Debt is one of the biggest obstacles to financial stability in Kenya today. From Fuliza overdrafts, mobile loans (Tala, Branch, Hustler Fund, M-Shwari), to chama and SACCO debts, many Kenyans feel trapped in a cycle where money comes in only to go out almost immediately.

But here’s the truth: Debt doesn’t have to define your financial future. With the right plan and tools, you can move from debt stress to financial freedom.

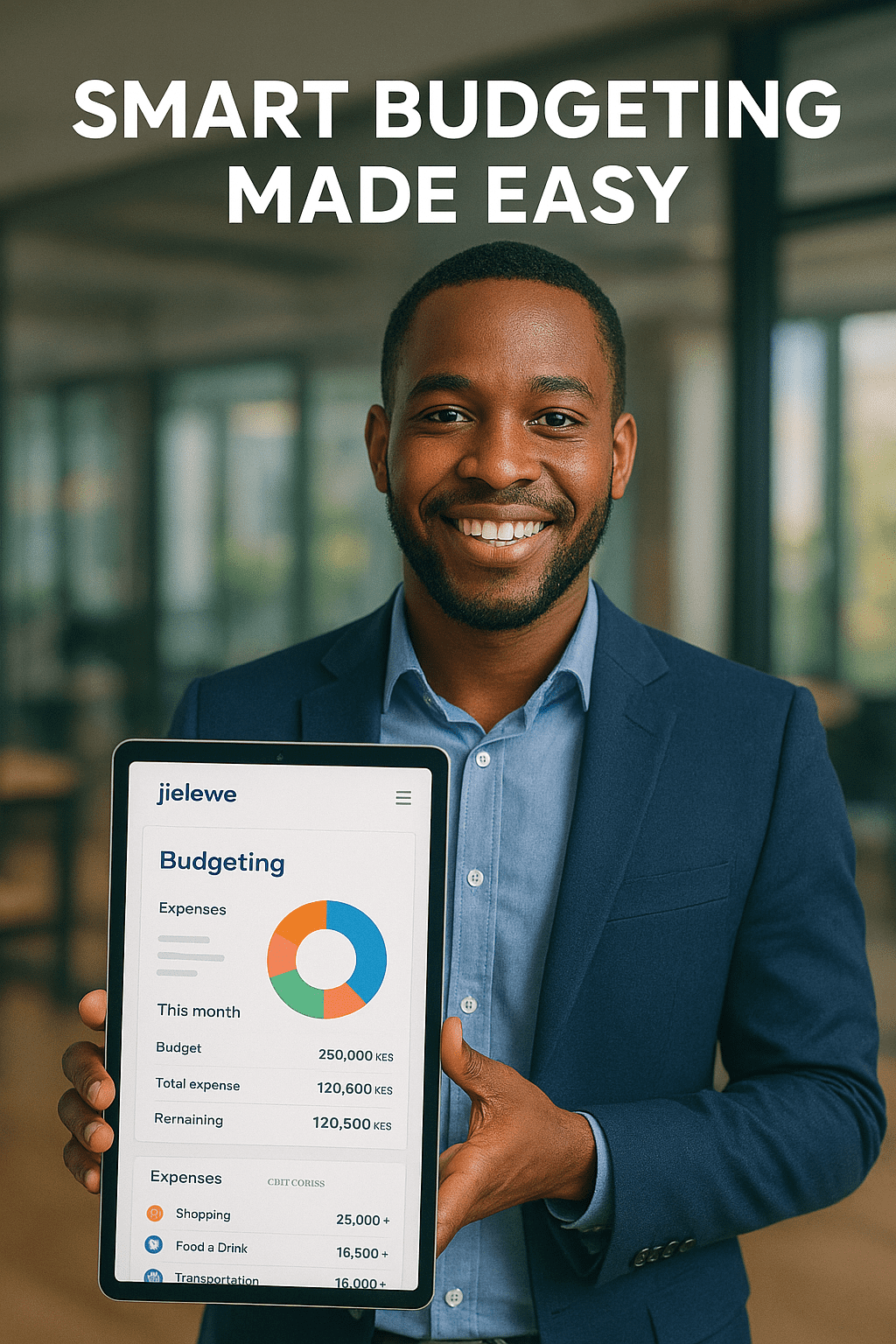

This guide will walk you through a step-by-step debt recovery plan tailored to Kenya, and show you how the Jielewe app helps you stay on track.

