In Kenya today, having just one source of income is no longer enough. With the rising cost of living, more and more people are turning to side hustles to supplement their salaries or support their families. But while side hustles bring in much-needed cash, the real challenge is managing the income wisely.

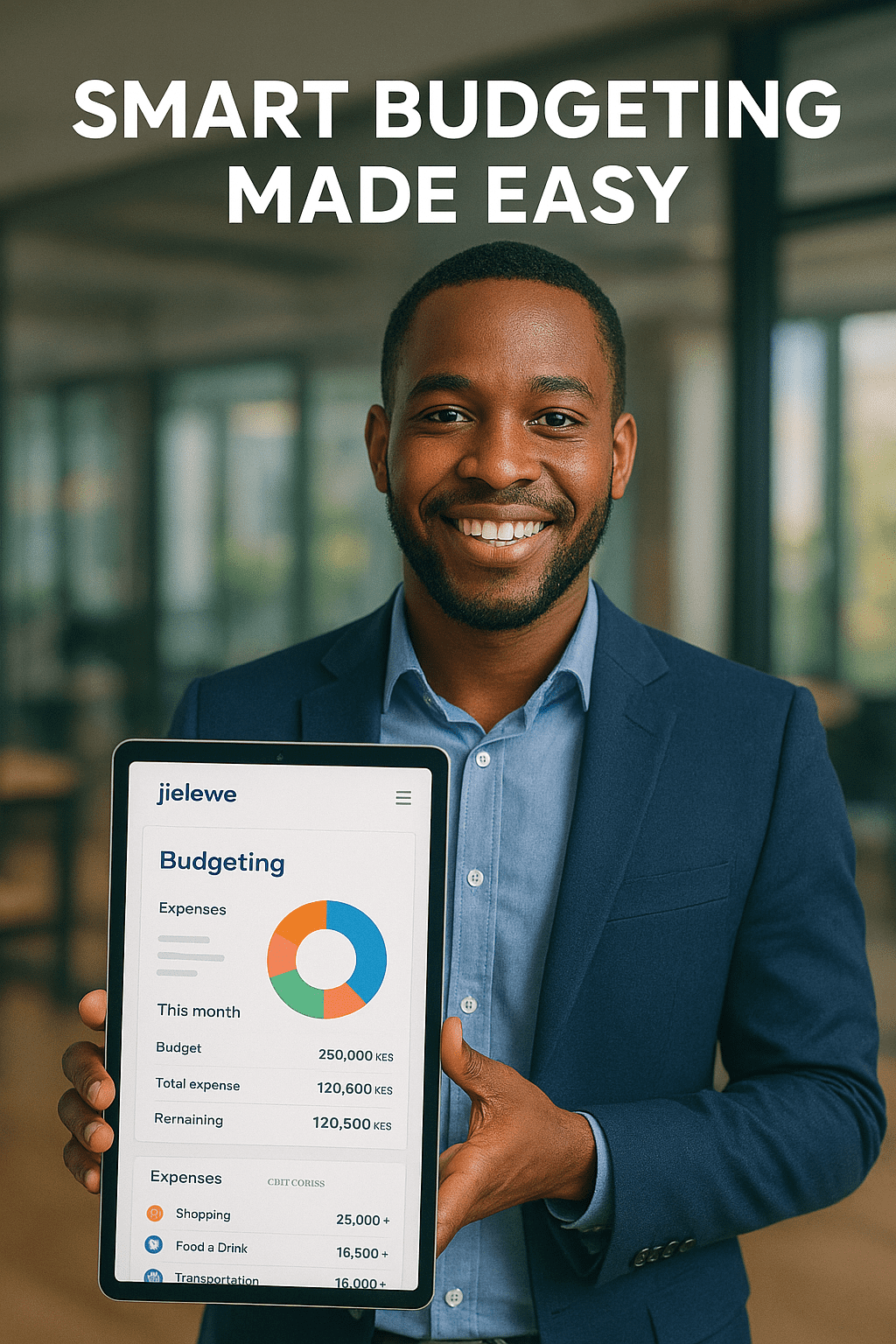

In this article, we’ll explore the top side hustles in Kenya (2025) and show you how to track and manage the extra money using Jielewe — Kenya’s #1 budgeting and money management app.

Popular Side Hustles in Kenya (2025)

1. Online Freelancing

Platforms like Upwork, Fiverr, and local gigs allow Kenyans to earn from writing, design, coding, and virtual assistance. Freelancing is flexible but requires discipline to save and invest income.

2. E-commerce & Online Shops

Many Kenyans sell clothes, shoes, or gadgets via Instagram, WhatsApp, or Jumia. With digital payments like M-Pesa, e-commerce is booming.

3. Agribusiness

From poultry farming to vegetable growing, agribusiness remains one of the most profitable side hustles. The key is proper record-keeping and reinvestment of profits.

4. Ride-Hailing & Delivery

Platforms like Uber, Bolt, and Glovo offer flexible income opportunities. However, fuel, repairs, and commissions must be tracked to avoid losses.

5. Content Creation & Influencing

With TikTok, YouTube, and Instagram paying creators, content creation is now a serious side hustle. Managing irregular income is crucial to avoid overspending.

6. Real Estate & Airbnb Hosting

Some Kenyans earn extra cash by renting out property or offering Airbnb services. This hustle requires expense tracking and savings for maintenance.

7. Tutoring & Online Courses

From academic tutoring to teaching skills online, education-based hustles continue to grow.

How to Manage Side Hustle Income in Kenya

Earning money from a side hustle is exciting, but without proper planning, it can easily disappear into daily expenses. Here’s how to take control:

✅ 1. Separate Side Hustle Money from Salary

Create a separate account or wallet for your side hustle income to avoid mixing it with your main salary.

✅ 2. Track Every Transaction

Use Jielewe to record M-Pesa payments, bank deposits, and expenses. This way, you’ll know whether your hustle is profitable.

✅ 3. Create a Budget

Budgeting ensures you don’t spend all your hustle money on impulse. With Jielewe, you can set spending limits and track progress.

✅ 4. Save and Reinvest

Set aside at least 20–30% of your hustle earnings for savings or reinvestment. Jielewe’s goal tracking feature makes this easier.

✅ 5. Pay Off Debt First

If you’re using Fuliza or M-Shwari loans to support your hustle, prioritize paying off debt before expanding.

Why Jielewe is Perfect for Side Hustlers

Unlike generic global apps, Jielewe is designed for Kenyan side hustlers.

With Jielewe you can:

- Track multiple income sources (salary + side hustle).

- Categorize expenses (rent, transport, farming, marketing, etc.).

- Set financial goals and monitor progress.

- Stay disciplined with budget alerts.

👉 Whether you’re a student freelancing online or a professional running a weekend business, Jielewe helps you turn side hustle money into real wealth.

Final Word

Side hustles are the future of financial independence in Kenya. But earning extra income is just half the battle — the real power lies in managing that income wisely.

With Jielewe, you can ensure your side hustle income doesn’t disappear but instead helps you save, invest, and achieve financial freedom.

👉 Start today with Jielewe and take full control of your finances.