University life is exciting, full of independence, social activities, and new experiences. But for many students in Kenya, financial management can be a challenge. Without proper planning, it’s easy to fall into money traps that affect your studies, social life, and future financial health.

Luckily, with the right strategies and tools like Jielewe, you can avoid common pitfalls and take control of your finances. Here’s a guide to the top 10 financial mistakes university students make and how to avoid them.

1. Overspending on Social Life and Entertainment

Many students splurge on parties, outings, and social events without tracking their spending.

How to Avoid:

- Set a monthly entertainment budget.

- Track every expense using Jielewe, so you know exactly how much you have left for fun.

2. Ignoring a Budget

Not having a budget is one of the fastest ways to run out of money mid-month.

How to Avoid:

- Create a simple monthly budget in Jielewe for tuition, rent, food, transport, and personal expenses.

- Review your spending weekly to stay on track.

3. Relying Too Much on Loans or Credit

Using student loans or credit cards without a repayment plan can lead to debt accumulation.

How to Avoid:

- Only borrow what you truly need.

- Record your loan and repayment goals in Jielewe to monitor your progress.

4. Not Saving at All

Many students don’t think about savings, even for small goals like books, gadgets, or emergencies.

How to Avoid:

- Start small — save a portion of your allowance or part-time income.

- Use Jielewe to set savings goals and track progress visually, making saving fun and motivating.

5. Impulse Buying

Buying items on impulse, like the latest gadgets, clothes, or snacks, can ruin a student budget.

How to Avoid:

- Make a shopping list before spending.

- Use Jielewe to categorize your purchases and identify impulse spending patterns.

6. Not Planning for Academic Expenses

Textbooks, printing, and study materials can add up quickly.

How to Avoid:

- Include academic expenses in your monthly budget.

- Track every academic expense in Jielewe to avoid surprises.

7. Poor Meal Planning

Eating out too often can drain your allowance fast.

How to Avoid:

- Plan meals and buy groceries wisely.

- Track food and dining expenses in Jielewe to see where you can save.

8. Not Keeping Track of Part-Time Job Income

Many students work part-time but fail to track income properly.

How to Avoid:

- Record every income source in Jielewe.

- Allocate funds for savings, essentials, and personal spending.

9. Ignoring Small Expenses

Small daily purchases like coffee, snacks, or transport can add up.

How to Avoid:

- Track every shilling, no matter how small, using Jielewe.

- Small adjustments can make a big difference by the end of the month.

10. Failing to Set Financial Goals

Without goals, students spend aimlessly, which leads to stress and financial problems.

How to Avoid:

- Set short-term goals (like buying a laptop) and long-term goals (like saving for post-graduation).

- Jielewe allows you to set, track, and achieve your financial goals easily.

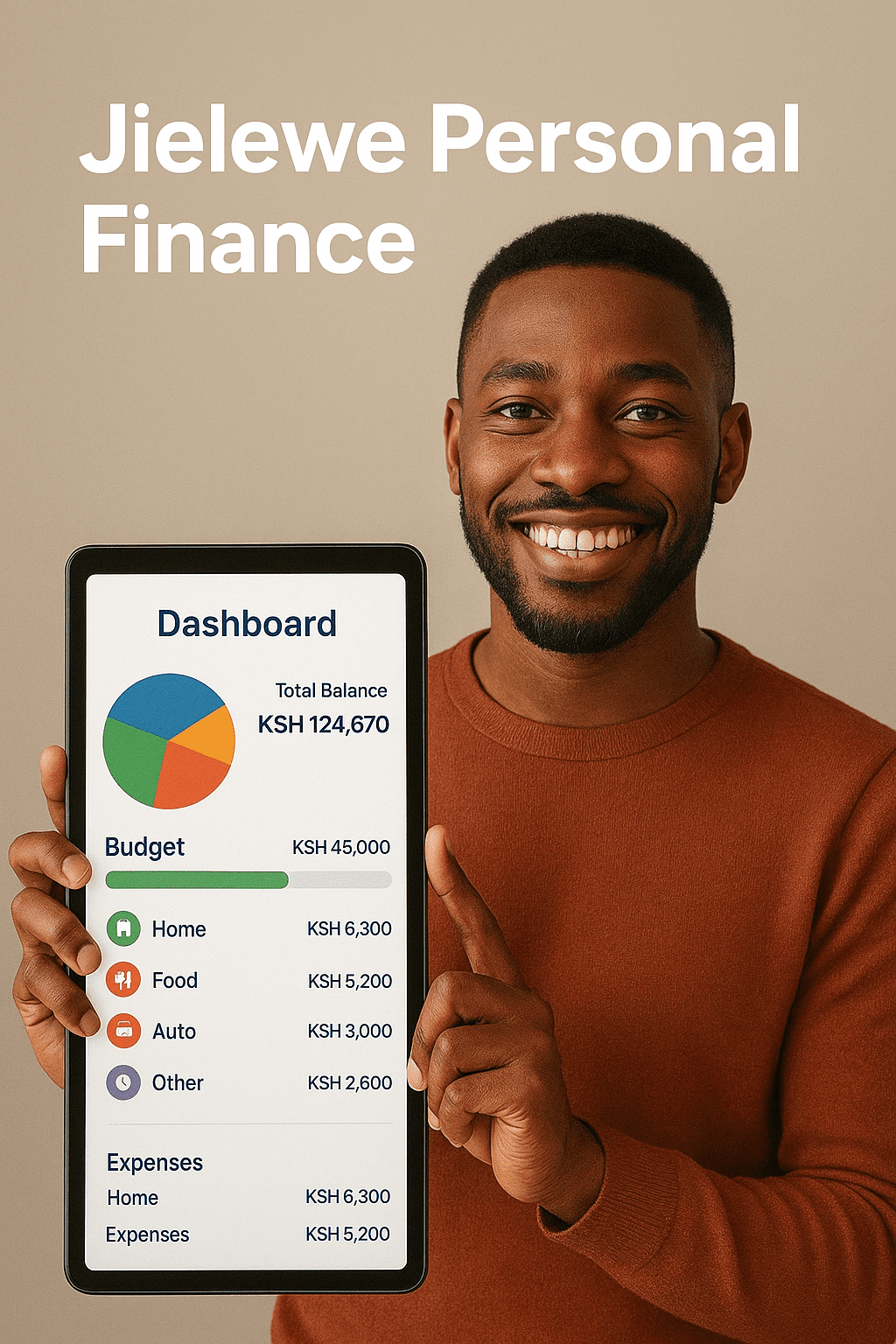

Why Jielewe is the Best App for Students

Jielewe is specifically designed to help students in Kenya manage their finances effortlessly:

- Budget Tracking: See exactly where your money goes each month.

- Goal Setting: Save for gadgets, trips, tuition, or personal goals.

- Expense Categorization: Identify areas where you overspend.

- Mobile-Friendly: Manage your money anywhere, anytime.

With Jielewe, staying on top of your finances is simple, visual, and even fun!

Take Control of Your Finances Today

Avoid the stress of financial mismanagement and make the most of your university life. Download Jielewe today and start budgeting, saving, and tracking your goals.

➡️ Visit jielewe.co.ke to get started!