If you’re Kenyan, chances are that M-Pesa is your main bank. From paying rent, buying food, sending money to family, shopping online, or even taking Fuliza loans, almost every financial transaction passes through your M-Pesa wallet.

But here’s the problem: your M-Pesa money disappears too quickly. One minute you’ve received your salary, HELB loan, or business profits—and within days, you’re left wondering “Where did all my money go?”

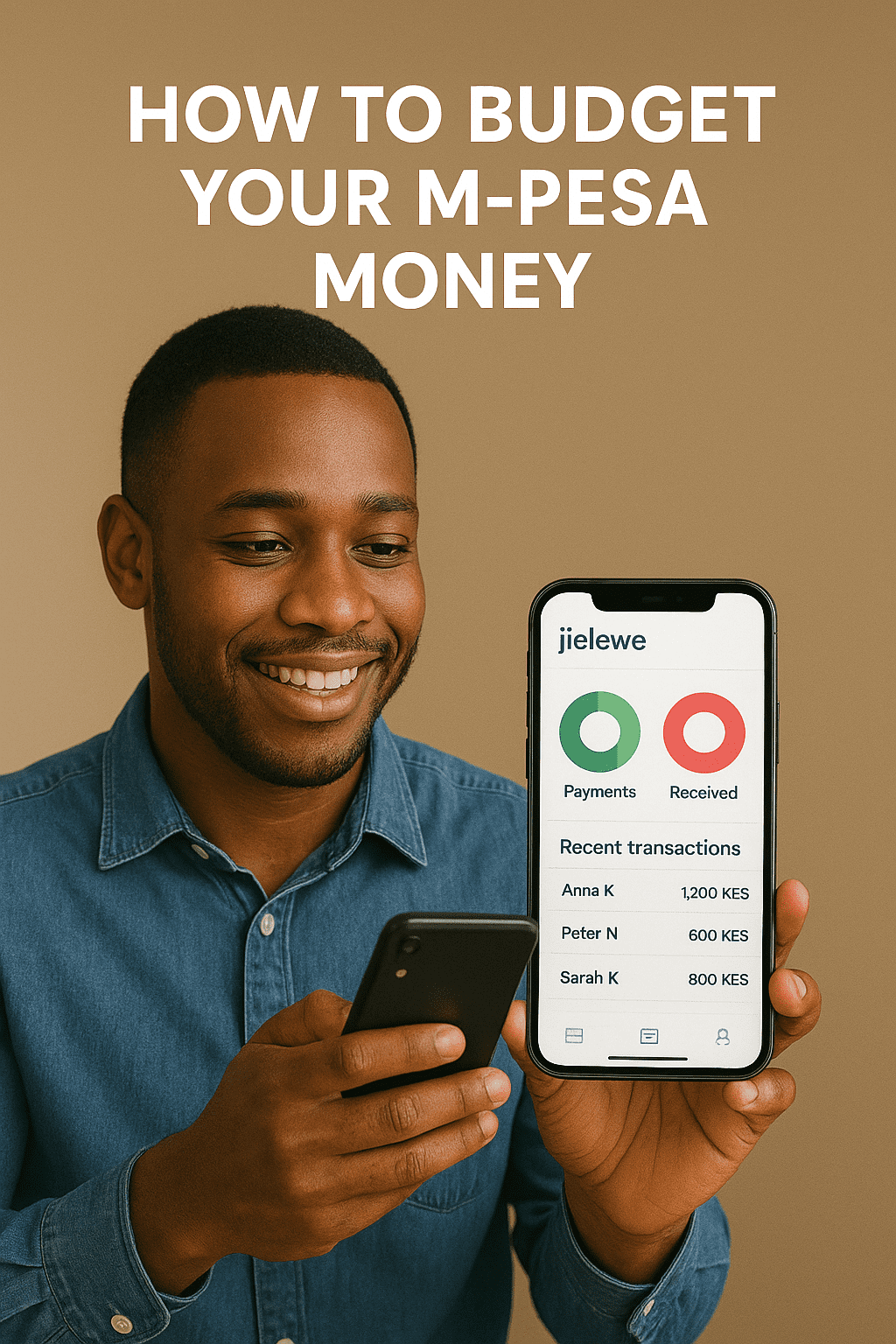

The solution? Budgeting your M-Pesa money like a pro. In this guide, we’ll show you practical steps to track, control, and grow your money using tools like Jielewe—a budgeting app built specifically for Kenyans.

Why You Need to Budget Your M-Pesa Money

- M-Pesa feels invisible – It’s easy to spend without noticing.

- Impulse spending is instant – Betting, airtime, and online shopping drain money fast.

- Fuliza debt traps – Many young Kenyans rely on overdrafts, leaving them stuck in cycles of debt.

- No record keeping – Without a budget, you can’t see where your money is going.

👉 That’s why tracking your M-Pesa transactions and budgeting wisely is the secret to financial freedom in Kenya.

Step 1: Track Every M-Pesa Transaction

Your first step is to understand your spending habits. Instead of scrolling through endless SMS messages, let Jielewe do the heavy lifting:

- Automatically sync and categorize your M-Pesa transactions.

- Separate income, expenses, and savings.

- Generate reports showing where most of your money goes.

💡 Example: You might realize 40% of your money goes to food delivery and data bundles—giving you a chance to cut back.

Step 2: Categorize Your Spending

Don’t treat M-Pesa as one big wallet. Break it down into categories like:

- Rent & bills

- Food & groceries

- Transport (matatus, Uber, fuel)

- Airtime & data

- Savings

- Fuliza & loans

👉 In Jielewe, you can create custom categories and assign every M-Pesa transaction. This way, you’ll see clearly where your money leaks.

Step 3: Pay Yourself First

Before spending, always save. Even if it’s 10% of your income, send it directly to savings goals in Jielewe:

- Emergency Fund

- School fees

- New phone or laptop

- Business startup fund

When you save before spending, you avoid the trap of waiting to save “what’s left”—because usually, nothing is left.

Step 4: Set Smart Budgets

Budgets work best when they’re realistic. Use Jielewe to:

- Set daily, weekly, or monthly budgets.

- Receive alerts when you overspend.

- Adjust based on your lifestyle.

💡 Example: If you set a KSh 5,000 monthly food budget and Jielewe shows you’ve already spent KSh 4,000 by mid-month—you’ll know it’s time to slow down.

Step 5: Avoid Fuliza and Loan Overdependence

Fuliza and quick mobile loans might feel like lifelines—but they’re traps.

- You spend tomorrow’s money today.

- You lose money to daily interest and fees.

- You reduce your future savings potential.

👉 Instead of relying on Fuliza, build an emergency fund in Jielewe. That way, when unexpected expenses hit, you use your savings—not debt.

Step 6: Review and Adjust Every Month

Budgeting is not “set and forget.” It’s a habit. At the end of every month:

- Check your Jielewe reports.

- Identify where you overspent.

- Adjust next month’s budget accordingly.

Over time, you’ll gain full control over your M-Pesa money.

Final Word: Jielewe Makes Budgeting Easy for Kenyans

Your money shouldn’t control you—you should control your money. With Jielewe, you can:

- Track M-Pesa transactions automatically.

- Create personalized budgets.

- Set financial goals and watch your savings grow.

💡 Whether you’re a student, young professional, or small business owner, Jielewe helps you budget your M-Pesa money like a pro.

👉 Try Jielewe today and take charge of your financial future.