Saving money is never easy, and in Kenya, where the cost of living keeps rising, it can feel almost impossible—especially if you’re a student, employee, or small business owner living paycheck to paycheck. But the truth is, saving is possible even on a tight budget. All you need is discipline, smart strategies, and the right tools to guide you.

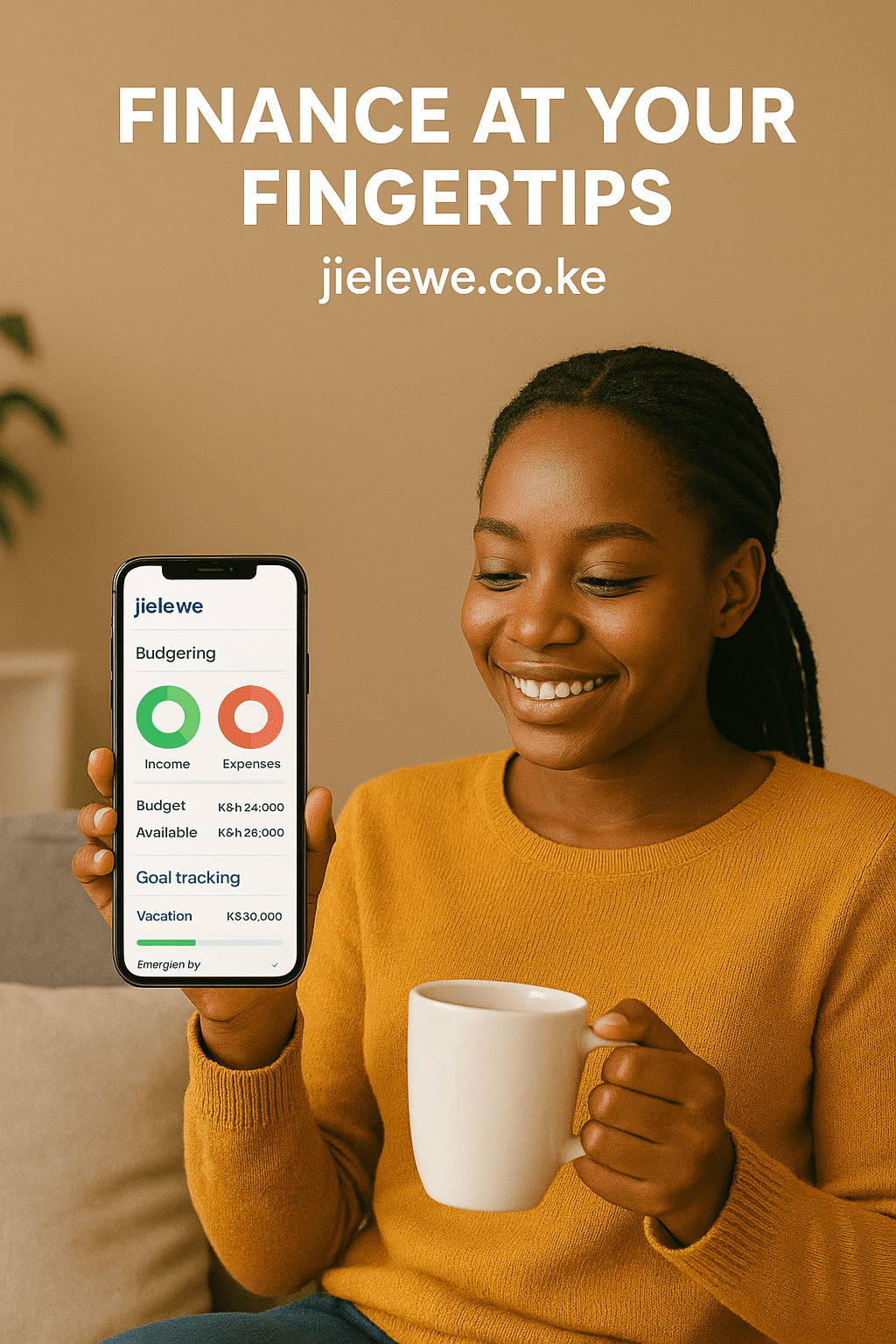

Let’s dive into practical ways you can start saving today and how Jielewe can help you gain clarity on your finances.

Why Saving is Hard in Kenya

Before we talk solutions, let’s acknowledge the challenges:

- Rising Expenses: Rent, food, transport, and school fees keep going up.

- M-Pesa Loans & Fuliza: Easy access to quick loans traps many in debt.

- Side Hustle Pressure: Even with extra income, poor planning makes it vanish.

But despite these obstacles, you can still create a savings culture—no matter how small your income.

7 Practical Ways to Save Money on a Tight Budget

1. Track Every Shilling

Most people underestimate how much they spend daily on airtime, snacks, and M-Pesa charges. With Jielewe, you can:

- Track income and expenses automatically.

- See categories like food, transport, and entertainment.

- Identify leaks in your budget instantly.

👉 What gets tracked, gets managed.

2. Budget Before Spending

Don’t spend and then budget—budget first, spend second.

- Allocate money for essentials: rent, food, utilities.

- Cut down on non-essentials like eating out or impulse buying.

- Use Jielewe’s budgeting feature to stick to your plan.

3. Embrace “Tight Budget” Hacks

- Cook at home instead of ordering takeout.

- Use public transport instead of frequent taxis.

- Buy in bulk from wholesale markets.

- Share rent or utilities with a roommate if possible.

4. Automate Savings

Treat savings like a bill. If you earn Ksh 20,000, decide 10% (Ksh 2,000) goes to savings first.

👉 You can even set a goal in Jielewe (e.g., emergency fund, school fees, or vacation) and watch your progress grow.

5. Say No to Unnecessary Loans

Fuliza and short-term loans feel like solutions but end up eating your income.

Instead of borrowing, plan your expenses in advance with Jielewe and avoid the debt trap.

6. Find and Grow Side Hustle Income

Kenya is the land of side hustles—graphic design, mitumba business, boda boda, online freelancing, etc.

But remember: earning more won’t help if you don’t track and budget it properly. Jielewe lets you combine salary + hustle income into one budget.

7. Set Realistic Goals

Saving without a purpose is hard. Whether it’s paying off debt, buying land, or going back to school—set goals.

Jielewe makes it easy by helping you track goal progress and stay motivated.

Real-Life Example

Take Mary, a university student in Nairobi. She thought she was “too broke to save.” After using Jielewe, she realized she spent Ksh 3,000 monthly on snacks and impulse buys. By redirecting just half of that, she saved Ksh 18,000 in six months.

👉 Proof that saving on a tight budget is possible.

Take Control of Your Money with Jielewe

Saving money in Kenya on a tight budget is tough, but with the right mindset and the right app, it’s achievable.

👉 Register with Jielewe today to track your income, monitor expenses, and finally save for what matters.

👉 Don’t just earn—take control of your money.