M-Pesa has transformed how Kenyans handle money. From paying bills and shopping to sending pocket money and taking loans, it’s no exaggeration to say M-Pesa is the backbone of financial transactions in Kenya.

But here’s the challenge: while M-Pesa makes spending easy, it also makes it harder to track your money. Before you know it, your salary or side hustle income has been swallowed by daily transactions—airtime, Fuliza, food deliveries, and unexpected payments.

So, how can you track and manage your M-Pesa spending effectively and build financial discipline? Let’s dive in.

Why Tracking M-Pesa Spending Matters

Over 30 million Kenyans use M-Pesa, yet very few know exactly where their money goes each month.

Here’s why tracking matters:

- Hidden Spending Leaks: Small payments add up—think Ksh 50 here, Ksh 100 there.

- Fuliza & Loan Cycles: Easy borrowing leads to endless debt.

- Impulse Purchases: M-Pesa makes buying as simple as a tap.

- No Saving Culture: Without visibility, saving feels impossible.

👉 If you don’t track your M-Pesa transactions, your money will always feel like it disappears into thin air.

Traditional Ways to Track M-Pesa Spending

Some Kenyans rely on manual tracking methods:

- M-Pesa SMS Statements

- Safaricom sends messages for every transaction.

- The downside? Sorting through hundreds of SMS is time-consuming.

- M-Pesa App & Mini Statements

- Shows balances and some transaction history.

- Limited analysis, no proper budgeting insights.

- Bank/M-Pesa Integration

- If linked, you can see transfers.

- Still doesn’t show where the money goes.

These methods give raw data, but not actionable insights. That’s where smarter tools come in.

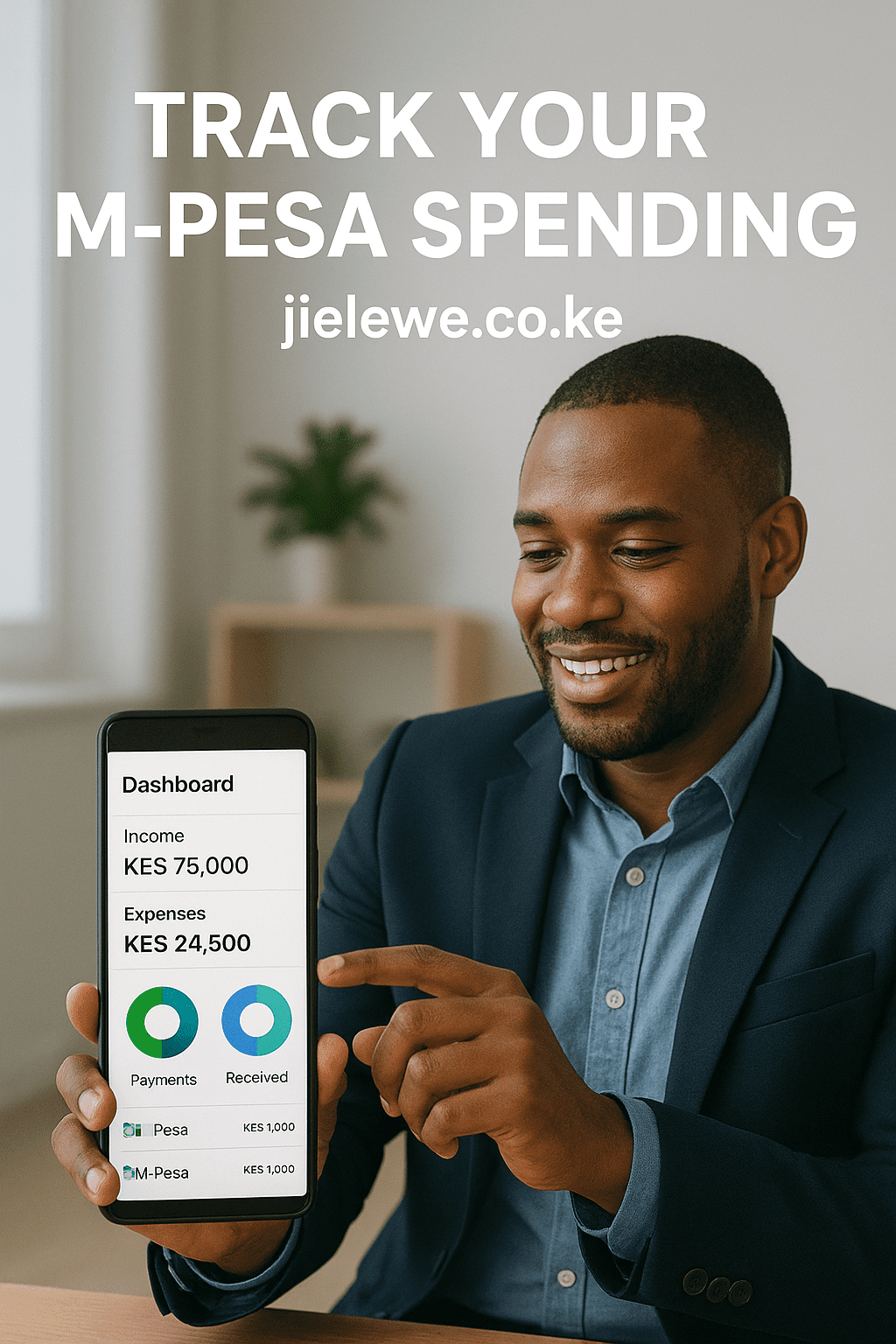

The Smarter Way: Using Jielewe to Track M-Pesa

Jielewe is a Kenyan-built budgeting and money management app that makes tracking M-Pesa simple, automatic, and insightful.

Here’s how Jielewe helps:

1. Automatic Tracking

Jielewe pulls in your M-Pesa transactions so you don’t have to manually record every expense.

2. Expense Categorization

Transactions are grouped into categories like food, bills, transport, shopping, savings, and debt repayment. You instantly see where your money is going.

3. Budgeting Tools

Set a monthly budget and receive alerts when you overspend. For example, if your “transport” budget is Ksh 4,000 but you hit 4,200 mid-month, Jielewe notifies you.

4. Goal Tracking

Saving for school fees, an emergency fund, or a holiday? Jielewe helps you set and track your progress.

5. Insights & Reports

Unlike SMS or mini-statements, Jielewe gives you visual dashboards showing trends in your spending and savings.

Real-Life Example: From Salary to Clarity

Meet Faith, a young professional in Nairobi earning Ksh 50,000 per month. She always felt “broke” by the 20th of the month.

After registering with Jielewe:

- She discovered 35% of her salary went to impulse food orders.

- She set a budget to cut that to 15%.

- She redirected the difference into her savings goal.

Three months later, she had saved Ksh 15,000—something she had never achieved before.

👉 With Jielewe, she turned confusion into clarity.

Take Charge of Your M-Pesa Today

M-Pesa is powerful, but without proper tracking, it can trap you in a cycle of confusion and debt.

The solution? Clarity.

And the best way to achieve clarity is with Jielewe—the budgeting and money management app built specifically for Kenyans.

🚀 Register with Jielewe today and take control of your M-Pesa transactions, income, and savings.