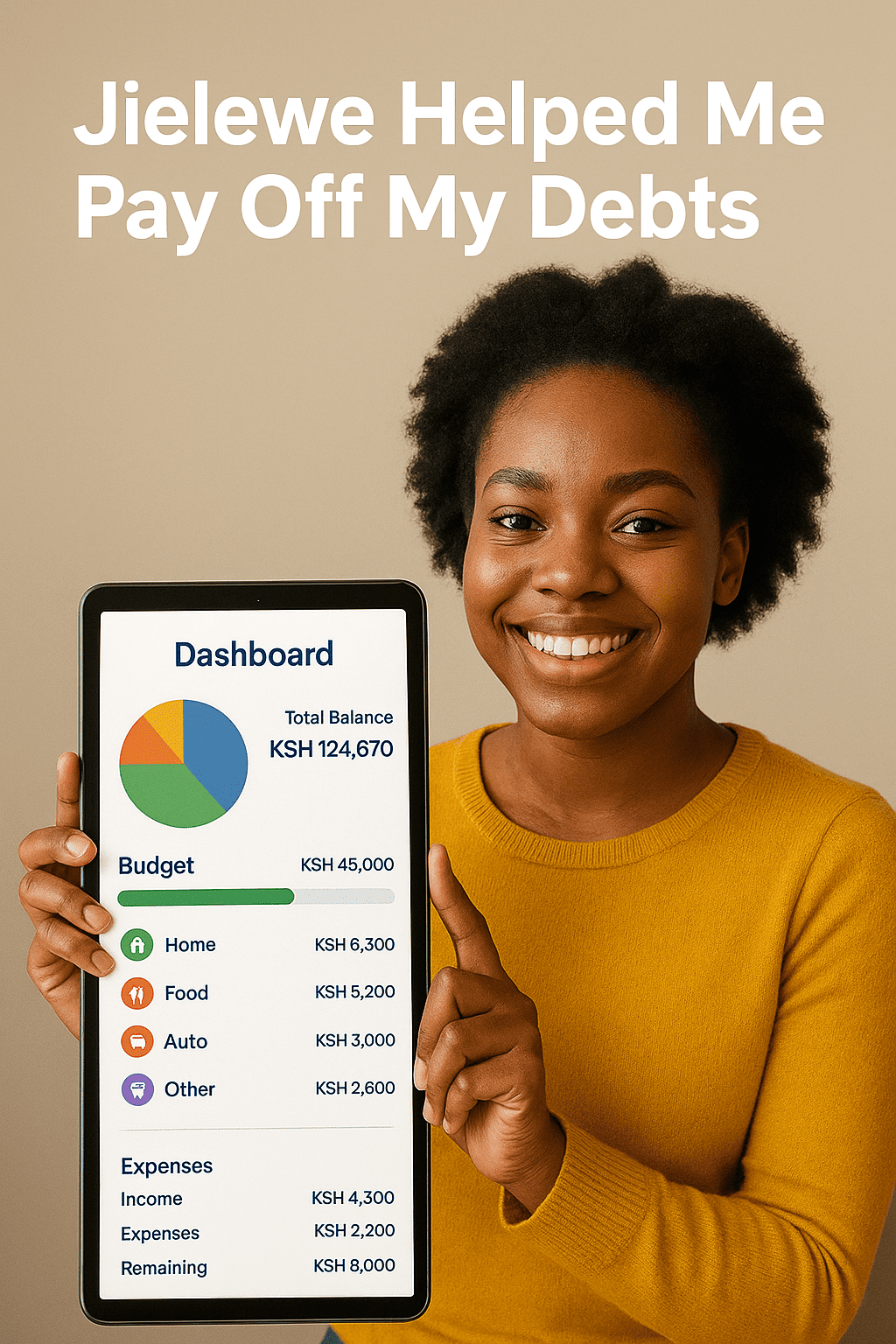

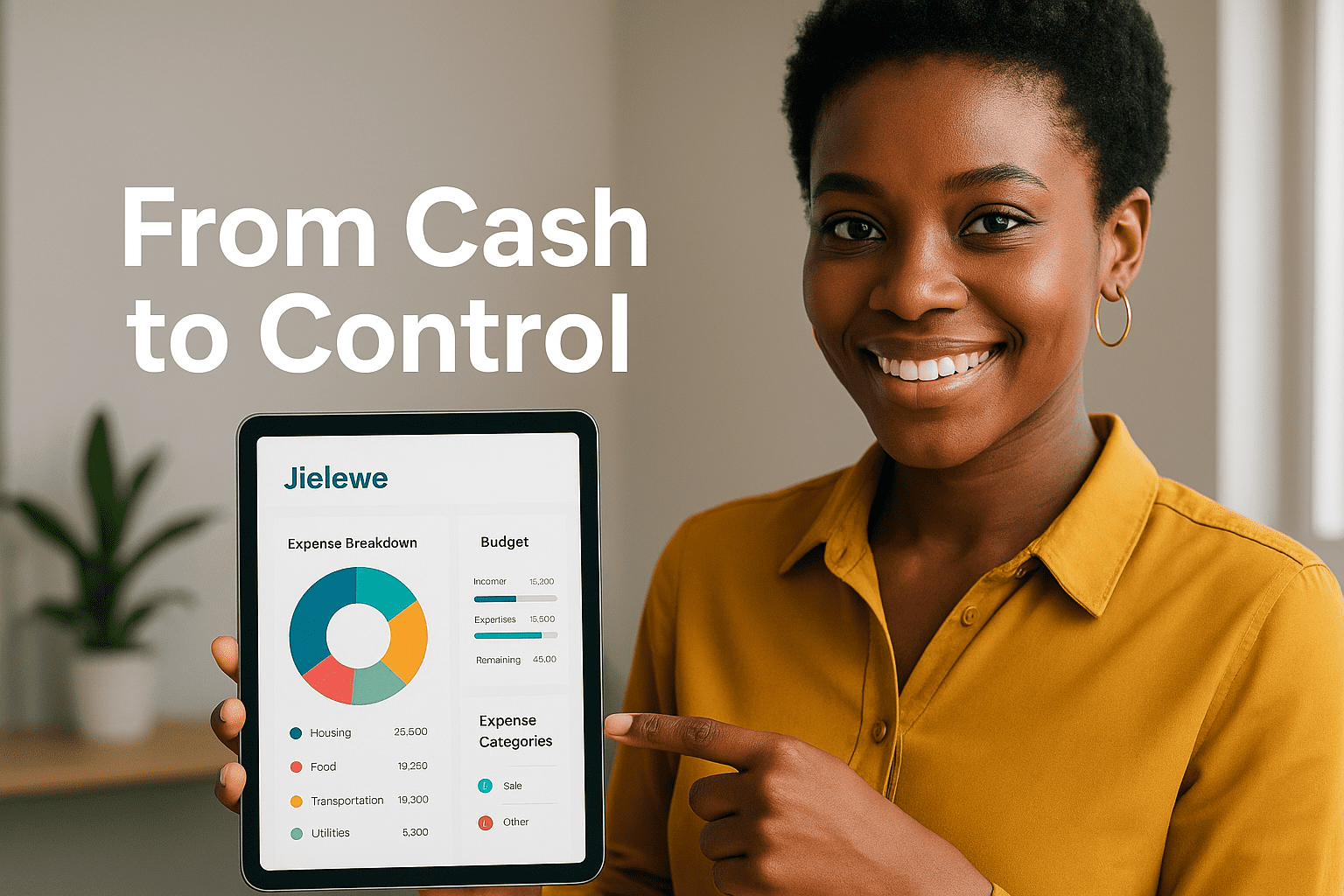

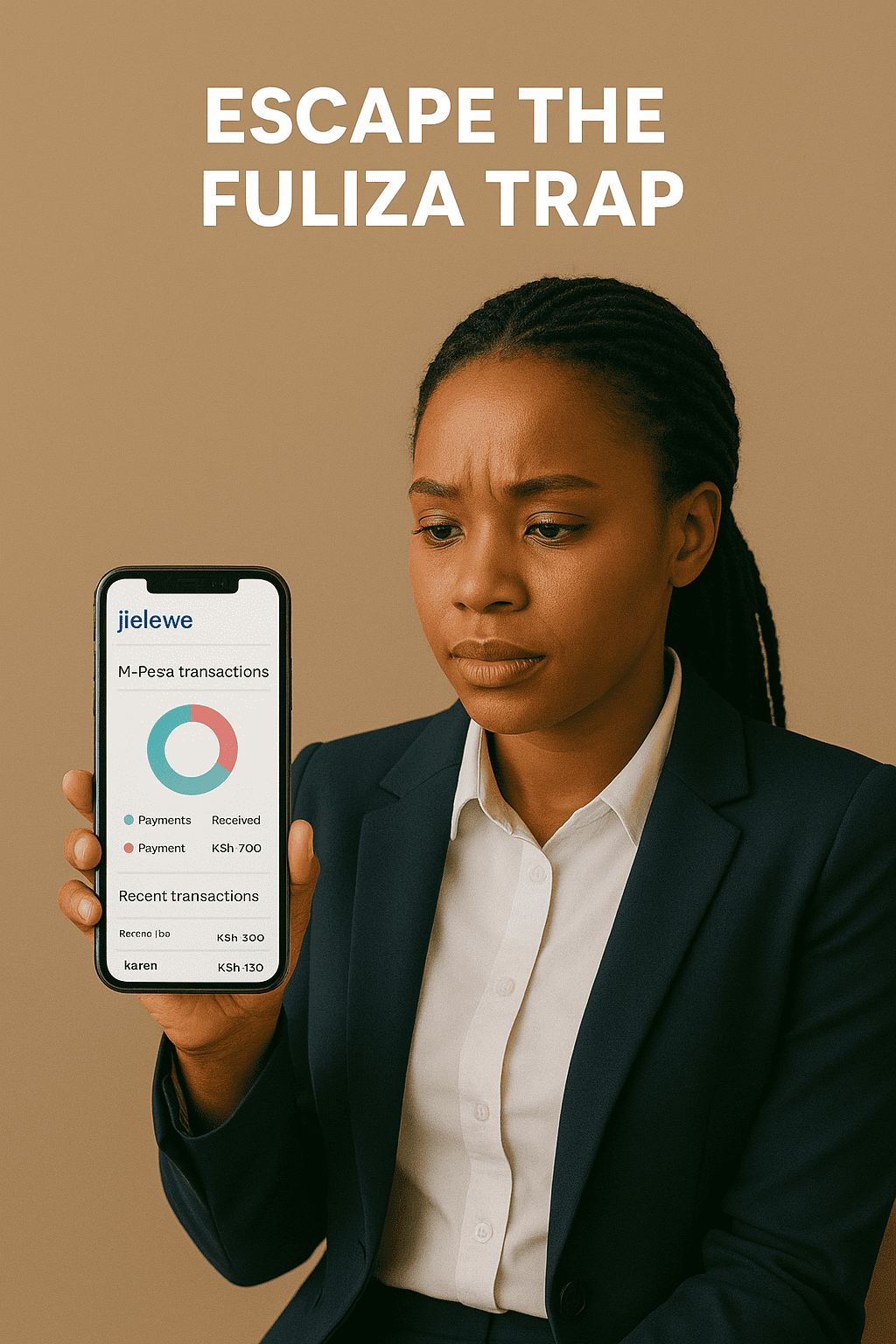

