Financial freedom starts here – Jielewe.co.ke

Budgeting & Expense Tracking

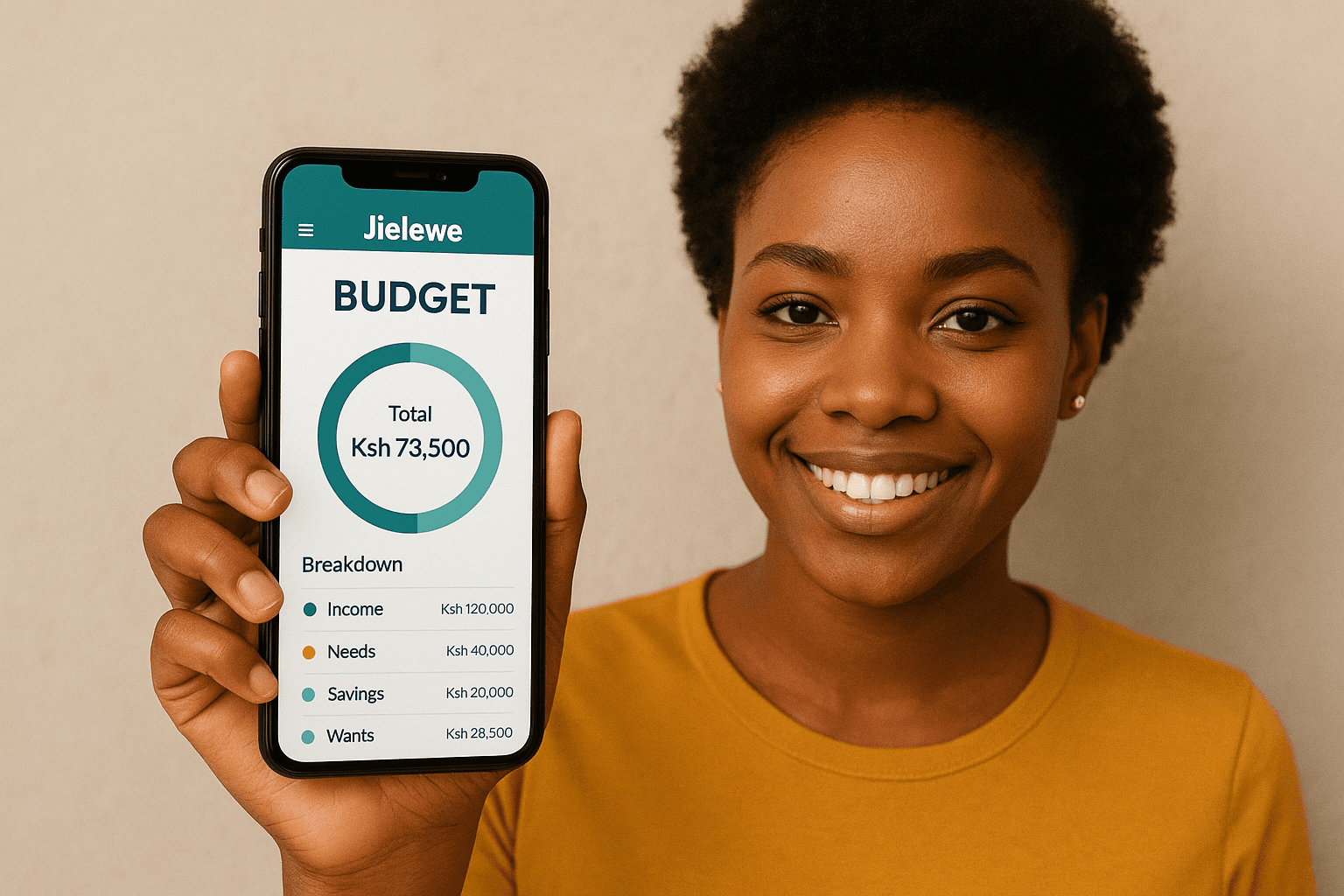

A budget is a plan that helps you track your income and expenses. It is important because it allows you to control spending, save money, and achieve financial goals.

Track your average monthly income, categorize your expenses, and prioritize essentials first. Set aside a percentage of each payment for savings and discretionary spending.

A common rule is 20% savings, 50% needs, and 30% wants. Adjust based on your personal goals and financial situation.

Use apps like Jielewe, spreadsheets, or even a small notebook to record every expense daily.

Both work. Monthly budgets are better for bills and rent, while weekly budgeting helps control discretionary spending.

Split into essentials (rent, food, utilities), non-essentials (entertainment, dining out), and savings/investments.

Digital apps like Jielewe, Mint, YNAB, or even simple Excel sheets can help automate budgeting.

