Introduction

Life is unpredictable. A sudden medical bill, job loss, school fees, or even an urgent home repair can disrupt your finances if you’re not prepared. Many Kenyans turn to mobile loans or shylocks in such cases, which only worsens the problem.

That’s why building an emergency fund in Kenya is not just important—it’s essential. In this post, we’ll explain why you need one, how much to save, and practical steps to start today with the help of Jielewe.

What is an Emergency Fund?

An emergency fund is money you set aside specifically for unexpected expenses. It acts as a financial safety net, protecting you from debt or financial strain when emergencies happen.

It’s not for luxuries or planned spending—it’s strictly for unforeseen situations like:

- Medical emergencies

- Sudden job loss

- Car or home repairs

- School fee delays

- Family emergencies

Why Every Kenyan Needs an Emergency Fund

1. Avoid Mobile Loan Dependence

Many Kenyans rely on mobile loans like Fuliza or Tala in emergencies, but high interest rates make repayment harder. An emergency fund saves you from this trap.

2. Financial Peace of Mind

Knowing you have money set aside reduces stress and helps you focus on long-term goals.

3. Protects Your Future Goals

Without an emergency fund, you may be forced to dip into savings meant for land, a house, or business investments.

4. Helps During Job Loss

Kenya’s job market is unpredictable. An emergency fund gives you time to recover without immediately falling into debt.

How Much Should You Save?

Most financial experts recommend saving 3–6 months of expenses.

For example, if your monthly expenses are KSh 30,000, aim for an emergency fund of KSh 90,000 – 180,000.

If that feels overwhelming, start small—even KSh 100 a day adds up over time.

How to Start an Emergency Fund in Kenya

1. Track Your Expenses

First, know how much you spend monthly. Apps like Jielewe help you record expenses and identify areas to cut back.

2. Set a Realistic Goal

Decide on your first target, e.g., KSh 10,000. Once you reach it, move toward bigger milestones.

3. Open a Separate Savings Account

Keep your emergency fund separate from your daily spending account to reduce temptation.

4. Automate Savings

Set up automatic transfers or commit to saving a fixed amount weekly.

5. Avoid Touching It

Only use the fund for real emergencies—not shopping, entertainment, or holidays.

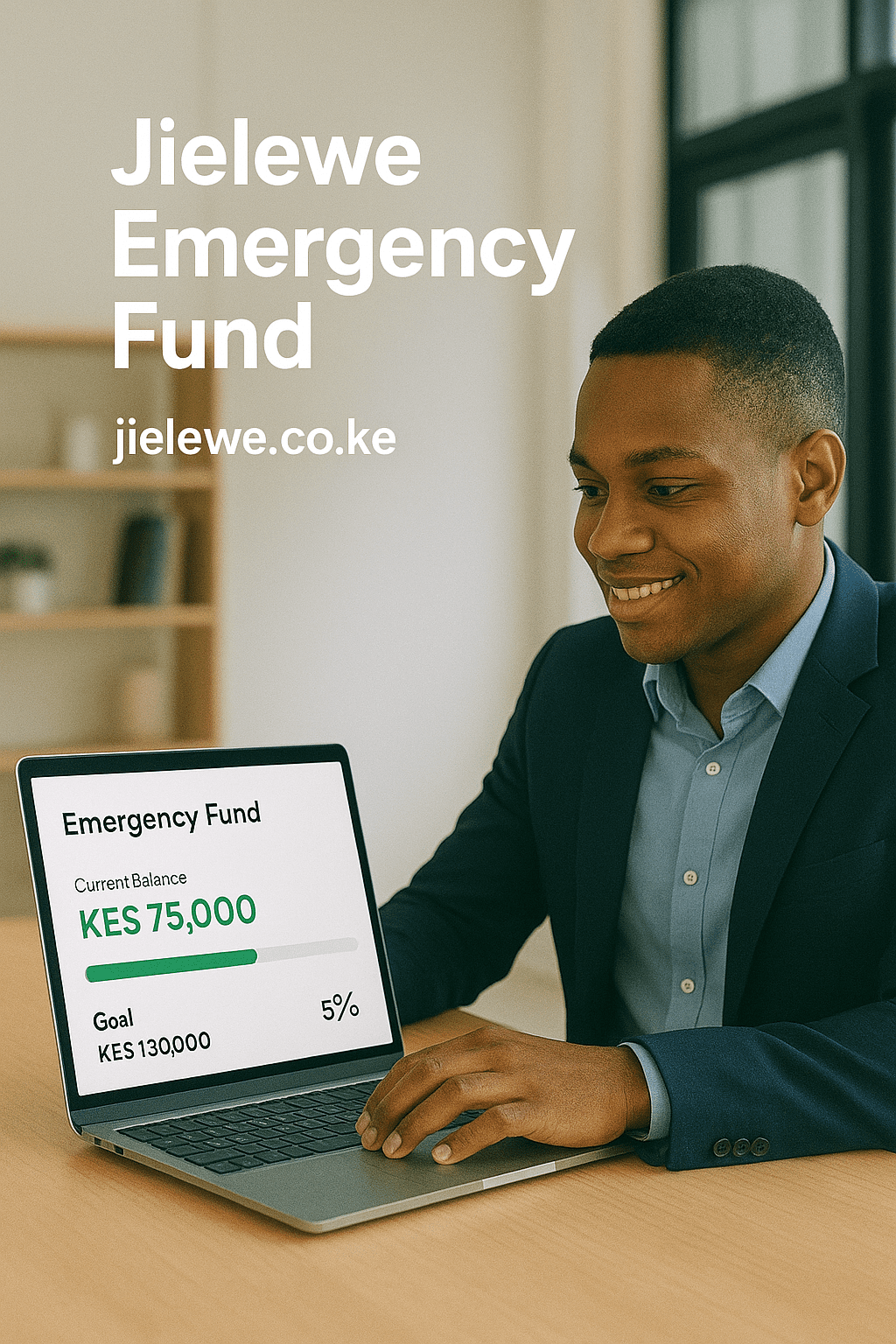

How Jielewe Helps You Build an Emergency Fund

The Jielewe app is tailored for Kenyans who want to manage money better. With Jielewe you can:

- Track daily income and expenses

- Set clear savings goals like “Emergency Fund”

- Monitor progress visually

- Stay accountable with reminders

- Build a culture of saving consistently

Final Thoughts

Emergencies are part of life, but financial stress doesn’t have to be. By starting an emergency fund in Kenya, you protect yourself and your family from unexpected expenses and debt.

Begin today—whether it’s KSh 100, 500, or 1,000—small steps add up to big security. And with tools like Jielewe, you’ll stay on track toward building a financial safety net.

👉 Don’t wait for a crisis. Start your emergency fund now and secure your peace of mind.