Why Many Kenyans Fall Into Debt

Before we fix the problem, let’s understand the causes:

- Overreliance on mobile loans (Tala, Fuliza, Hustler Fund) to cover daily expenses.

- High cost of living (food, rent, school fees rising faster than salaries).

- Impulse spending—M-Pesa makes it too easy to spend without thinking.

- Lack of budgeting tools—most Kenyans still guess where money goes.

- Unforeseen emergencies (medical bills, funerals, business losses).

The good news? These challenges can be overcome with intentional planning.

Step 1: Acknowledge and List All Your Debts

You can’t fix what you don’t face. Write down:

- Mobile loan balances (Fuliza, Tala, Hustler Fund, M-Shwari, etc.)

- SACCO or chama loans

- Bank loans or credit card balances

- Personal debts from friends/family

👉 Pro tip: Use Jielewe to record all debts in one dashboard. It helps you see the full picture instead of guessing.

Step 2: Stop Digging the Hole Deeper

Pause taking new loans—especially high-interest short-term loans. Instead:

- Switch to cash or debit card for daily expenses.

- Cut non-essential spending (eating out, impulse shopping).

- Create a weekly expense limit inside Jielewe and stick to it.

Step 3: Build a Starter Emergency Fund

Most debt cycles happen because of emergencies. Start by saving even a small buffer—KSh 2,000 to KSh 5,000—so you don’t run back to Fuliza when something small happens.

With Jielewe Goals, you can set an Emergency Fund goal and track progress automatically.

Step 4: Choose a Debt Repayment Strategy

There are two proven strategies:

✅ Debt Snowball (Motivation First)

- Pay off the smallest debt first while making minimum payments on the others.

- Once cleared, move to the next smallest.

- Builds momentum and confidence.

✅ Debt Avalanche (Interest First)

- Focus on the debt with the highest interest rate.

- Saves more money in the long run.

👉 Use Jielewe to see which debts are draining you most and choose your method.

Step 5: Create a Personalized Budget

Debt repayment only works if you control your money. A personalized budget ensures your income is allocated wisely:

- Essentials (rent, food, transport, school fees)

- Debt repayment

- Savings (even if small)

- Lifestyle (entertainment, shopping)

With Jielewe, budgeting is automatic:

- M-Pesa and cash expenses are tracked

- Categories are created for you (rent, food, transport, fees)

- Alerts notify you when you overspend

Step 6: Grow Your Income

Cutting expenses isn’t enough—you must also earn more to speed up debt freedom. In Kenya, this could mean:

- Starting a side hustle (online freelancing, farming, mitumba sales).

- Turning a skill into income (photography, tutoring, catering).

- Investing in SACCOs or unit trusts once debt is manageable.

Track both income and expenses inside Jielewe to see your real net position.

Step 7: Stay Consistent and Reward Progress

Debt repayment takes time. Celebrate small wins—like clearing Fuliza or paying off your first SACCO loan. The sense of progress keeps you motivated.

Jielewe provides weekly and monthly reports so you see progress clearly.

Step 8: Move From Debt-Free to Financial Freedom

Becoming debt-free isn’t the end—it’s the beginning. Next steps include:

- Building a full emergency fund (3–6 months of expenses).

- Saving for goals (school fees, buying land, building a house).

- Starting to invest (SACCO shares, money markets, real estate).

With Jielewe, you can track all three: debt-free living, goal savings, and investment growth.

Final Word: Your Path to Financial Freedom Starts Today

Debt is not permanent—it’s a phase. With discipline, strategy, and the right tools, you can break free and build wealth.

💡 Remember: Every shilling you manage well today brings you closer to financial freedom tomorrow.

Start your journey today with Jielewe—the app designed for Kenyans to track expenses, budget, and achieve their financial goals.