Most people say they fear poverty, enemies, bad luck, or the economy. But the truth is simpler — the future you should fear most is the one you didn’t prepare for.

This idea sits at the heart of The Future You Should Fear: The Price You Will Pay for Every Year You Waste. It’s a powerful reminder that time is either working for you or against you — and there is no neutral ground.

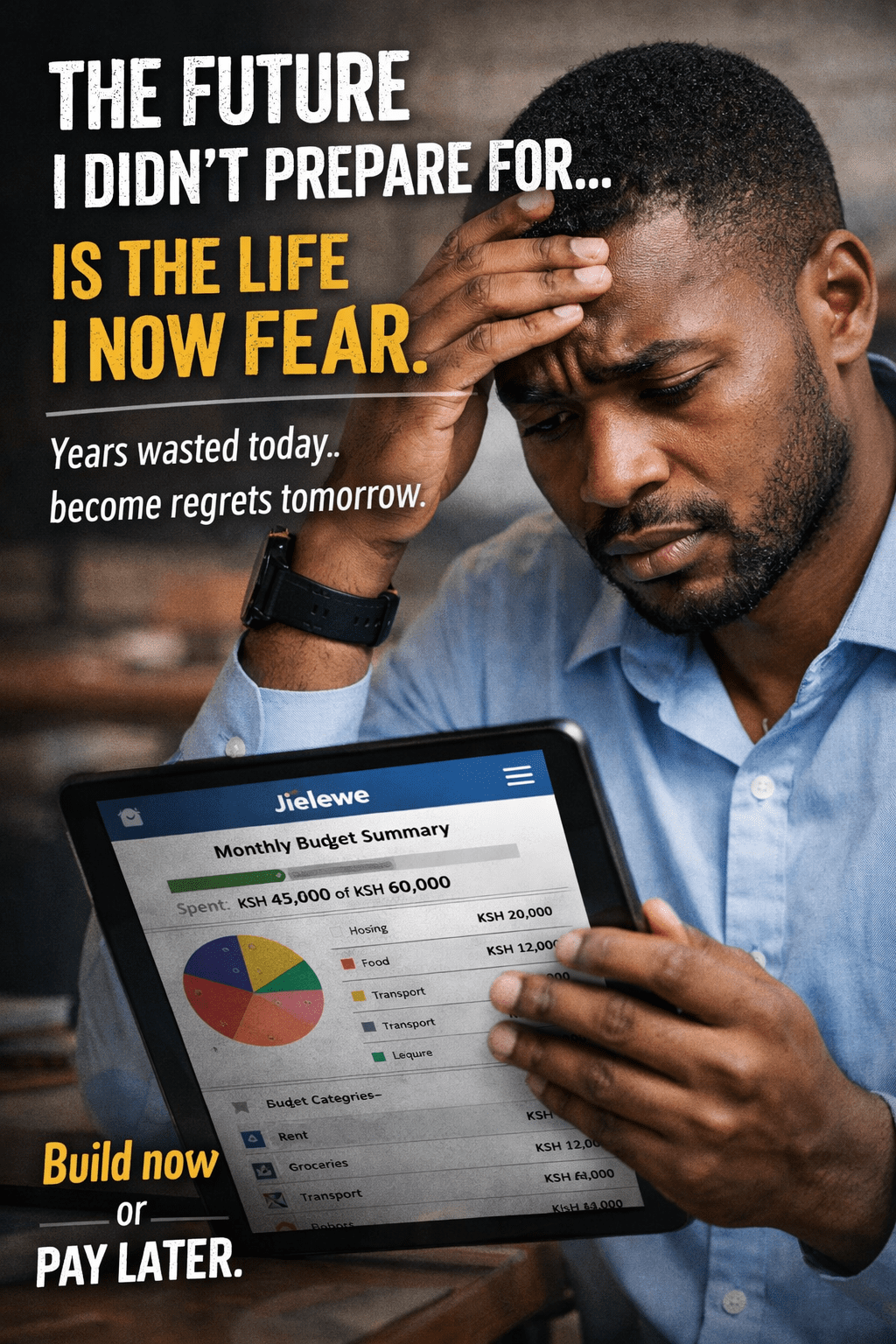

At Jielewe, where we help Kenyans take control of their personal finances, this message matters deeply. Because wasted years don’t just disappear — they come back as financial pressure, regret, and stress.

