Introduction

Mobile loans have become a quick fix for many Kenyans, offering instant cash in emergencies. But with high interest rates, short repayment periods, and easy access, millions of Kenyans now find themselves stuck in a cycle of debt.

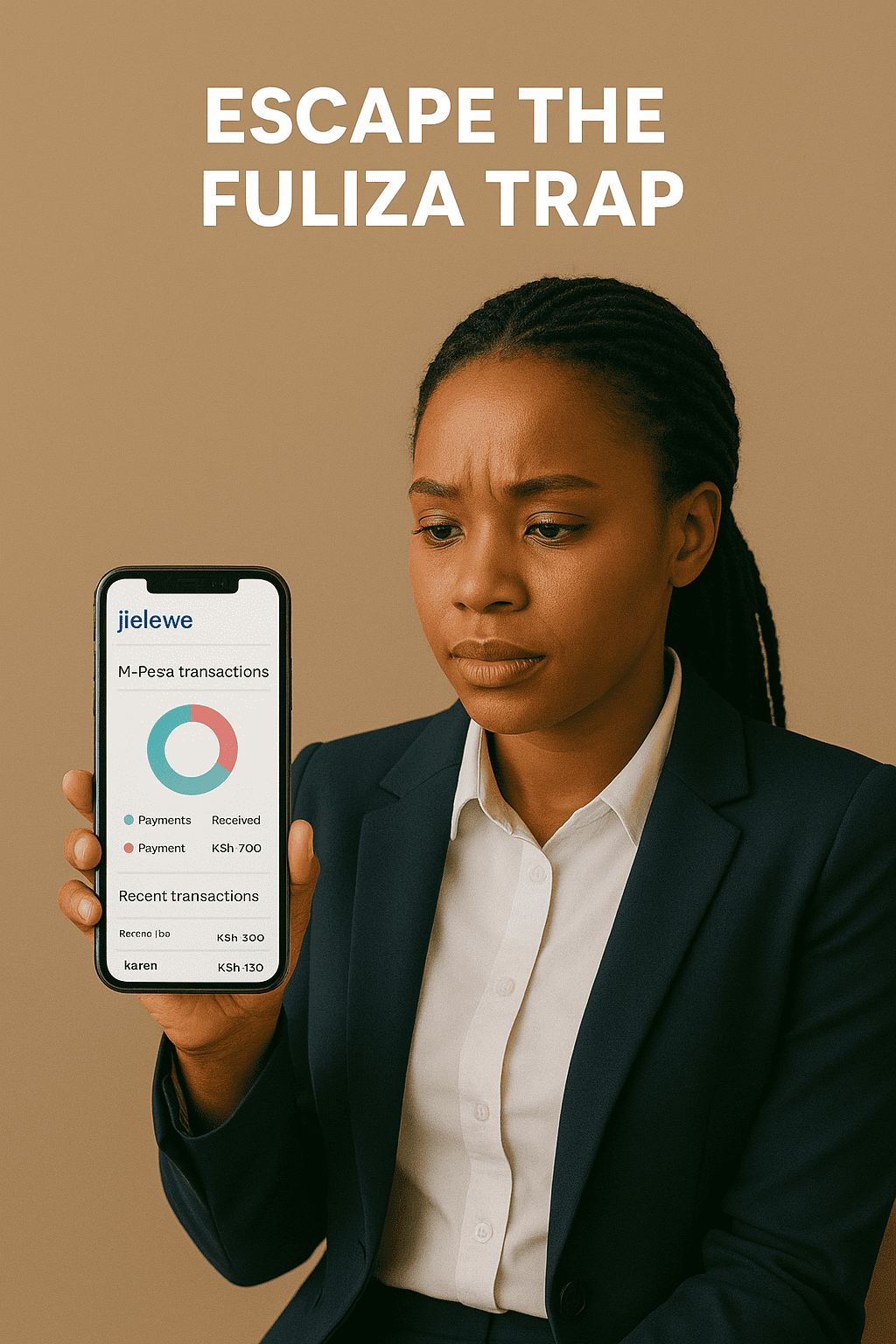

The good news? You can break free. In this guide, we’ll show you how to get out of mobile loan debt in Kenya, step by step, and how Jielewe can help you regain financial freedom.

Why Mobile Loan Debt is a Growing Problem in Kenya

- High Interest Rates – Some lenders charge up to 15–30% per month.

- Easy Access – A few clicks and the loan is in your M-Pesa.

- Multiple Borrowing – Many people borrow from several apps at once.

- CRB Listings – Late repayments hurt your credit score, limiting future borrowing.

- Debt Stress – Constant calls and reminders create financial anxiety.

Steps to Get Out of Mobile Loan Debt in Kenya

1. Acknowledge the Problem

The first step is being honest with yourself. List down every loan — app name, amount, due date, and interest rate.

👉 Jielewe makes this easy by letting you record and track all your debts in one place.

2. Stop Borrowing More

Taking new loans to pay old ones only digs the hole deeper. Put a pause on all new mobile loans.

3. Prioritize Repayments

Focus on clearing high-interest loans first (avalanche method) or small debts first for motivation (snowball method).

4. Negotiate with Lenders

Some apps allow extensions or restructuring if you show commitment to pay. Call or email them early before defaulting.

5. Cut Unnecessary Spending

Review your budget and redirect money from non-essentials (entertainment, impulse buys) towards loan repayments.

👉 Jielewe helps you track expenses so you see where your money is leaking.

6. Increase Your Income

Consider short-term hustles — delivery work, freelancing, or selling items you don’t need. Use extra cash to speed up debt repayment.

7. Build an Emergency Fund

Once loans are cleared, start saving even small amounts daily. This will reduce the need to borrow again when emergencies happen.

How Jielewe Helps You Escape Mobile Loan Debt

The Jielewe app is built to give Kenyans control over their finances. With Jielewe, you can:

- Record all your loans and repayment dates.

- Receive reminders before deadlines.

- Track daily spending and cut unnecessary expenses.

- Set goals to stay motivated until you’re debt-free.

- Build a savings habit to avoid future reliance on loans.

Instead of struggling alone, you’ll have a structured plan to regain financial stability.

Final Thoughts

Mobile loans can be useful in emergencies, but without discipline, they can trap you in a cycle of debt. The key to getting out is acknowledging the problem, committing to repayment, budgeting smarter, and using tools like Jielewe to stay accountable.

👉 Start today. Visit jielewe.co.ke and take the first step toward financial freedom.