Debt can feel like a heavy cloud hanging over your life — the kind that dims your dreams and steals your peace of mind. For me, it was credit card bills, a few digital loans, and unpaid school fees. I tried budgeting apps, notebooks, even financial gurus on YouTube — nothing seemed to work.

Then, I discovered Jielewe — and everything changed.

My Turning Point: Discovering Jielewe

One sleepless night, while scrolling through Google looking for “best apps to manage debt in Kenya,” I came across Jielewe, a modern financial tracking app designed for everyday people like me. The tagline said:

“Understand your money. Control your future.”

That spoke to me.

Within minutes, I signed up, connected my accounts, and started exploring. The clean interface, easy navigation, and insightful tips instantly made me feel like I finally had a financial partner — not just another app.

Month 1–2: Seeing Where My Money Actually Went

Before Jielewe, I had no idea how much I was spending on small things — snacks, subscriptions, random M-Pesa charges.

Jielewe automatically categorized every transaction. In less than a week, I could see clear reports:

- How much I earned

- How much I spent

- And most importantly, where my money was leaking

This awareness was a game changer. I set spending limits using Jielewe’s budget tool, and the app would alert me whenever I was close to overspending.

Month 3–4: Creating My Debt Payoff Plan

Jielewe has a built-in Goal Planner, which lets you set personalized financial goals — from paying off debt to saving for a dream vacation.

I entered all my loans, from mobile lenders to credit cards. The app generated a realistic repayment schedule and showed how every payment would reduce my debt over time. Watching that progress bar move each week was addictive — and motivating!

Even better, Jielewe sent smart reminders before due dates. No more late fees or penalties!

Month 5–6: Tracking Progress and Staying Accountable

By the fifth month, I was seeing real change. My spending had dropped, my savings were growing, and I was down to my final two loans.

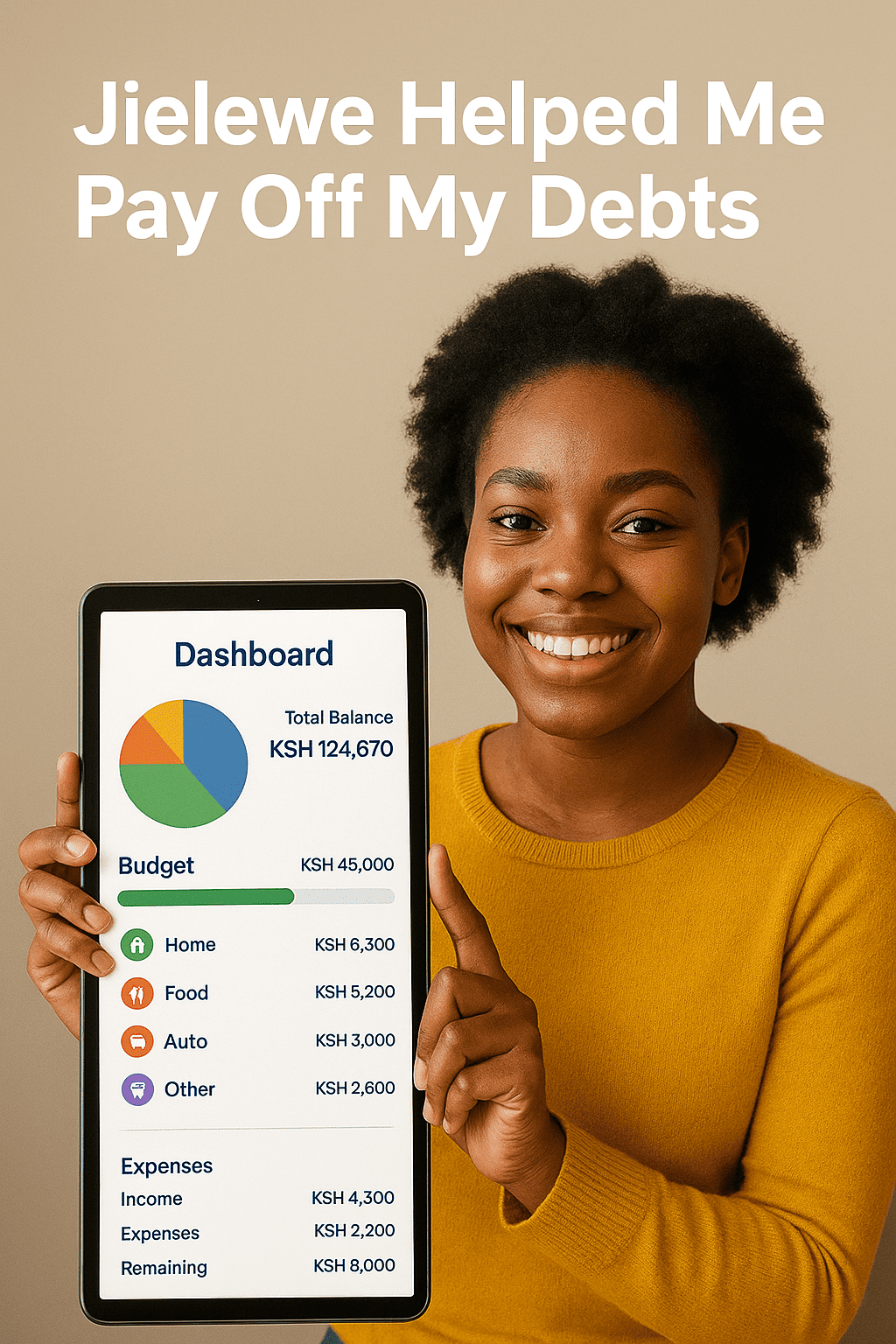

Jielewe’s financial dashboard gave me daily insights into my net worth, upcoming bills, and even savings growth trends. Every week, the app celebrated small milestones — like “You cleared 20% of your debt!” — and that positive reinforcement kept me going.

By the end of the sixth month, I had paid off all my debts. For the first time in years, I could breathe freely.

Why Jielewe Works

Unlike traditional budgeting apps, Jielewe is designed with the Kenyan lifestyle in mind. It integrates seamlessly with:

- M-Pesa transactions

- Bank accounts

- Local payment systems

It helps you:

✅ Track your income and expenses

✅ Set smart budgets and goals

✅ Monitor debt repayment

✅ Receive real-time alerts and insights

Whether you’re managing household expenses, business cash flow, or personal savings, Jielewe simplifies money management and helps you take control.

Real Stories. Real Results.

What I love about Jielewe is that it’s not just an app — it’s a movement. Thousands of Kenyans are using it to:

- Escape the cycle of debt

- Build savings habits

- Grow their financial confidence

Every story is different, but the outcome is the same — financial freedom.

Final Thoughts: From Stress to Success

Looking back, I wish I’d discovered Jielewe sooner. It’s more than a budgeting tool — it’s a mindset shift.

Jielewe taught me that managing money isn’t about restriction; it’s about awareness, discipline, and smart tools.

So, if you’re tired of juggling bills, late fees, and endless debt, take this as your sign.

✨ Start your journey to financial freedom today at Jielewe.co.ke ✨