Smart Budgeting in Kenya: How to Take Control of Your Money

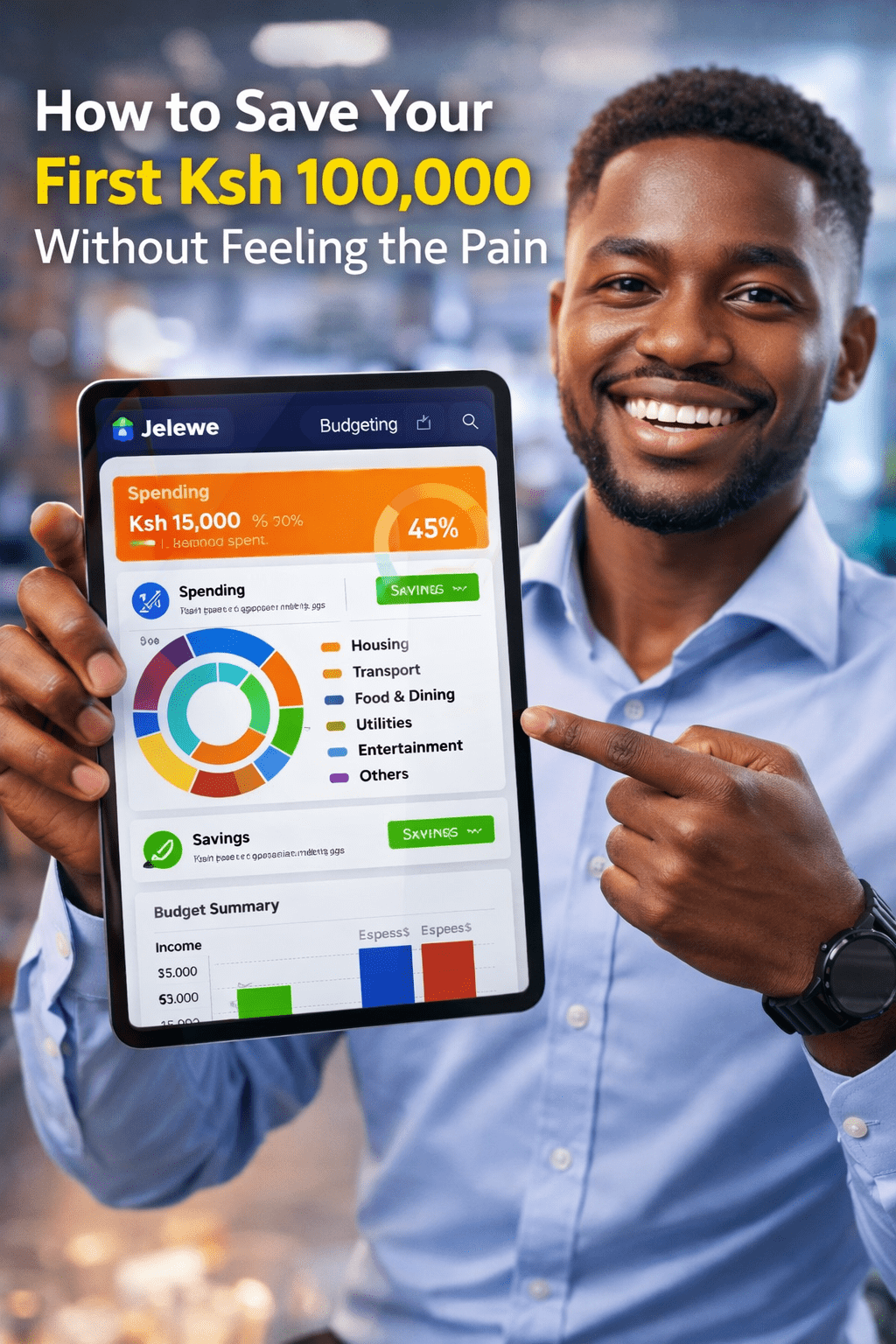

In today’s Kenya, where the cost of living is rising and every shilling counts, budgeting is no longer optional — it’s a survival skill. Whether you’re a student, employed, running a small business, or part of a chama, having a clear plan for your money is the first step toward financial freedom. That’s why we … Read more