It’s payday! You open your M-Pesa or bank app, see that sweet SMS from your employer… and suddenly, life feels good. You pay a few bills, buy data, treat yourself “kidogo,” and before you know it — you’re broke again by the 15th.

Sound familiar? You’re not alone. Millions of Kenyans ask themselves the same painful question every month:

👉🏾 “Where did my salary go?”

The truth is — it didn’t disappear. You just didn’t track where it went.

🧾 The Real Kenyan Spending Pattern

Let’s be honest. A typical Kenyan’s monthly flow looks like this:

| Date | Transaction | Amount (KSh) |

|---|---|---|

| 1st | Rent | 15,000 |

| 2nd | M-Pesa Fuliza repayment | 2,500 |

| 3rd | Grocery shopping | 3,000 |

| 5th | Transport (matatu, fuel) | 1,200 |

| 7th | Lunches, snacks | 1,000 |

| 9th | Impulse online purchase | 1,500 |

| 10th | Chama contribution | 2,000 |

| 15th | Airtime & bundles | 500 |

| 20th | Emergency “loan” to a friend | 1,000 |

| 25th | “Just 2 beers” weekend | 800 |

| End Month | Balance | KSh 0.00 |

Every expense makes sense in the moment — until you add them all up.

🧠 The Problem: You’re Managing Money in Your Head

We all think we know where our money goes — until we track it.

The average Kenyan underestimates daily spending by up to 40%, especially on small, cashless transactions (like M-Pesa and card payments).

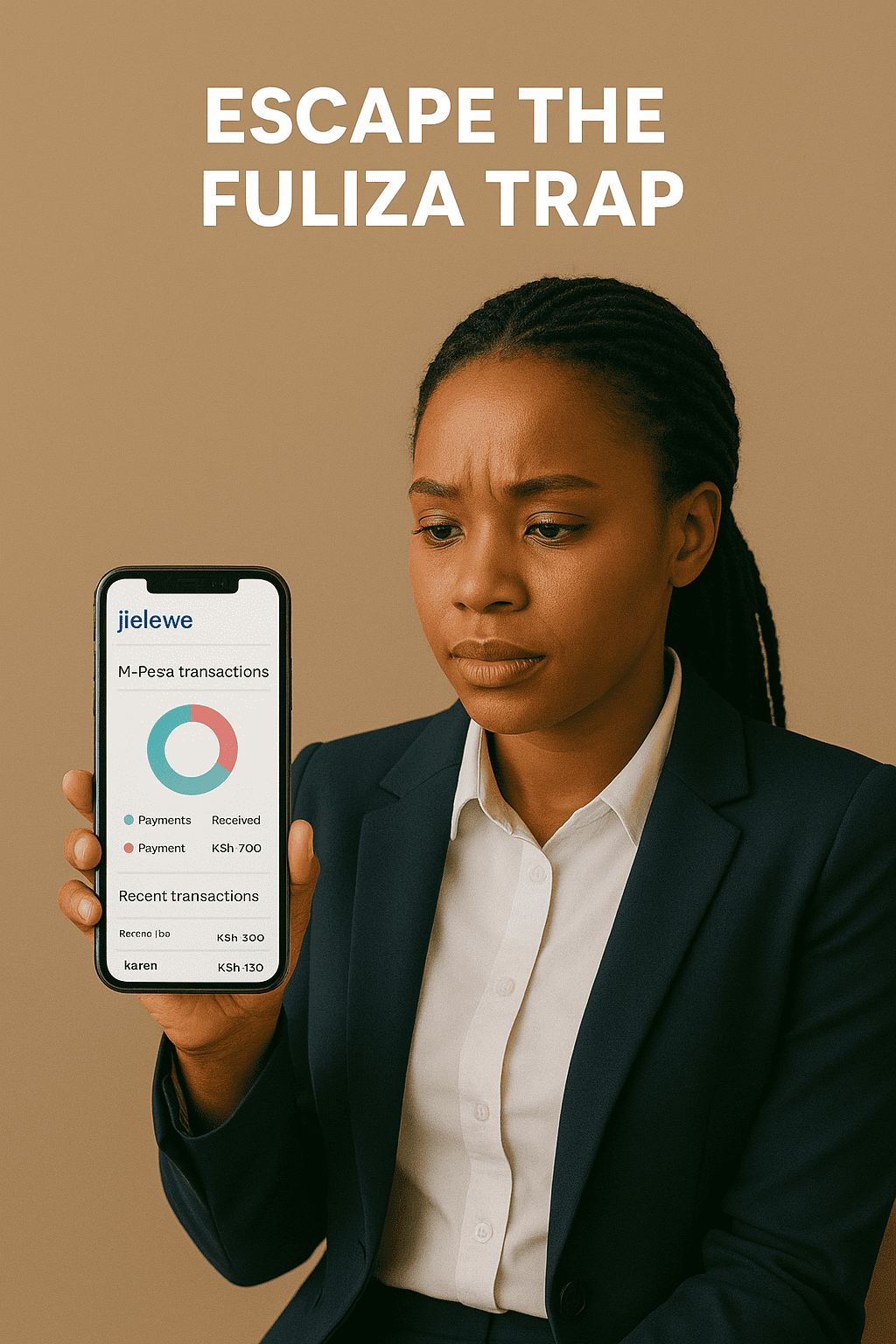

That’s where the Jielewe App comes in.

📱 Meet Jielewe — Kenya’s Smart Money Tracker

Jielewe helps you see exactly where your salary goes — down to the last shilling.

It automatically organizes your spending into categories like:

- 🥘 Food & groceries

- 🚖 Transport

- 💡 Bills & utilities

- 🎉 Entertainment

- 💸 Savings & investments

So instead of guessing, you get clear insights in one simple dashboard.

🔍 Why Tracking Your Spending Changes Everything

When you start tracking every shilling, three things happen almost immediately:

1️⃣ You Discover Your Money Leaks

That KSh 150 daily snack or 200 bob impulse buy suddenly looks bigger when it totals to KSh 6,000+ a month.

2️⃣ You Make Conscious Choices

Instead of “I’m broke,” you start thinking, “Do I really need this right now?”

3️⃣ You Build Control & Confidence

Knowing exactly where your money goes gives you power — and peace of mind.

🧩 How to Start Tracking Every Shilling

- Download Jielewe App — create your free account.

- Sync your transactions or add them manually.

- Set up your spending categories (Rent, Food, Transport, etc.)

- Review weekly summaries to see where your salary goes.

- Set small goals — like cutting food delivery costs by 10%.

Within a month, you’ll see clear patterns — and more savings.

💬 Real Talk: It’s Not About Earning More, It’s About Understanding More

You don’t need a raise to feel richer — you need clarity.

Most Kenyans earn enough to live decently, but lose control because they don’t track their spending.

As one Jielewe user put it:

“Once I started tracking, I realized my problem wasn’t low income — it was careless spending.”

🪙 Ready to Stop Wondering Where Your Salary Went?

Start tracking. Start understanding. Start changing.

👉🏾 Visit Jielewe.co.ke and download the app today.

Discover where your money really goes — and how to take control of it.