In Kenya today, Fuliza has become a daily lifeline for millions. Whether it’s paying for food, transport, or emergencies, M-Pesa’s overdraft service offers instant access to cash when you need it most.

But here’s the reality: Fuliza is not free money. High fees and interest can trap you in a debt cycle, making it harder to save, budget, or build wealth. If you’ve ever wondered why your salary or business earnings vanish so fast—it’s probably because Fuliza is eating into your income.

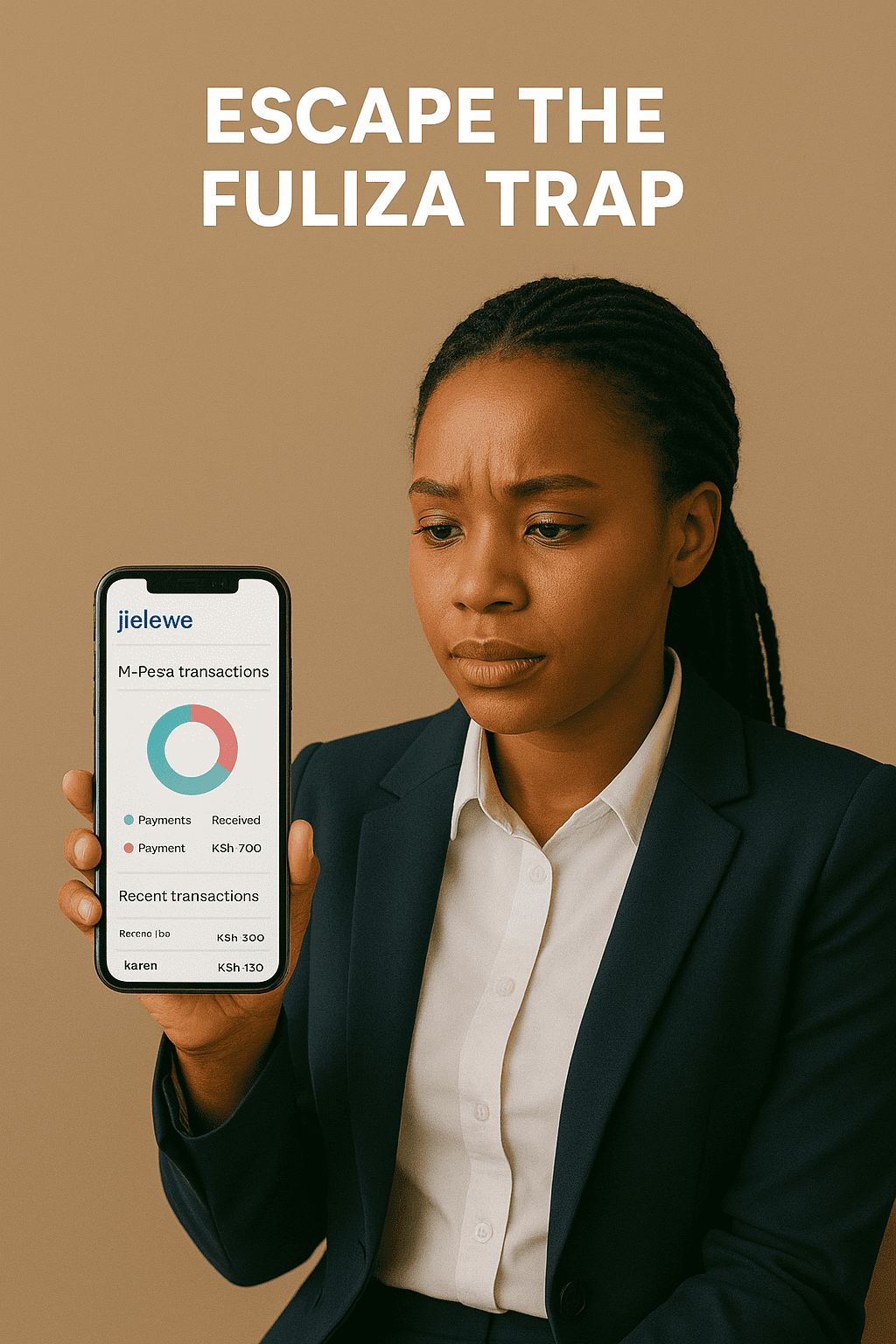

The good news? You can escape the Fuliza trap with the right money strategies and tools like Jielewe—a budgeting app designed for Kenyans to track M-Pesa transactions, set budgets, and grow savings.

Why Fuliza Feels Like a Trap

Fuliza is convenient, but it comes at a cost:

- Instant temptation: Easy access makes it harder to say “no.”

- Hidden costs: Fees and interest eat into your future earnings.

- Debt cycle: You borrow today, repay tomorrow, and borrow again.

- Stress: Living paycheck to paycheck with constant overdrafts creates financial anxiety.

👉 Without budgeting, you’ll always feel broke—even when money is coming in.

Step 1: Track Your Fuliza Usage

Most people don’t realize how much they borrow monthly. Start by checking your M-Pesa messages or, better yet, let Jielewe track it for you:

- Automatically sync M-Pesa transactions (including Fuliza).

- See exactly how much you borrow and repay.

- Spot patterns (e.g., “I borrow Fuliza every Friday night” or “I overspend on data bundles”).

💡 Awareness is the first step to breaking the cycle.

Step 2: Identify Your Spending Triggers

Why are you always in Fuliza? Common triggers include:

- Impulse buying (snacks, airtime, betting).

- Overspending on entertainment.

- Not planning for emergencies.

- Salary delays.

👉 In Jielewe, you can categorize every transaction and see which areas push you into overdraft.

Step 3: Build an Emergency Fund

Instead of relying on Fuliza for emergencies, start saving—even a little:

- Save KSh 50–200 daily in a separate goal on Jielewe.

- Aim for one month’s expenses over time.

- Use savings for true emergencies instead of Fuliza.

💡 Small, consistent savings will eventually replace the need for overdrafts.

Step 4: Set Smart Budgets

Budgets help you live within your means:

- Create categories in Jielewe (food, rent, data, transport).

- Allocate money before spending.

- Get alerts when you overspend.

👉 Example: If you set a KSh 2,000 monthly data budget, Jielewe will notify you when you’re close to overspending—so you avoid topping up via Fuliza.

Step 5: Diversify Your Income

If you’re always in Fuliza, it might mean your income isn’t enough. Consider:

- Side hustles (freelancing, online work, reselling).

- Group savings (chamas, saccos).

- Skills training (financial literacy, digital skills).

👉 The more income streams you have, the less dependent you’ll be on overdrafts.

Final Word: Break Free with Jielewe

Fuliza might feel like a quick solution, but in the long run, it drains your money and limits your growth. By tracking your transactions, setting budgets, and building savings with Jielewe, you can:

- Escape the Fuliza trap.

- Take control of your M-Pesa money.

- Build a clear path toward financial freedom.

💡 Remember: The best time to take control of your finances is today.

👉 Sign up for Jielewe and start your journey toward a debt-free future.