Time Is Expensive — You Just Don’t See the Invoice Yet

When you’re young, time feels unlimited. You tell yourself:

- “I still have time.”

- “I’ll get serious later.”

- “Things will work out somehow.”

But life keeps records.

Every year you delay building skills, saving money, or managing your finances properly, you accumulate a hidden debt. The bill doesn’t come immediately — it arrives later, when energy is lower and responsibilities are heavier.

The future doesn’t punish you for what you tried and failed at. It punishes you for what you never attempted at all.

The Dangerous Lie: ‘I’ll Fix It Later’

One of the most expensive lies people believe is that problems can always be fixed later.

In reality:

- Bills grow with age

- Responsibilities multiply

- Opportunities narrow

- Energy declines

If you don’t build financial discipline early, your future self pays the price. Not because life is unfair — but because compound neglect works the same way compound interest does.

What Wasted Years Really Cost You

The book’s core warning is simple: every wasted year charges interest.

Here’s how it shows up later:

- No savings when emergencies hit

- Dependence on debt for basic needs

- Stress from living paycheck to paycheck

- Regret from missed opportunities

At 25, poor money habits feel harmless. At 45, they feel suffocating.

The future you should fear isn’t dramatic — it’s quietly uncomfortable, financially unstable, and full of “if only” moments.

Fear the Unprepared Future, Not the Unknown

Many people fear things they can’t control — the economy, politics, or other people. But the biggest threat is often the version of yourself that never prepared.

A future without:

- Financial clarity

- Budgeting discipline

- Savings goals

- Spending awareness

…is a future filled with avoidable stress.

That’s why personal finance is not about being rich overnight. It’s about not becoming trapped later.

How to Protect Your Future Self (Starting Now)

The good news? You don’t need massive income to prepare for the future. You need consistency and visibility.

Here’s where tools like Jielewe come in.

By tracking your expenses, setting realistic budgets, and creating savings goals, you stop living blindly. You begin making decisions your future self will thank you for.

Small actions today:

- Tracking where your money goes

- Cutting unnecessary spending

- Saving intentionally

- Planning instead of guessing

…add up to massive relief later.

Your Future Is Watching What You Do Today

The future you should fear isn’t out to harm you.

It’s simply honest.

It will reflect:

- The habits you built

- The discipline you ignored

- The money you managed — or didn’t

Every year you waste has a price. But every year you invest wisely becomes protection.

Start now. Your future self is counting on you.

👉 Take control of your financial life today with Jielewe — because the best time to prepare for tomorrow is always now.

FAQ’s

When you delay managing your money, bad habits compound over time. You end up relying on debt, struggling with emergencies, and carrying financial stress into later years when responsibilities are higher.

Saving is hard because income often feels limited and expenses feel urgent. Without tracking and budgeting, money disappears unnoticed. Tools like Jielewe help bring visibility and control.

A good rule is to save at least 10–20% of your income. The key is consistency, not amount. Even small monthly savings grow into meaningful financial security.

No. It’s never too late — but the earlier you start, the less painful it becomes. Starting today prevents your future self from paying a higher price later.

Summary:

The Future You Should Fear reminds readers that the real threat is not external — it’s the consequences of wasted time and unprepared financial habits. Every year spent without budgeting, saving, or building discipline compounds into stress, debt, and missed opportunities later in life. The blog emphasizes taking control of your finances today using tools like Jielewe to track spending, plan budgets, and build savings. By acting now, you protect your future self and avoid the hidden cost of years lost.