Your daily money habits shape your financial future more than one-time decisions. From how you spend on food, entertainment, and shopping to how consistently you save and invest, your lifestyle choices directly impact your financial stability.

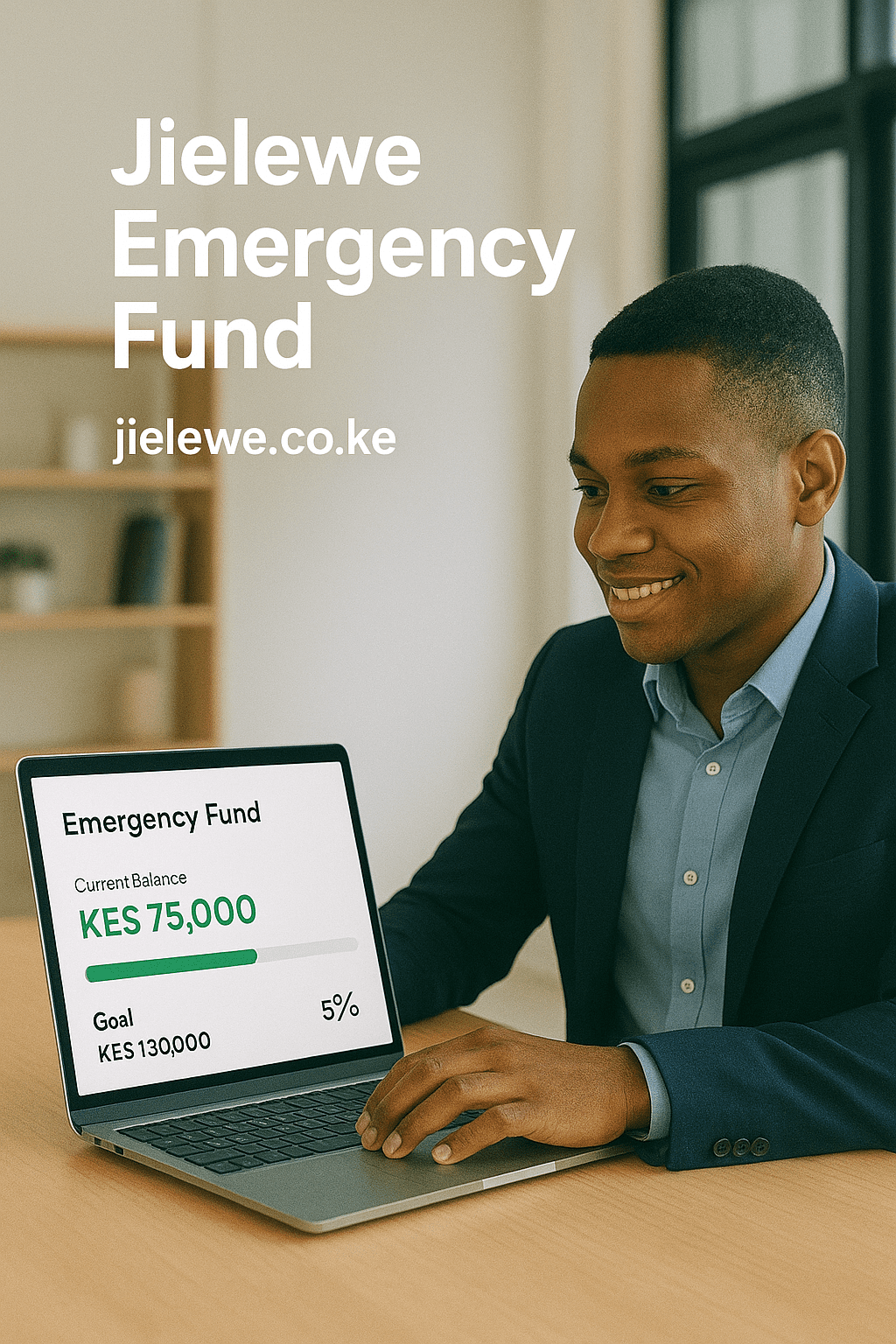

At Jielewe, we help Kenyans build healthy money habits that align with their lifestyle and financial goals. This Lifestyle & Money Habits FAQs section answers common questions about spending wisely, avoiding lifestyle inflation, and creating sustainable routines that support long-term wealth.

👉 Explore related guides:

- Budgeting & Expense Tracking FAQs

- Saving & Emergency Funds FAQs

- Investments & Wealth Building FAQs

- Debt Management FAQs

- Financial Goal Setting FAQs

Lifestyle & Money Habits FAQs

Follow your budget, prioritize high-value experiences, and practice mindful spending.

Yes, small expenses add up and can derail budgets if ignored.

Maintain consistent spending habits even as income grows, and increase savings proportionally.

Wait 24 hours before buying non-essential items to reduce impulse purchases.

Stick to your budget, communicate your financial goals, and avoid unnecessary comparisons.

Studies show investing in experiences yields more lasting happiness than material possessions.

Start early with allowances, saving jars, and simple discussions about money management.

Plan in advance, use budget-friendly accommodations, and track all expenses.

Allocate a portion of your budget for leisure to avoid burnout and maintain financial discipline.

Yes, it gives a complete picture of financial health beyond just income and expenses.

Conclusion

Money habits are built one choice at a time. Whether it’s sticking to a budget, cutting unnecessary expenses, or consistently saving, your lifestyle decisions create the foundation for financial freedom.

At Jielewe, we encourage you to adopt practical money habits that fit your lifestyle while helping you reach your bigger financial goals. Remember, it’s not about being perfect — it’s about being consistent.

💡 Small daily habits compound into life-changing financial results.