Online and Mobile Loans in Kenya: What You Need to Know

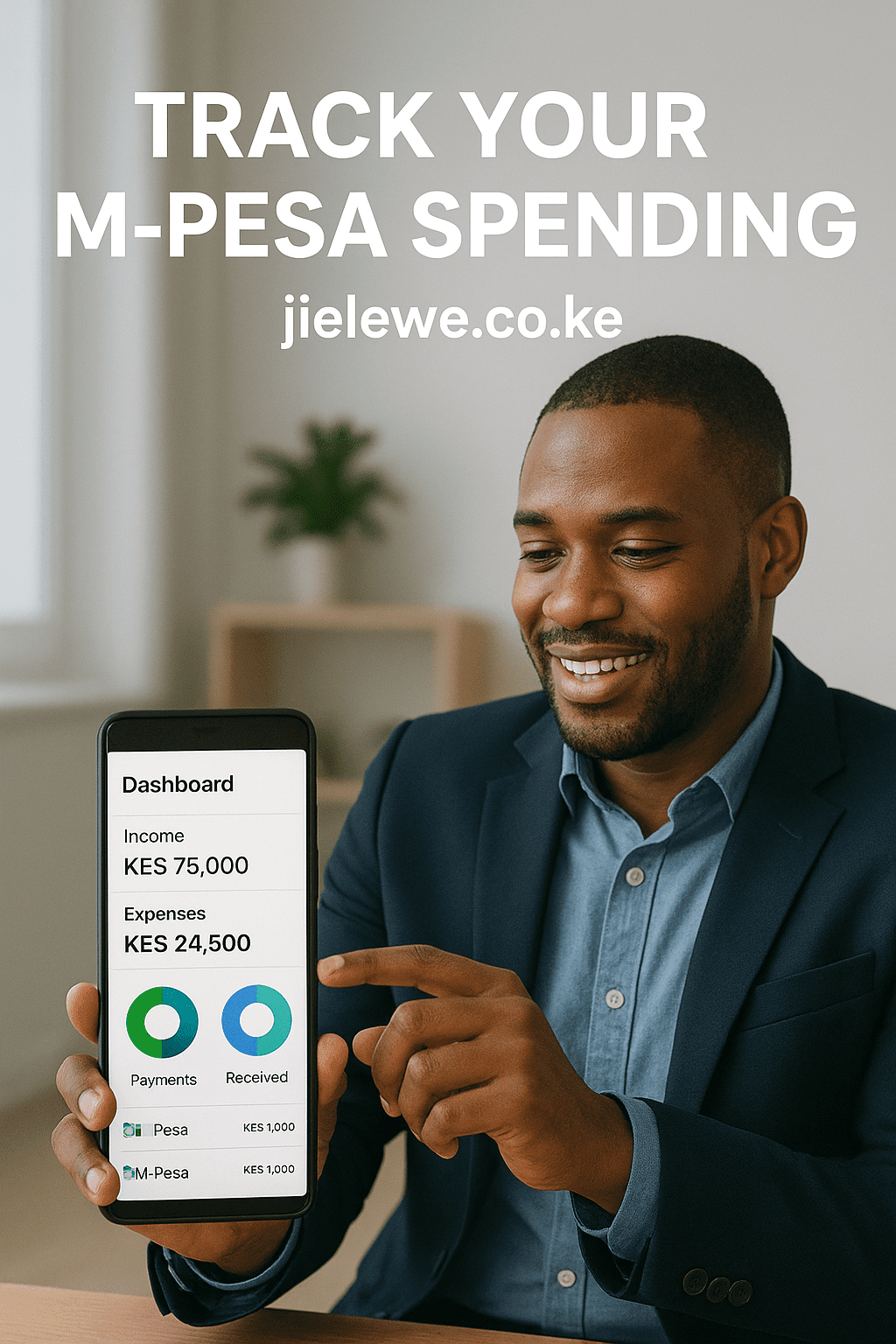

Introduction In Kenya today, online and mobile loans have become one of the most accessible ways to borrow money. Thanks to platforms like M-Pesa, mobile banking apps, and digital lenders, millions of Kenyans can access loans instantly without visiting a bank branch. But while these loans are convenient, they also come with risks. Understanding how … Read more