In today’s Kenya, where the cost of living is rising and every shilling counts, budgeting is no longer optional — it’s a survival skill. Whether you’re a student, employed, running a small business, or part of a chama, having a clear plan for your money is the first step toward financial freedom.

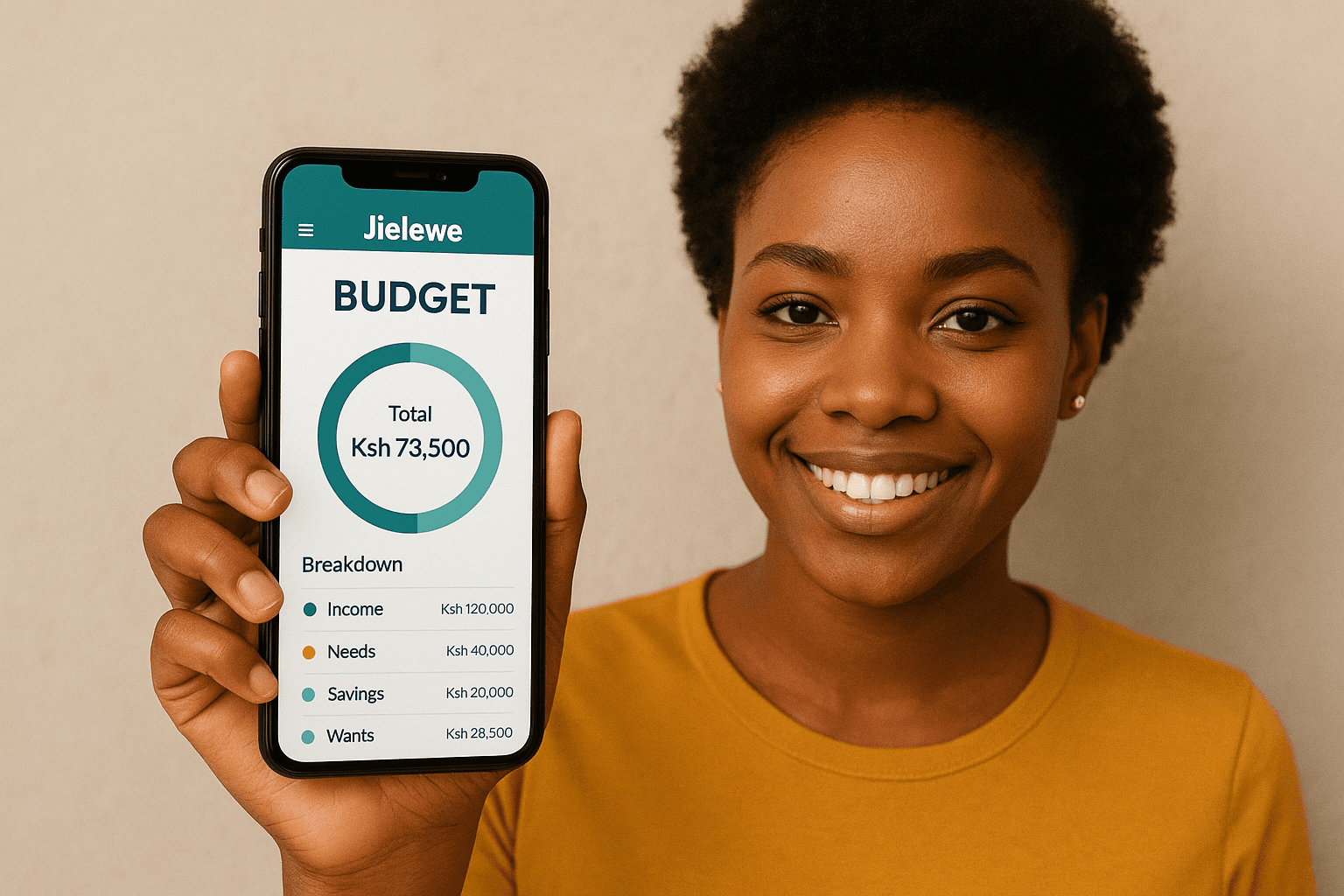

That’s why we built Jielewe — a simple, powerful app to help Kenyans budget smarter, track expenses, and save more.

Why Budgeting Matters in Kenya

- Cost of Living is Rising – Food, rent, and fuel prices continue to go up. Without a budget, it’s easy to spend more than you earn.

- M-Pesa Lifestyle – Many Kenyans transact daily on M-Pesa. While it’s convenient, it’s also easy to lose track of where your money goes.

- Savings Culture – Chamas and saccos have shown that when we plan, we save. Budgeting makes saving easier and more consistent.

- Financial Freedom – Budgeting is not about restriction — it’s about giving your money direction.

5 Practical Budgeting Tips for Kenyans

1. Track Every Shilling

From matatu fare to that quick lunch in town, record every expense. You’ll be shocked at how small costs add up.

👉 With Jielewe, all your expenses are tracked in one place automatically.

2. Use the 50/30/20 Rule (Kenya Edition)

- 50% – Needs (rent, food, transport, school fees)

- 30% – Wants (entertainment, dining out, luxuries)

- 20% – Savings & investments (chamas, saccos, stocks, or even emergency fund)

3. Leverage Technology

Gone are the days of paper notebooks. With tools like Jielewe, you can budget, categorize spending, and even set financial goals directly from your phone or laptop.

4. Plan for M-Pesa Charges

Many Kenyans forget to account for transaction fees. Add them to your budget to avoid hidden money leaks.

5. Set SMART Financial Goals

Whether it’s buying land, paying school fees, or saving for business capital, write down Specific, Measurable, Achievable, Relevant, and Time-bound (SMART) goals. Jielewe lets you create and track goals with ease.

Budgeting Challenges in Kenya — and How to Overcome Them

- Impulse Buying: Mitigate by setting spending limits in your budget.

- Irregular Income: For freelancers, boda boda riders, and hustlers, base your budget on average income, not best months.

- Peer Pressure: Social spending is real. Budgeting helps you say “yes” only when you can truly afford it.

Why Jielewe is the Best Budgeting App for Kenyans

Unlike generic finance apps, Jielewe is designed for Kenyans by Kenyans. It integrates well with how we live and spend:

✅ Simple interface for tracking M-Pesa, cash, and bank transactions

✅ Custom categories like “Chama”, “School Fees”, “Fuel”, “Shopping”

✅ Goal tracking to help you save for land, emergencies, or education

✅ Accessible anywhere — web-based and mobile-friendly

Final Thoughts: Your Money, Your Freedom

Budgeting is the bridge between where your money goes and where you want it to go. The earlier you start, the faster you’ll experience peace of mind and financial growth.

👉 Don’t wait until the end of the month to wonder where your salary went.

👉 Start budgeting today with Jielewe

Because financial freedom in Kenya starts with one word: Jielewe.