In today’s fast-paced world, money seems to disappear faster than it comes in — especially for students and young professionals juggling school fees, rent, meals, and endless small expenses. The problem isn’t always lack of income — it’s lack of financial awareness.

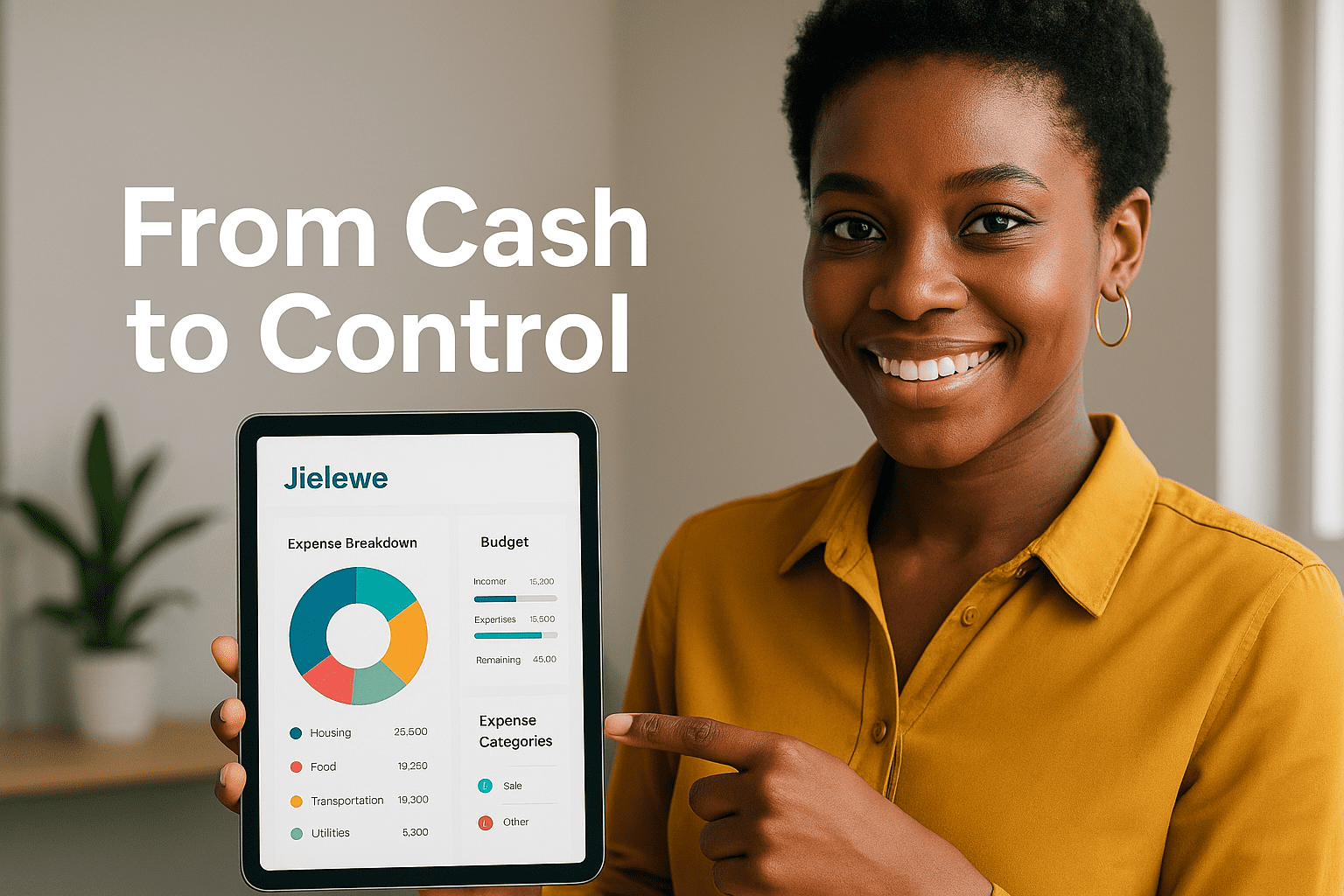

That’s where digital expense tracking steps in — and platforms like Jielewe.co.ke are leading this transformation across Kenya.

🎓 The Reality for College and University Students

For most students, managing money means making it stretch until the next HELB disbursement or allowance. But how often do you actually know where your money goes?

Here’s a common scenario:

- Ksh 50 for breakfast,

- Ksh 120 for lunch,

- Ksh 300 for an outing,

- Ksh 100 on “just snacks.”

By the end of the week, you’re shocked at how your wallet emptied itself.

With Jielewe, you can track every coin in real-time. You’ll quickly see patterns — the little spends that add up, the unnecessary treats, and where you can save. That’s the first step toward financial discipline.

💡 What Is Digital Expense Tracking?

Digital expense tracking means using a smart tool or app to record, categorize, and analyze how you spend your money. Unlike writing in a notebook or depending on memory, it gives you data-driven insights — your personal money map.

Jielewe does exactly that:

- Automatically categorizes your transactions

- Tracks spending habits

- Helps you create and stick to budgets

- Allows you to set financial goals and monitor progress

Whether you’re a student, intern, or employee, Jielewe helps you take control of your money — effortlessly.

🚀 Why Financial Discipline Matters (Especially for Students)

Financial discipline isn’t just about saving money — it’s about developing a lifestyle of awareness and control.

Here’s what it teaches you:

- Prioritize needs over wants. You’ll quickly know what’s essential.

- Plan ahead. Set aside money for books, rent, or emergencies.

- Avoid debt traps. No more relying on friends or mobile loans mid-month.

- Build saving habits early. The earlier you start, the faster you grow wealth.

Jielewe helps you master these principles while you’re still in campus — setting you up for financial success long after graduation.

🧠 From Students to Salaried Employees — One App, One Discipline

For employees, especially young professionals in Kenya’s growing workforce, tracking expenses digitally means smarter budgeting and less financial stress.

No more wondering “Where did my salary go?” two weeks after payday.

With Jielewe, you’ll have a full picture — from rent and transport to impulse purchases and M-Pesa charges.

By staying consistent, you can build financial discipline that transforms your life — not just your bank balance.

📊 Why Jielewe Stands Out

Unlike generic budgeting apps built for foreign markets, Jielewe is built for Kenya — for the way Kenyans actually earn, spend, and save.

✅ Sync your M-Pesa transactions automatically

✅ Set daily, weekly, or monthly budgets

✅ View spending charts and trends

✅ Create savings and goal targets

✅ Access your financial dashboard anytime, anywhere

Whether you’re a college student managing pocket money or an employee planning your next investment, Jielewe adapts to your lifestyle.

🌍 Financial Freedom Starts with Awareness

Financial discipline begins the moment you start paying attention. Every shilling has a story — Jielewe simply helps you tell it clearly.

When you understand your spending habits, saving becomes second nature. And when you save consistently, you gain control over your future.

That’s how you move from cash to control — with Jielewe by your side.

💬 Final Thoughts

In a world where money moves fast, it’s easy to lose track. But with Jielewe, you don’t just track your expenses — you build a lifestyle of accountability, control, and confidence.

So whether you’re in university, starting your career, or already earning, now’s the time to take charge.

👉 Start tracking your expenses today at Jielewe.co.ke

Because the earlier you understand your money, the sooner you’ll master it. 💪