For many Kenyans, payday is a moment of relief—but by the second or third week, the salary is already gone. Bills, M-Pesa transactions, Fuliza, and daily expenses drain money so fast that most people end up broke before month-end.

This cycle of living paycheck to paycheck creates stress, debt, and financial instability. But the good news is—you can break free. With the right strategies and tools like Jielewe, you can finally take control of your income and start building a better financial future.

Why Kenyans Struggle with Paycheck-to-Paycheck Living

The paycheck-to-paycheck cycle is common in Kenya for several reasons:

- High cost of living: Rent, transport, food, and utilities take up most of the salary.

- Untracked M-Pesa spending: Small daily payments add up quickly without notice.

- No budget: Many people spend as money comes without planning.

- Debt reliance: Fuliza, mobile loans, and shylocks eat into income through interest.

- Impulse buying: Offers and unplanned expenses drain savings.

👉 Without a system to track and plan money, salaries vanish fast.

How to Break the Cycle and Gain Control

Here’s a step-by-step guide for Kenyans who want to stop living paycheck to paycheck:

1. Track Every Shilling

You can’t manage what you don’t measure. Start by tracking all your income and expenses—both bank and M-Pesa.

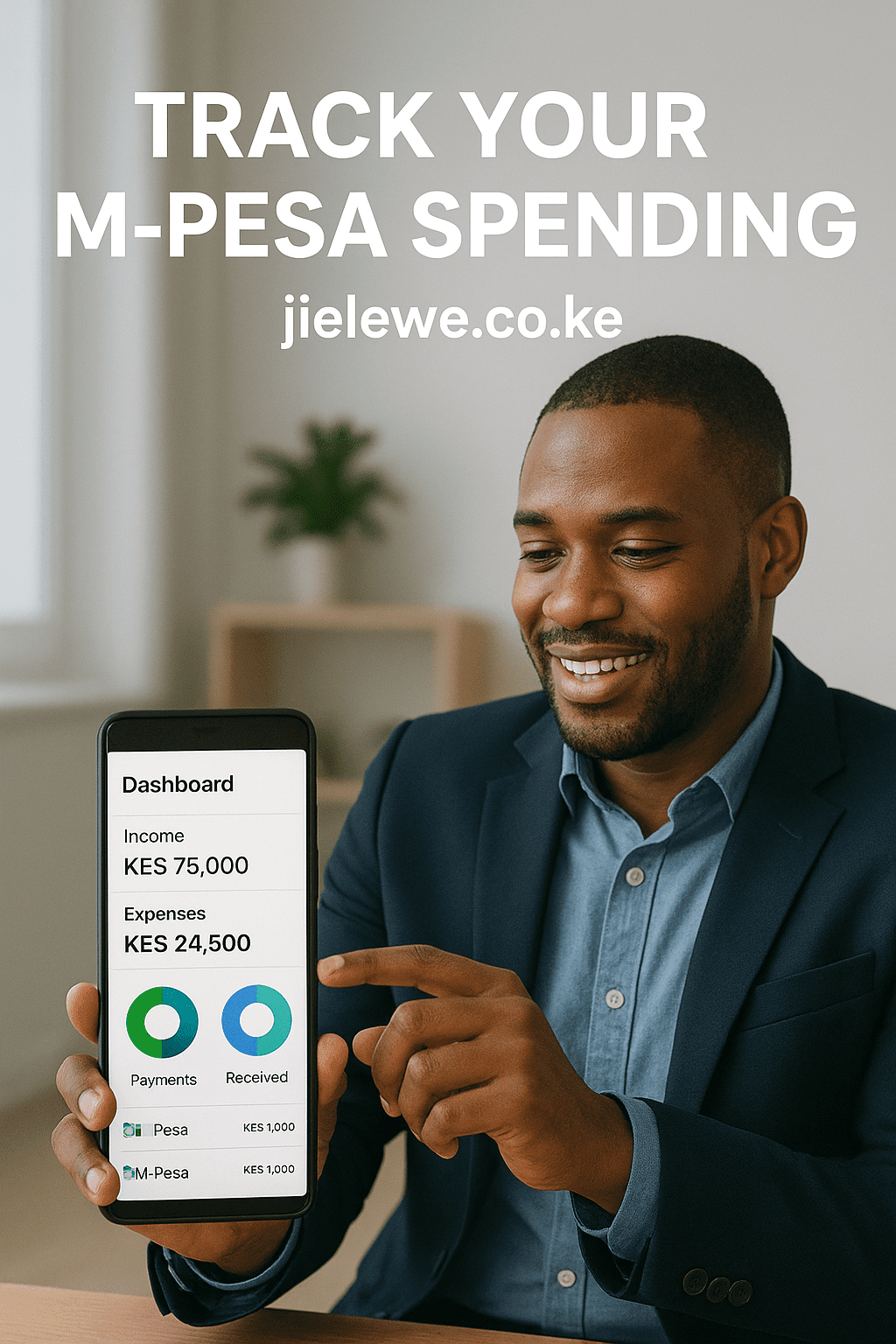

✅ With Jielewe, every transaction (bank deposits, M-Pesa payments, withdrawals) is categorized automatically so you know exactly where your money is going.

2. Create a Realistic Budget

Budgeting isn’t about restriction—it’s about clarity. Split your income into:

- Needs (50%) – rent, bills, food, transport.

- Wants (30%) – eating out, entertainment.

- Savings/Investments (20%) – emergency fund, SACCO, business capital.

📌 Jielewe makes budgeting easy by showing when you overspend and reminding you to stick to your goals.

3. Save First, Spend Later

Most Kenyans save what remains after spending—but often, nothing remains. Flip the script: save immediately when salary arrives.

💡 In Jielewe, you can set goals (school fees, emergency fund, investments) and allocate money towards them before spending on wants.

4. Escape the Fuliza and Loan Trap

Fuliza and mobile loans seem small but they trap many Kenyans in debt cycles. Imagine paying 10–15% in interest every month—money that could go into savings.

👉 Use Jielewe to track debt repayments and plan ahead so you don’t fall back into borrowing.

5. Build an Emergency Fund

Unexpected expenses (medical, repairs, family needs) force many back into debt. An emergency fund of just KSh 20,000–50,000 can give peace of mind.

Jielewe helps you track progress as you build this safety net little by little.

Real-Life Example: A Kenyan Teacher Breaks Free

Take Mary, a primary school teacher in Nairobi earning KSh 35,000.

- Before Jielewe: By mid-month, she relied on Fuliza for basics. She never understood where her money went.

- After Jielewe: She tracked her M-Pesa, bank, and cash flow in one place. She discovered 25% of her income went to eating out. By budgeting, she cut this in half and redirected savings into her SACCO shares.

💡 In 6 months, Mary cleared her Fuliza balance and saved KSh 18,000.

Why Jielewe Is the Solution for Kenyans

Jielewe is built for Kenyans who want clarity over their money.

- Tracks M-Pesa and bank transactions together.

- Helps you create and follow realistic budgets.

- Sets and monitors financial goals.

- Breaks the cycle of living salary to salary.

🚀 Start today with Jielewe and take your first step toward financial freedom.