Introduction

Young Kenyans today have more opportunities than ever before — side hustles, online jobs, and mobile money access. But with opportunities also come pitfalls. Many young people fall into avoidable financial mistakes that prevent them from saving, investing, and growing wealth.

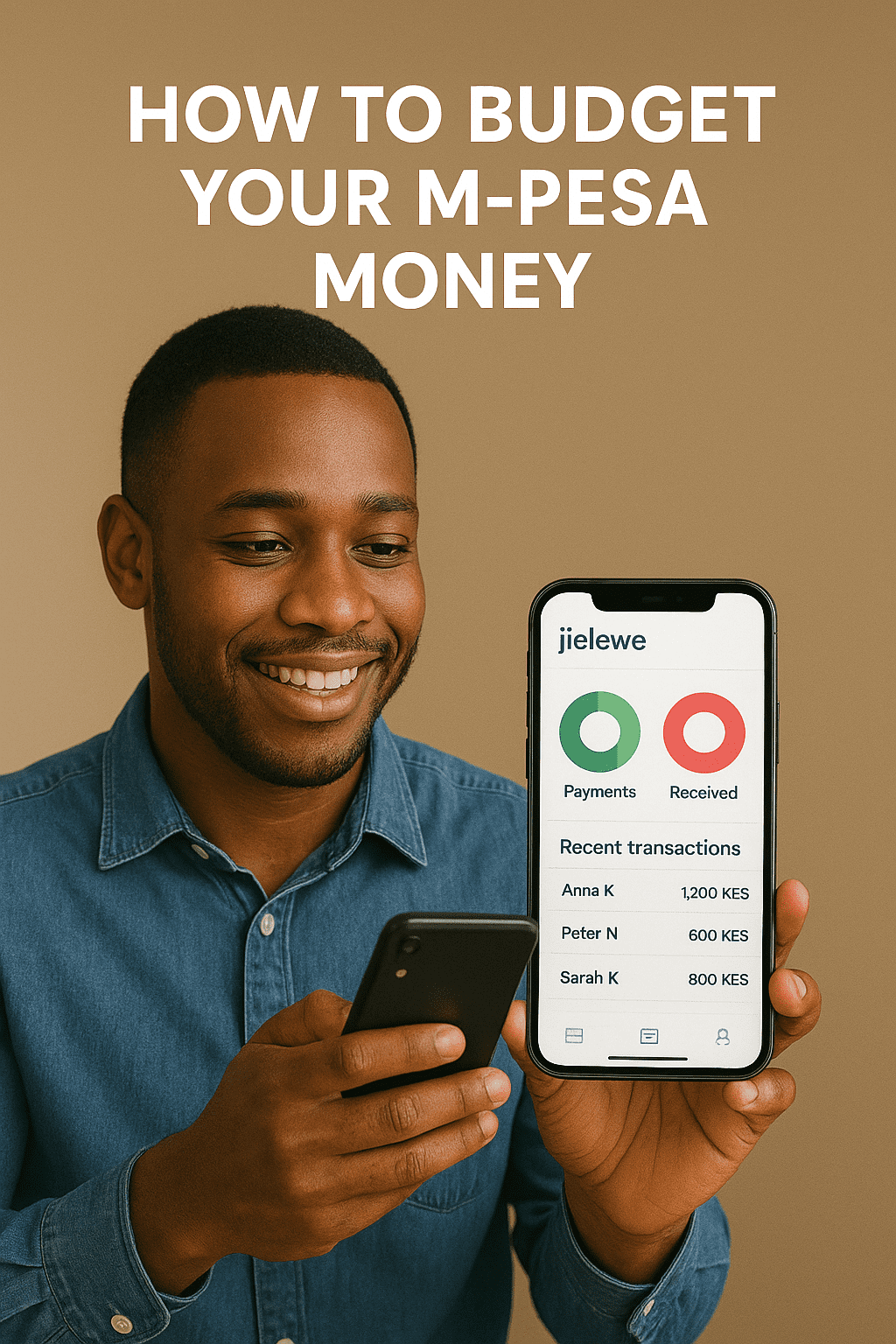

Here are the top financial mistakes young Kenyans make, and practical tips on how to avoid them with the help of tools like Jielewe.

1. Living Beyond Their Means

Social media pressure and peer influence make many young people spend more than they earn. From expensive gadgets to nights out, lifestyle inflation eats into savings.

Fix: Create a realistic budget with Jielewe and track your spending. Focus on needs before wants.

2. Overreliance on Mobile Loans

Mobile lending apps make borrowing easy, but they also trap many in a cycle of debt. High interest rates drain income and delay financial growth.

Fix: Avoid borrowing for non-essential expenses. Use Jielewe to monitor debts and prioritize repayments.

3. Ignoring Savings and Emergency Funds

Many young people postpone saving, assuming they’ll start later when they earn more. The result? No safety net when emergencies strike.

Fix: Start small but stay consistent. Even KES 100 a day adds up. Jielewe helps you set savings goals and track progress.

4. Lack of Financial Planning

Without a plan, money slips away on impulse buys, entertainment, or unnecessary subscriptions.

Fix: Use Jielewe to create financial goals — whether it’s buying land, paying school fees, or starting a business — and align your spending.

5. Not Investing Early

Young people often avoid investing due to fear, lack of knowledge, or procrastination. They miss out on the power of compound growth.

Fix: Learn basic investment options like SACCOs, unit trusts, and retirement funds. Track contributions in Jielewe to stay consistent.

6. Ignoring Retirement Planning

Retirement feels far away, but the earlier you start, the easier it becomes. Waiting too long means you’ll need to save much more later.

Fix: Start contributing to a pension or savings plan now. Jielewe helps you monitor your long-term goals.

7. Poor Record Keeping

Many young Kenyans don’t know where their money goes each month. Without records, it’s impossible to cut unnecessary expenses.

Fix: Use Jielewe to automatically categorize and track all your income and expenses.

Why Jielewe is the Solution for Young Kenyans

The Jielewe app is designed for Kenyans who want to take control of their finances. With Jielewe you can:

- Create budgets that fit your income.

- Track daily expenses and avoid overspending.

- Monitor debts and repayment schedules.

- Set and achieve savings goals.

- Build a financial habit that supports long-term growth.

Instead of repeating common mistakes, you’ll have a clear roadmap to financial success.

Final Thoughts

Being young gives you the biggest advantage in personal finance: time. Avoid these mistakes, build strong money habits early, and you’ll set yourself up for a secure future.

👉 Start today with jielewe.co.ke — the smarter way to budget, save, and grow your money.