Create an emergency fund or include a “miscellaneous” category in your budget for unplanned costs.

Yes, prioritize debt repayment while also setting aside a small portion for essentials and savings to avoid falling behind.

Weekly reviews help catch overspending, while monthly reviews ensure you stay on track with bigger financial goals.

A zero-based budget ensures every dollar is allocated to a category, leaving no unassigned money at the end of the month.

Identify unnecessary subscriptions, cook at home, use public transportation, and negotiate bills like internet and utilities.

Cash can help control spending, but digital payments make it easier to track expenses through apps and bank statements.

Create a waiting period before buying, set shopping lists, and stick to your budget.

50% for needs, 30% for wants, and 20% for savings or debt repayment—a simple framework for managing money.

Yes, sum all income streams, then allocate according to your priorities and financial goals.

Recalculate essentials, reduce discretionary spending, and adjust savings proportionally to maintain financial stability.

Use calendar reminders, banking alerts, or finance apps to track monthly subscriptions and bills automatically.

Divide the total cost by 12 months and include a portion each month in your budget.

Yes, plan for charitable donations or gifts so they don’t disrupt your financial goals.

Saving & Emergency Funds

Aim for 3–6 months of living expenses to cover unexpected job loss, medical bills, or urgent repairs.

Yes, even saving a small percentage of your income regularly can grow over time using compounding.

A sinking fund is money set aside for a specific future expense, like a car repair, vacation, or holiday shopping.

It depends; typically, maintain a small emergency fund while aggressively paying off high-interest debt.

Use high-yield savings accounts or low-risk instruments separate from your emergency fund.

Set clear goals, track progress visually, and reward yourself when milestones are achieved.

Yes, automatic transfers ensure consistency and reduce temptation to spend.

Look for accounts with interest, low fees, and easy access; mobile banking and digital wallets like M-Pesa are convenient.

Contribute to retirement schemes like NSSF, personal pension plans, or investment accounts early to benefit from compounding.

Short-term is for expenses within a year, while long-term is for goals beyond a year, including retirement or property.

Yes, keep emergency funds in liquid accounts and invest the rest for growth.

At least quarterly, or whenever there’s a significant income or expense change.

Prioritize essential savings first, then allocate a small amount for discretionary spending.

Secure an emergency fund first, then invest extra funds for growth.

Set up dedicated savings or investment accounts and contribute regularly, even small amounts.

Investments & Wealth Building

Start with low-risk options like savings bonds, mutual funds, or diversified ETFs.

Open an account with a licensed broker or invest through platforms like NSE, Unit Trusts, or digital investment apps.

Stocks offer higher growth potential but higher risk; bonds are safer but with lower returns. Diversify across both.

A common rule is at least 10–20% of your income, adjusted for your risk tolerance and financial goals.

Spreading investments across different assets to reduce risk and improve potential returns.

Check the risk, return, liquidity, fees, and credibility of the platform or company.

Compounding is earning interest on both your initial capital and the accumulated interest, growing wealth exponentially over time.

Yes, digital platforms allow investing small amounts regularly, making it accessible to everyone.

Exchange-Traded Funds (ETFs) are collections of stocks or bonds that trade on stock exchanges, ideal for beginners.

Research thoroughly, verify licenses, and avoid schemes promising guaranteed high returns.

Passive investing follows the market (like index funds), while active investing requires frequent buying and selling to beat the market.

Consider market volatility, time horizon, liquidity, and your personal risk tolerance.

Cryptocurrency is highly volatile. Only invest what you can afford to lose and do thorough research.

Investing a fixed amount regularly regardless of market price, reducing the impact of volatility.

Capital gains, dividends, and interest income may be taxed. Plan and invest through tax-efficient instruments when possible.

An investment that offers above-average returns, usually with higher risk. Balance with safer assets.

Use your brokerage platform or investment account to liquidate assets, ensuring you understand fees and tax implications.

Adjusting your investments periodically to maintain desired risk levels and asset allocation.

Yes, especially for complex investments, but educate yourself first to make informed decisions.

Use your investment platform, apps like Jielewe, or spreadsheets to monitor returns and adjust your strategy.

Debt Management

Good debt is used for investments that increase your net worth (e.g., mortgages, education loans). Bad debt is used for consumption with high interest, like credit cards or payday loans.

Use the avalanche method (highest interest first) or the snowball method (smallest balance first) to systematically reduce debt.

Set up reminders, automate payments, and prioritize bills in your budget.

Debt consolidation can simplify payments and reduce interest if done responsibly with lower-interest loans.

Aim to keep your debt-to-income ratio below 36%. High ratios indicate financial strain.

Pay bills on time, keep credit utilization low, avoid multiple new credit applications, and monitor your credit report.

