Money influences every part of our lives — from what we eat, where we live, to how we dream. Yet, most Kenyans leave school knowing how to solve quadratic equations but not how to budget, save, or invest.

As Kenya races toward a digital and entrepreneurial future, financial literacy is no longer optional — it’s essential. If we want a generation that is debt-free, financially independent, and wealth-minded, then financial education must start early.

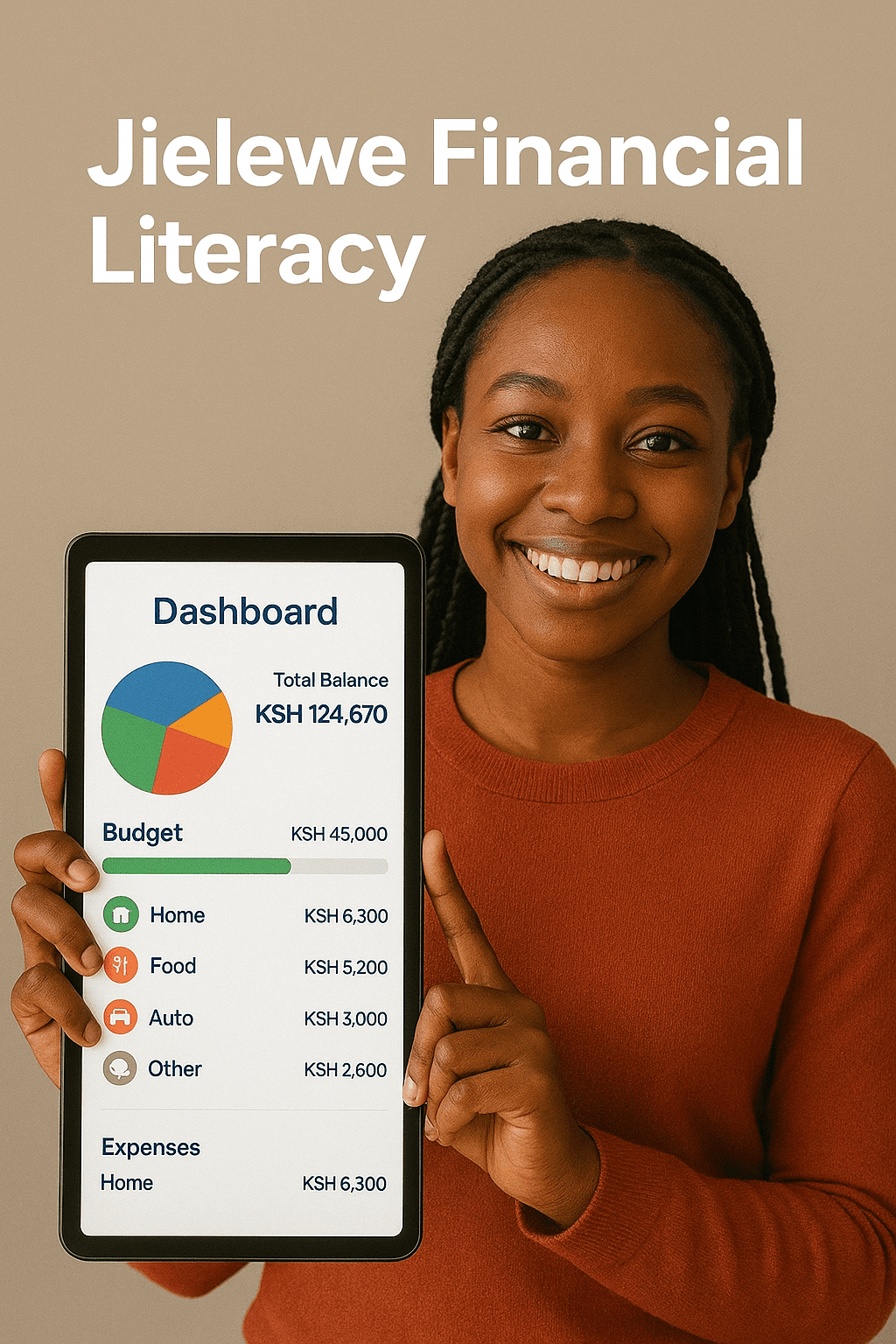

That’s exactly what forward-thinking platforms like Jielewe are trying to change — by bringing practical financial tools directly to the people.

💡 1. The Harsh Reality: Money Confusion Among Young Kenyans

Walk into any university campus or youth group and you’ll hear the same story:

“I’m broke.”

“My HELB is gone.”

“I took a Fuliza to survive the week.”

These aren’t just personal stories — they’re national trends. According to financial surveys, over 70% of young Kenyans have taken at least one form of mobile loan, and most lack a plan for repayment.

Why? Because no one taught them how money really works.

In schools, we’re taught about history and geography, but not how interest rates, taxes, or credit scores affect our lives. When young adults finally start earning, they fall into the same traps — impulsive spending, debt dependency, and zero savings.

🎓 2. Why Financial Literacy Belongs in the Curriculum

Imagine if students learned how to budget their pocket money, save part of their allowance, or even start small ventures while in school. Imagine a generation that understands:

- The difference between good and bad debt

- How compound interest grows wealth

- How to plan and achieve long-term goals

That’s not just education — that’s empowerment.

Financial literacy builds confidence. It equips young people to make informed decisions about money, loans, careers, and investments. When we teach students how to manage money, we’re teaching them how to manage their lives.

📲 3. Technology Can Bridge the Gap — Enter Jielewe

The solution isn’t just in textbooks — it’s in digital tools that meet students where they already are: on their phones.

Jielewe is a financial tracking app designed for everyday Kenyans — students, professionals, and families alike. It transforms the abstract idea of “financial management” into something visual, personal, and engaging.

With Jielewe, users can:

- Track their spending and understand habits

- Create budgets and stick to them with smart alerts

- Set financial goals, from paying school fees to starting savings

- Learn through real insights, not boring lectures

If schools integrated such tools into lessons, financial literacy would no longer be a theory — it would be a daily habit.

💰 4. The Ripple Effect of Early Financial Education

Teaching financial literacy in schools doesn’t just benefit students — it transforms society.

When young people understand money:

- They make better choices as adults

- They reduce reliance on quick loans and debt traps

- They become smarter entrepreneurs and investors

- They strengthen Kenya’s economy through responsible financial behavior

Imagine a Kenya where graduates leave school not just with a certificate, but with financial wisdom — where every student knows how to earn, save, and grow money responsibly.

🌍 5. Jielewe’s Vision for a Financially Empowered Generation

Jielewe isn’t just another app; it’s a movement toward financial empowerment and literacy for all Kenyans.

Its mission is to make financial understanding simple, practical, and accessible to everyone — from students to business owners.

By turning financial data into clear visuals and actionable insights, Jielewe is helping people build the very skills that schools should be teaching — awareness, discipline, and long-term planning.

🚀 Final Thoughts: Start Financial Education Now

If Kenya wants to build a financially stable future, we must start in the classroom.

Let’s teach our students not just how to make money — but how to manage it wisely.

With Jielewe, that vision is already taking shape. Every Kenyan can now learn, track, and take control of their financial story — starting today.

💡 Start your journey today at Jielewe.co.ke