Introduction

Many Kenyans wonder why their money disappears so quickly, even when they try to budget carefully. The truth is, hidden costs—those small, often unnoticed expenses—are silently eating away at your income. Unless you identify and manage them, you’ll always feel financially stretched.

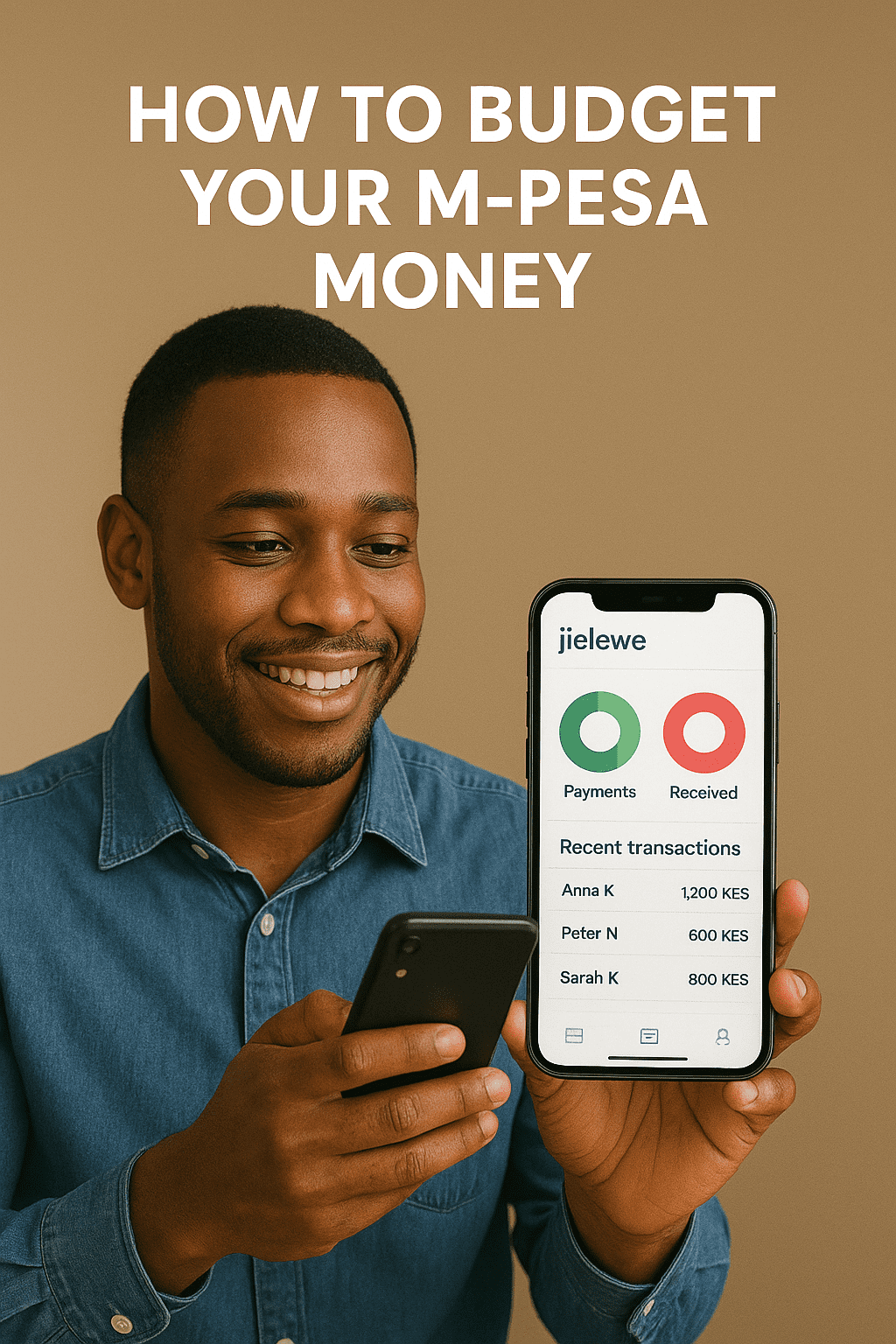

This is where tools like Jielewe come in. By tracking every shilling, you can finally see where your money is going and fix the leaks.

Common Hidden Costs in Kenya

1. Mobile Money Charges (M-Pesa & Banking Fees)

While convenient, mobile money transactions come with charges for sending, withdrawing, and even balance checks. Over time, these small fees add up to thousands of shillings annually.

Tip: Consolidate transfers, withdraw less frequently, and track all charges using Jielewe.

2. Loan Interest and Late Payment Penalties

Many Kenyans rely on mobile loans or bank credit, often overlooking hidden charges like:

- Processing fees

- Late payment penalties

- Account maintenance fees

These eat into your earnings and keep you in a cycle of debt.

3. Impulse Purchases and Delivery Costs

Online shopping and food delivery apps make spending effortless. But small add-ons like delivery fees, packaging, and convenience charges pile up without notice.

Tip: Use Jielewe to categorize such spending—seeing totals will help you cut down.

4. Bank Account Maintenance Fees

Some banks deduct monthly or annual maintenance fees silently. Add on ATM charges, standing orders, and SMS alerts, and you’re losing money without realizing it.

5. Subscriptions and Renewals

Streaming services, gym memberships, and software subscriptions often auto-renew. Even if you don’t use them, you’re still charged.

Tip: Set reminders and cancel unused services.

6. Fuel and Vehicle Maintenance

Owning a car comes with more than fuel. Consider insurance, servicing, parking, and unexpected repairs. These costs are often underestimated when budgeting.

7. Hidden Lifestyle Costs

- Eating out more often than planned

- Airtime and data bundles bought in small chunks

- “Social obligations” like chamas, weddings, and harambees

Individually, these look harmless—but combined, they drain your finances.

How to Fix These Money Leaks

- Track Every Expense – Use Jielewe to log transactions automatically and manually.

- Review Monthly Statements – Bank, mobile money, and subscription accounts.

- Set Spending Limits – Allocate fixed amounts for entertainment, transport, and social events.

- Build Awareness – Simply seeing how much you spend in hidden areas will encourage better decisions.

Conclusion

Hidden costs are the silent killers of wealth. From mobile money fees to forgotten subscriptions, they eat into your income without warning. The good news? Once you track and control them, you’ll instantly feel more financially secure.

With Jielewe, you can monitor every coin, stop unnecessary leaks, and redirect your money toward meaningful goals like savings, investments, or an emergency fund.

👉 Don’t let hidden costs rob your future. Start tracking today at jielewe.co.ke.