How to Get Out of Debt Fast Without Feeling Deprived

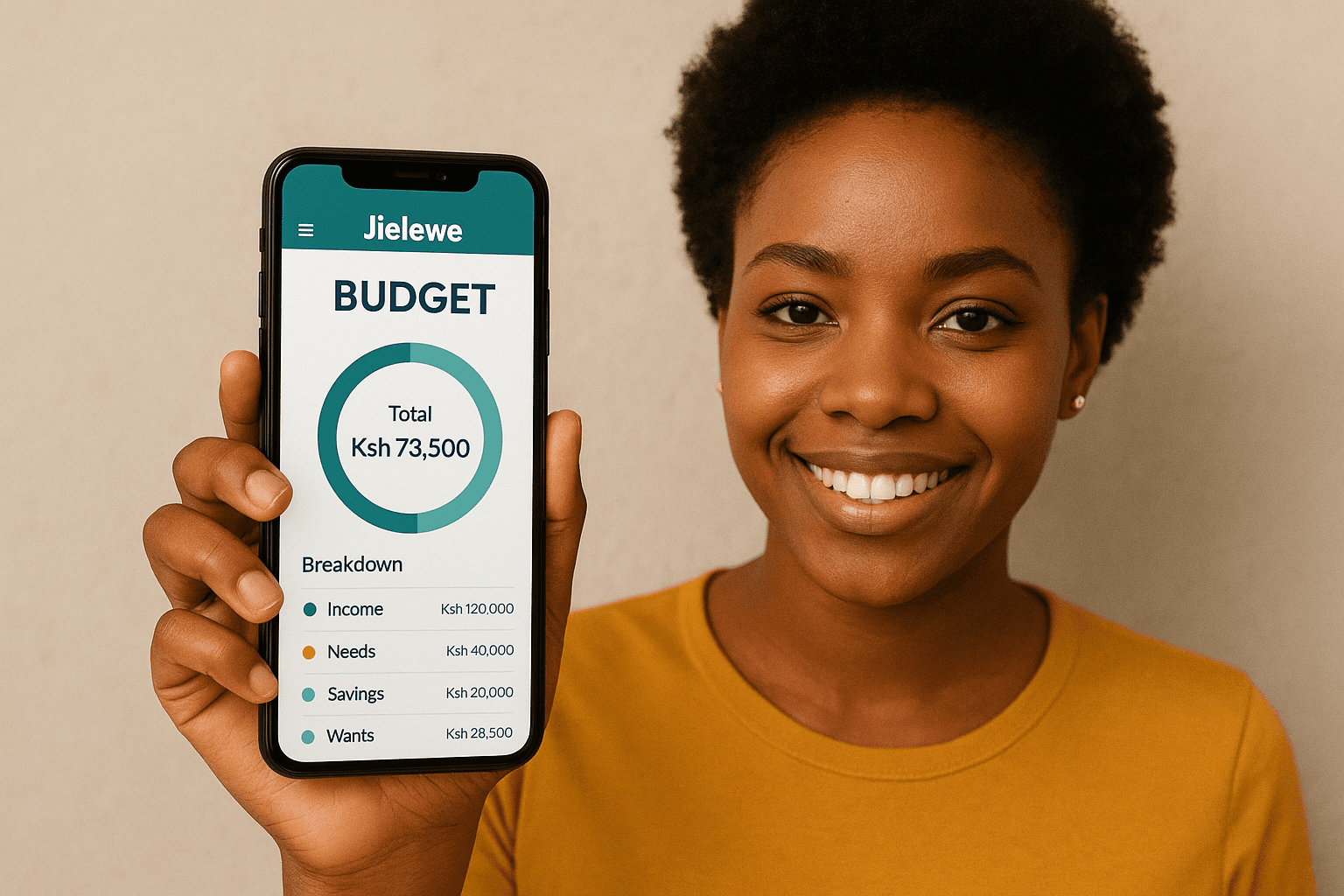

Debt can feel overwhelming — like a heavy chain that keeps you from living freely. But the good news is, you can break free from debt faster than you think, without sacrificing every joy in your life. The secret lies in smart planning, discipline, and using the right tools to track your progress. Here’s how … Read more