Yes, many creditors allow payment plans, reduced interest rates, or settlements in special circumstances.

A credit report tracks your credit history and score. It’s crucial for loan approvals, rental agreements, and some job applications.

Make consistent payments, explore repayment assistance programs, and avoid defaulting to maintain good credit.

Yes, refinancing can lower interest rates or extend payment terms, but check total cost over time.

Financial Goal Setting

Financial goals give direction to your money, increase motivation to save, and help measure progress.

Make them Specific, Measurable, Achievable, Relevant, and Time-bound.

Focus on urgent goals first, like debt repayment or emergency funds, then allocate resources to medium and long-term goals.

Yes, apps like Jielewe let you monitor progress, set reminders, and adjust budgets.

Review monthly or quarterly to adjust for life changes or income fluctuations.

Yes. Short-term goals cover 1–2 years, medium-term 3–5 years, and long-term 5+ years, like retirement.

Goal stacking is combining multiple goals to save and invest efficiently without overlapping or conflict.

Visualize success, celebrate milestones, and remind yourself why each goal matters.

Absolutely. Life changes may require recalibration, and adjusting goals is part of smart financial planning.

Yes, especially for joint expenses, savings, or shared investments. Communication is key.

Lifestyle & Money Habits

Follow your budget, prioritize high-value experiences, and practice mindful spending.

Yes, small expenses add up and can derail budgets if ignored.

Maintain consistent spending habits even as income grows, and increase savings proportionally.

Wait 24 hours before buying non-essential items to reduce impulse purchases.

Stick to your budget, communicate your financial goals, and avoid unnecessary comparisons.

Studies show investing in experiences yields more lasting happiness than material possessions.

Start early with allowances, saving jars, and simple discussions about money management.

Plan in advance, use budget-friendly accommodations, and track all expenses.

Allocate a portion of your budget for leisure to avoid burnout and maintain financial discipline.

Yes, it gives a complete picture of financial health beyond just income and expenses.

Taxes & Legal Financial Tips

File and pay your taxes before the Kenya Revenue Authority (KRA) deadlines to avoid penalties.

Sum all income sources and subtract allowable deductions like pension contributions, insurance, and business expenses.

Pension contributions, mortgage interest (under certain schemes), charitable donations, and insurance premiums.

File on time, pay estimated taxes, and maintain accurate records.

Yes, especially for business owners, high-income earners, or complex investment portfolios.

Value Added Tax is a consumption tax included in goods/services. It impacts your expenses and business reporting if you’re an entrepreneur.

Yes, legitimate business costs can reduce taxable income, but maintain documentation.

Keep accurate records, pay taxes on time, and stay updated with KRA and Central Bank rules.

Investments that minimize taxes legally, such as retirement accounts or specific government bonds.

Verify platforms, avoid unsolicited offers, and educate yourself on common schemes.

Money Mindset & Motivation

Educate yourself, set goals, avoid negative comparisons, and focus on financial growth.

Yes, journaling or using apps helps identify spending patterns and areas for improvement.

Create an emergency fund, budget, prioritize goals, and seek professional advice if needed.

Start small, learn the basics, and use simulation or demo platforms to build confidence.

Yes, dedicate time daily to read blogs, books, and use financial management apps like Jielewe.

Save aggressively, invest wisely, diversify income streams, and reduce unnecessary expenses.

Financial freedom means having enough income, savings, and investments to support your desired lifestyle without stress.

Acknowledge, learn, adjust your plan, and stay consistent with good habits.

Yes, diversify between salary, side hustles, investments, and passive income sources.

Automate savings, stick to budgets, avoid impulsive purchases, and track progress regularly.

Banking & Accounts

A savings account is ideal for beginners. It allows you to safely store money, earn interest, and learn basic money management skills.

Maintain minimum balances, use ATMs within your bank’s network, and avoid unnecessary overdrafts to reduce or eliminate fees.

Digital banks operate entirely online, offering lower fees and built-in budgeting tools. They are safe and convenient if regulated by local authorities.

Compare interest rates, fees, accessibility, online features, and customer service to select the bank that best fits your financial goals.

Debt Management

Use the debt snowball or debt avalanche method:

Debt snowball: Pay off smallest balances first.

Debt avalanche: Pay off highest interest debts first.

Debt consolidation can lower interest rates and simplify payments, but only if you avoid accumulating new debt afterward.

Good debt: An investment like education or property that increases future earning potential.

Bad debt: High-interest consumer debt that doesn’t generate value.

Create a budget, build an emergency fund, avoid impulse loans, and pay off credit cards in full each month.

Financial Planning & Goal Prioritization

Rank goals by urgency, impact, and timeline. Fund essential short-term goals first, then allocate resources to long-term goals.

