Kenya’s financial landscape is changing fast. From mobile banking to digital credit apps, Kenyans are managing money in ways that would have seemed impossible a decade ago. But behind this digital transformation lies a deeper story — one about debt, savings, and the growing need for financial awareness.

As we step into 2025, one thing is clear: how Kenyans manage their money is evolving, and platforms like Jielewe are leading the charge in helping individuals take control of their financial futures.

💡 1. The Current Financial Reality in Kenya

Recent reports show that more than 62% of Kenyans live paycheck to paycheck, and nearly half have active digital loans from platforms like M-Shwari, Tala, and Branch. The convenience of mobile credit has been both a blessing and a burden — easy access to cash, but often without structured financial planning.

At the same time, the cost of living continues to rise. Basic commodities, rent, and education expenses have outpaced income growth, forcing many Kenyans to rely on short-term debt to fill the gap.

But amidst this financial chaos, something positive is emerging: a new wave of financial awareness.

📊 2. A Growing Desire for Financial Literacy

Compared to five years ago, Kenyans today are far more proactive about learning how to budget, invest, and save.

Search trends on Google reveal spikes in terms like:

- “How to save money in Kenya”

- “Best budgeting apps in Kenya”

- “Debt management tools”

And that’s where Jielewe shines.

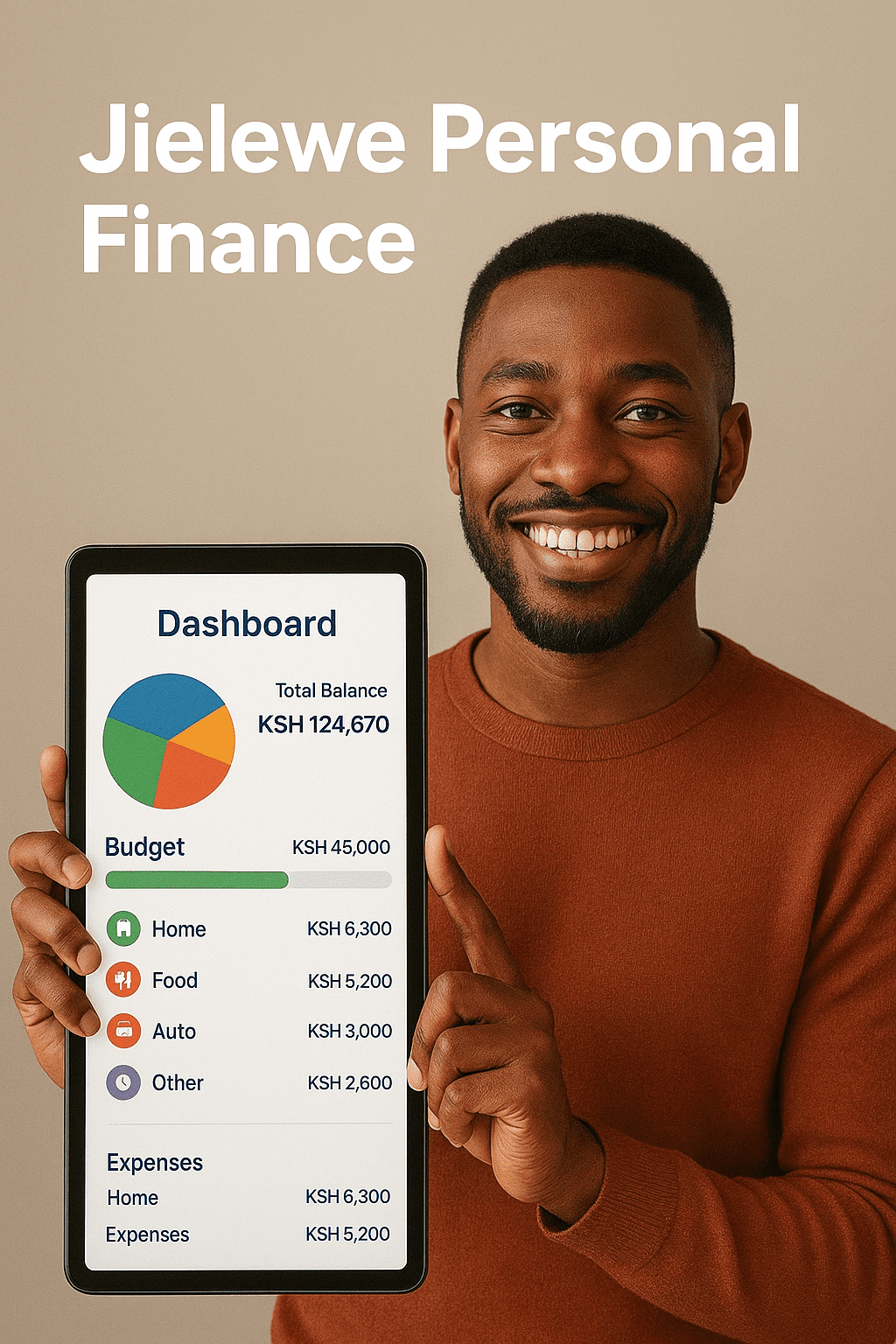

The Jielewe app empowers users to see exactly where their money goes, how to create budgets that actually work, and how to set smart goals that lead to real progress. It transforms vague financial goals into clear, measurable steps.

📱 3. Technology: The New Financial Partner

Fintech is redefining how Kenyans interact with money. From M-Pesa to online banking, financial data is more accessible than ever — but data without insight is noise.

That’s why Jielewe uses technology not just to show numbers, but to give meaning to your money.

With real-time syncing from M-Pesa, bank accounts, and spending categories, users can:

- Track every shilling automatically

- Receive spending alerts before overspending

- Set monthly budgets and financial goals

- Visualize progress toward debt-free or savings goals

In a country where most people don’t track their spending, tools like Jielewe are quietly changing lives — one transaction at a time.

💰 4. The Debt Situation: Kenya’s Silent Struggle

As of 2025, digital loan uptake remains high, but repayment rates are improving thanks to apps that help users stay accountable. The Central Bank of Kenya has emphasized the importance of financial discipline, but real progress starts at the personal level — with individuals making smarter choices daily.

Jielewe gives users a debt-tracking dashboard where they can see all their outstanding loans in one place, prioritize repayments, and receive alerts before due dates. That simple visibility helps reduce financial anxiety and keeps users focused on becoming debt-free.

🌍 5. The Future of Personal Finance in Kenya

The next five years will define Kenya’s financial culture. With the growing middle class, a tech-savvy youth, and a push toward digital literacy, the future looks promising — if people have the right tools.

Jielewe is more than a financial app; it’s part of this transformation. It empowers Kenyans to make informed decisions, build habits of saving, and create sustainable wealth.

The vision is simple:

A financially confident Kenya, one user at a time.

🚀 Conclusion: Understanding Money, Changing Lives

The data shows that Kenyans are ready for smarter money management — but information alone isn’t enough. You need insight, accountability, and actionable tools that simplify the journey.

That’s what Jielewe delivers. Whether you’re fighting debt, planning for your future, or just want to understand your spending better, Jielewe is your trusted partner in financial freedom.

💡 Start your journey today at Jielewe.co.ke