Introduction

Debt is one of the biggest financial struggles for many Kenyans. From mobile loans to bank overdrafts and SACCO loans, it’s easy to feel trapped in an endless repayment cycle.

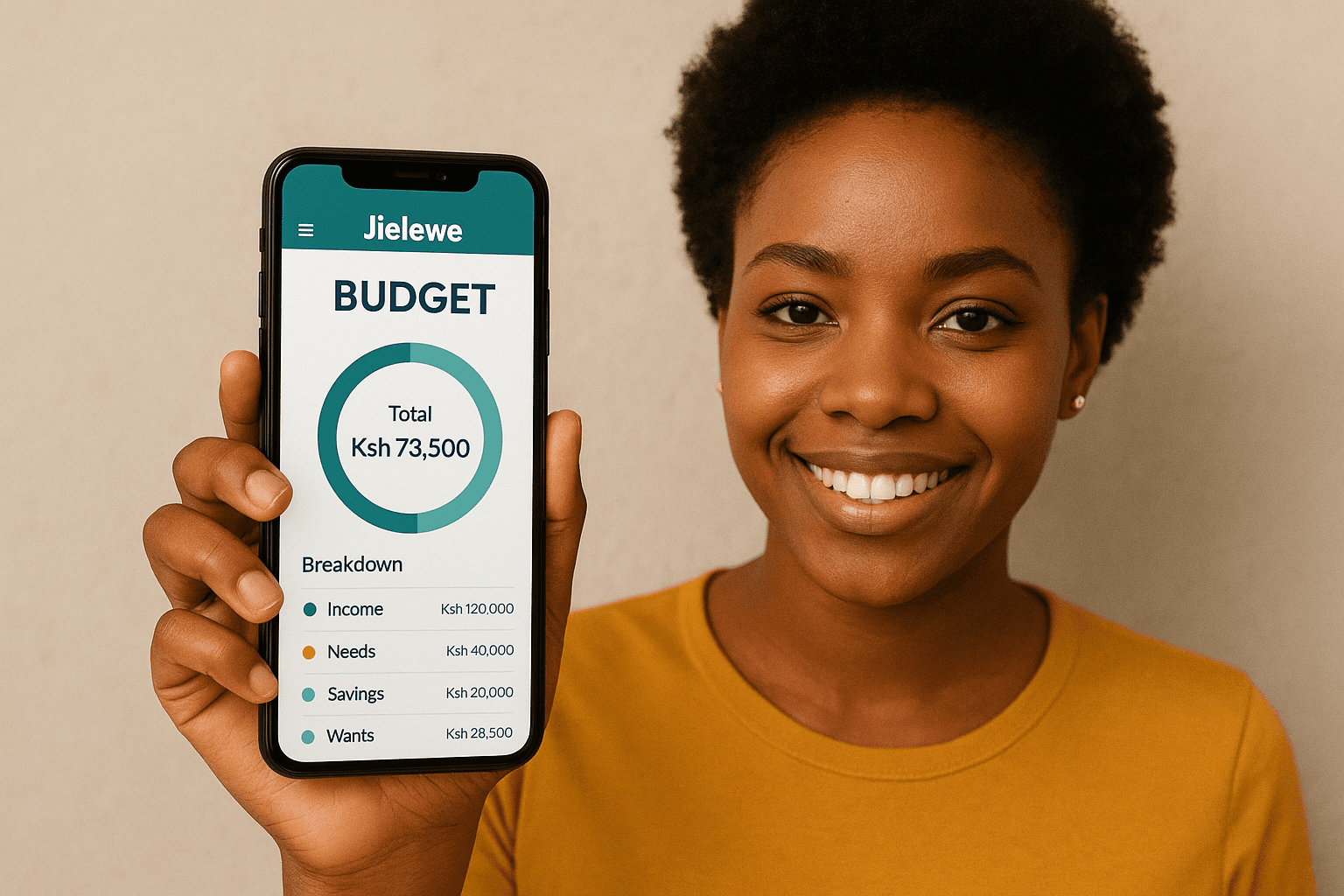

The good news is that you can take control by creating a debt repayment plan that works. With the right strategy and tools like Jielewe, you can manage your debt, regain financial freedom, and avoid falling back into the same trap.

Why You Need a Debt Repayment Plan

- Clarity: You know exactly how much you owe and to whom.

- Prioritization: Helps you focus on the most urgent or costly debts first.

- Stress Reduction: Having a plan reduces anxiety and gives you control.

- Financial Freedom: Once debts are cleared, your money goes towards savings and investments.

Steps to Create a Debt Repayment Plan That Works

1. List All Your Debts

Write down every debt — mobile loans, SACCO contributions, credit cards, or bank loans. Include amounts, interest rates, and due dates.

👉 With Jielewe, you can record all loans in one place for easy tracking.

2. Know Your Total Debt and Monthly Obligations

Add everything up to understand your true financial position. This will help you determine how much you can realistically repay each month.

3. Choose a Repayment Strategy

There are two popular approaches:

- Debt Snowball Method: Focus on paying off the smallest debt first while making minimum payments on others. Builds momentum.

- Debt Avalanche Method: Focus on the debt with the highest interest rate first. Saves money on interest.

Pick the one that motivates you most.

4. Create a Realistic Budget

Allocate money for debt repayment before anything else. Cut unnecessary expenses (eating out, impulse buys) and channel the extra towards debt clearance.

Jielewe makes this easier by showing how your daily expenses affect debt repayments.

5. Negotiate with Lenders

Don’t shy away from negotiating for lower interest rates, extended repayment terms, or settlement offers. Many lenders are open to discussion if you show commitment.

6. Automate Payments

Set standing orders or reminders so you never miss deadlines. Missed payments mean penalties and higher interest.

7. Track Your Progress

Regularly review your repayment plan. Celebrate small wins — each debt cleared is a step closer to financial freedom.

Jielewe helps by showing progress visually so you stay motivated.

How Jielewe Helps You Manage Debt

The Jielewe app is designed to make debt repayment simple and achievable for Kenyans. With Jielewe, you can:

- Record all your debts in one dashboard.

- Track repayment progress with reminders and alerts.

- Set financial goals to stay motivated.

- Build a budget that prioritizes debt clearance.

- Avoid falling back into bad borrowing habits.

Instead of stress and confusion, you’ll have a clear, actionable plan to eliminate debt.

Final Thoughts

Debt doesn’t have to control your life. With a proper repayment plan, discipline, and the right tools, you can clear what you owe and start building wealth.

Don’t wait for another overdue reminder — take charge of your finances today.

👉 Visit jielewe.co.ke and start your journey to debt freedom.