A sinking fund is money saved for future expenses like car maintenance or school fees, preventing debt accumulation.

Allocate funds to both based on your risk tolerance, time horizon, and financial objectives.

Retirement & Long-Term Planning

Both options are beneficial:

Pensions: Provide security and stability.

Private retirement funds: Offer flexibility and potential for higher returns.

Estimate your future expenses, consider inflation, and use online retirement calculators to determine realistic savings targets.

Yes, with disciplined savings, strategic investments, and a clear plan to cover living expenses before official retirement age.

Insurance & Risk Management

Yes. Unexpected illnesses or accidents can create significant financial strain without coverage.

Term life insurance provides coverage for a specific period, paying a lump sum to beneficiaries if the insured passes away during that term.

Compare premiums, claim histories, coverage options, and customer service ratings before deciding.

Side Hustles & Entrepreneurship

Identify market demand, set competitive pricing, promote online, and continuously improve your skills.

Yes. Start small, leverage digital tools and free marketing channels, and reinvest profits to grow your business.

Keep accurate records, track all expenses, and file taxes according to local regulations.

LLifestyle & Spending Habits

Increase savings proportionally as your income rises and avoid spending all new earnings on luxuries.

Experiences often provide more long-term satisfaction and lasting memories, while material goods depreciate in value.

Track your finances, create an emergency savings fund, set realistic goals, and seek professional financial advice when necessary.

Investments

Begin with low-risk options such as government bonds, mutual funds, or savings accounts. Use Jielewe.co.ke to track your investment contributions and returns.

A common guideline is 10–20% of your income, depending on goals and current expenses. Jielewe helps you allocate funds efficiently.

Exchange-Traded Funds (ETFs) are diversified portfolios that trade like stocks. They reduce risk compared to individual stocks. Track your investments in Jielewe for clarity.

Only invest what you can afford to lose. Track crypto gains and losses in Jielewe.co.ke to maintain an accurate financial picture.

Savings & Emergency Funds

Ideally 3–6 months of living expenses. Use Jielewe to calculate and monitor your emergency savings.

Prioritize high-interest debt, but maintain at least a small emergency fund. Jielewe helps you balance both priorities.

Automate transfers, set small goals, and track progress in Jielewe.co.ke to watch your savings grow.

Budgeting

Allocate 50% to needs, 30% to wants, and 20% to savings/investments. Jielewe can automate and visualize this allocation.

Track every expense, use alerts, and adjust categories. Jielewe.co.ke provides real-time tracking for accountability.

Base your budget on your lowest monthly income. Treat extra income as a bonus to save or invest using Jielewe.

Taxes

Track income and expenses diligently. Jielewe can generate reports for accurate tax filings.

Contributions to retirement funds, mortgage interest, and certain investments can reduce taxable income. Monitor them in Jielewe.

For complex finances, yes. Even with a professional, Jielewe keeps you organized and provides all necessary reports.

Financial Mindset & Lifestyle

Focus on long-term planning, consistent saving, investing, and tracking all money in Jielewe.co.ke.

Yes. Allocate a small percentage of income to fun. Jielewe helps track discretionary spending without harming goals.

Automate savings, track every expense in Jielewe, and gradually reduce unnecessary spending.

Family & Kids Finance

Introduce allowances, saving jars, and simple budgeting lessons. Show them how tools like Jielewe.co.ke can track money.

Absolutely. Even small contributions grow over time. Use Jielewe to track contributions and goals.

Maintain an emergency fund and insurance. Jielewe can track your progress and simulate future needs.

Travel & Lifestyle Budgeting

Set a travel fund and track it in Jielewe. Prioritize destinations and accommodation costs to avoid overspending.

Yes, by booking early, using deals, and tracking expenses with Jielewe.co.ke.

A mix is ideal. Use cards for security, cash for small expenses, and record all spending in Jielewe.

Goal Setting & Financial Planning

Define short, medium, and long-term goals. Track progress in Jielewe.co.ke for motivation and accountability.

Rank by urgency, necessity, and impact. Jielewe can help allocate funds dynamically.

Yes, by splitting savings proportionally and monitoring progress. Jielewe automates this tracking.

Credit & Loans

Pay loans and credit cards on time, keep balances low, and track all borrowing in Jielewe.

Only with caution. Borrowed money increases risk. Track potential returns vs. costs in Jielewe before proceeding.

Compare offers, switch to lower rates, and monitor repayment using Jielewe.

Retirement & Long-Term Planning

Aim for 15–20% of your income. Track goals in Jielewe.co.ke.

NSSF, personal pensions, and employer plans. Jielewe tracks contributions and growth.

Absolutely. Compounding works best over time. Jielewe.co.ke shows future projections.

Yes, with aggressive savings and investments. Track your progress in Jielewe.