Best Apps for Saving and Budgeting in Kenya (2025 Edition)

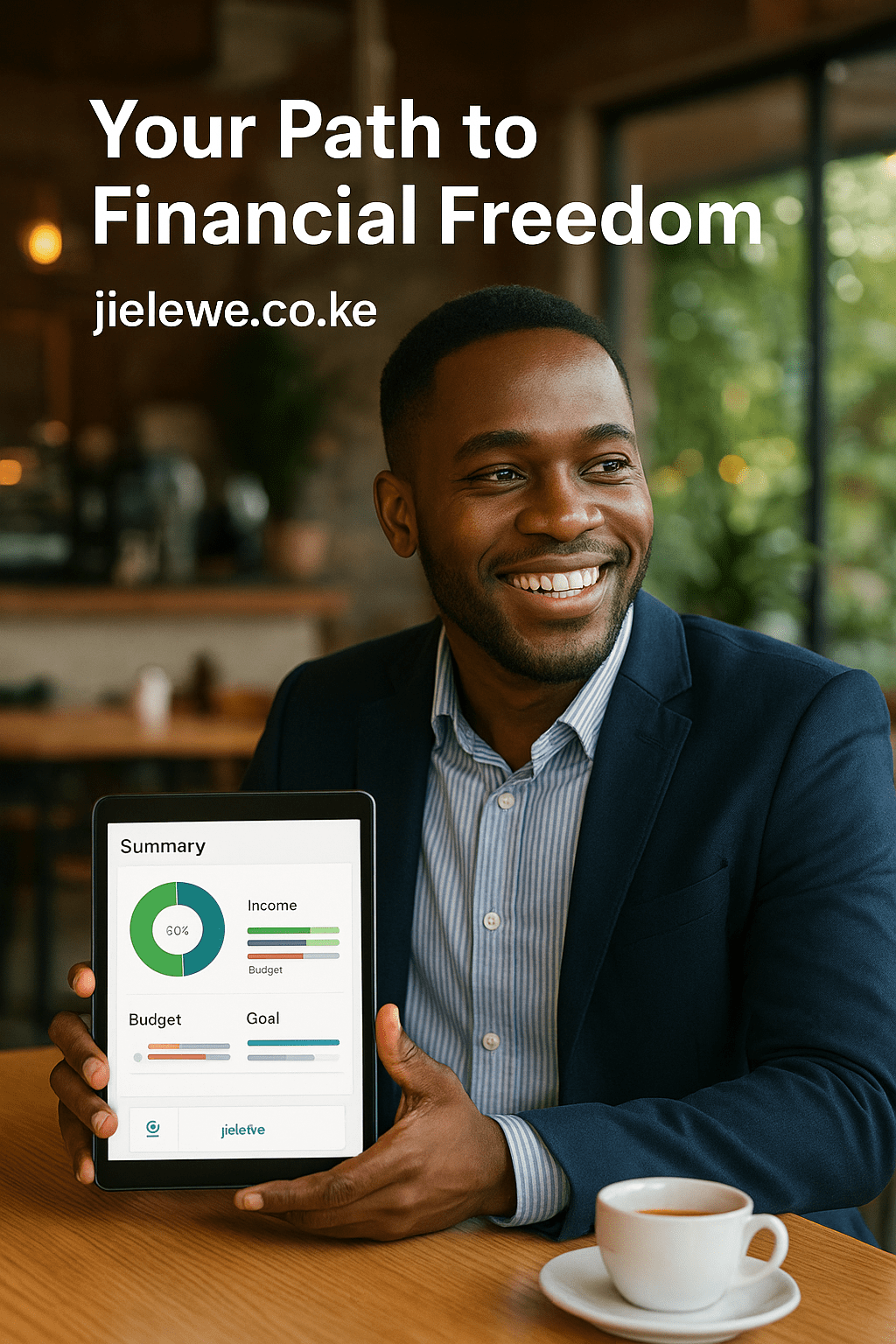

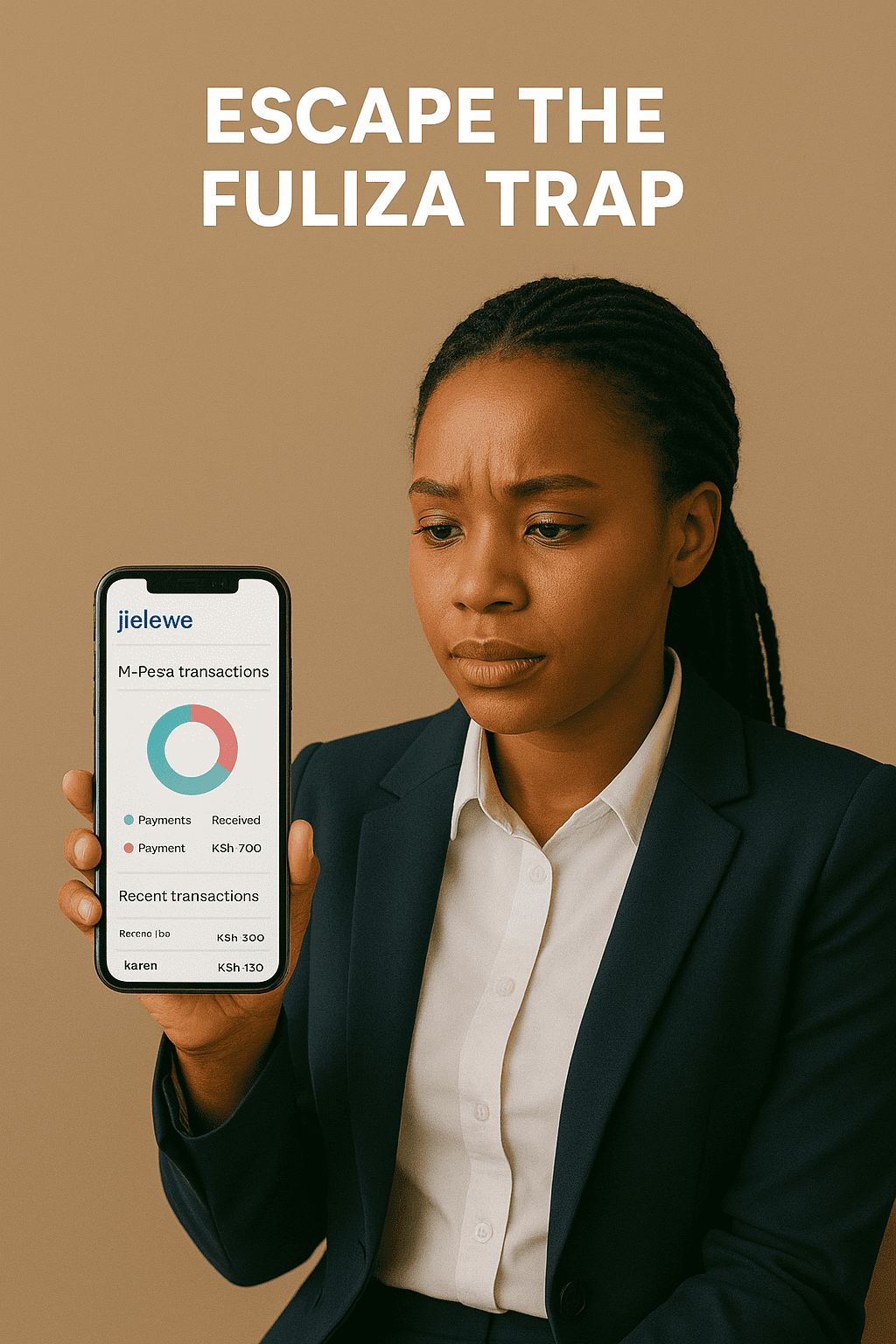

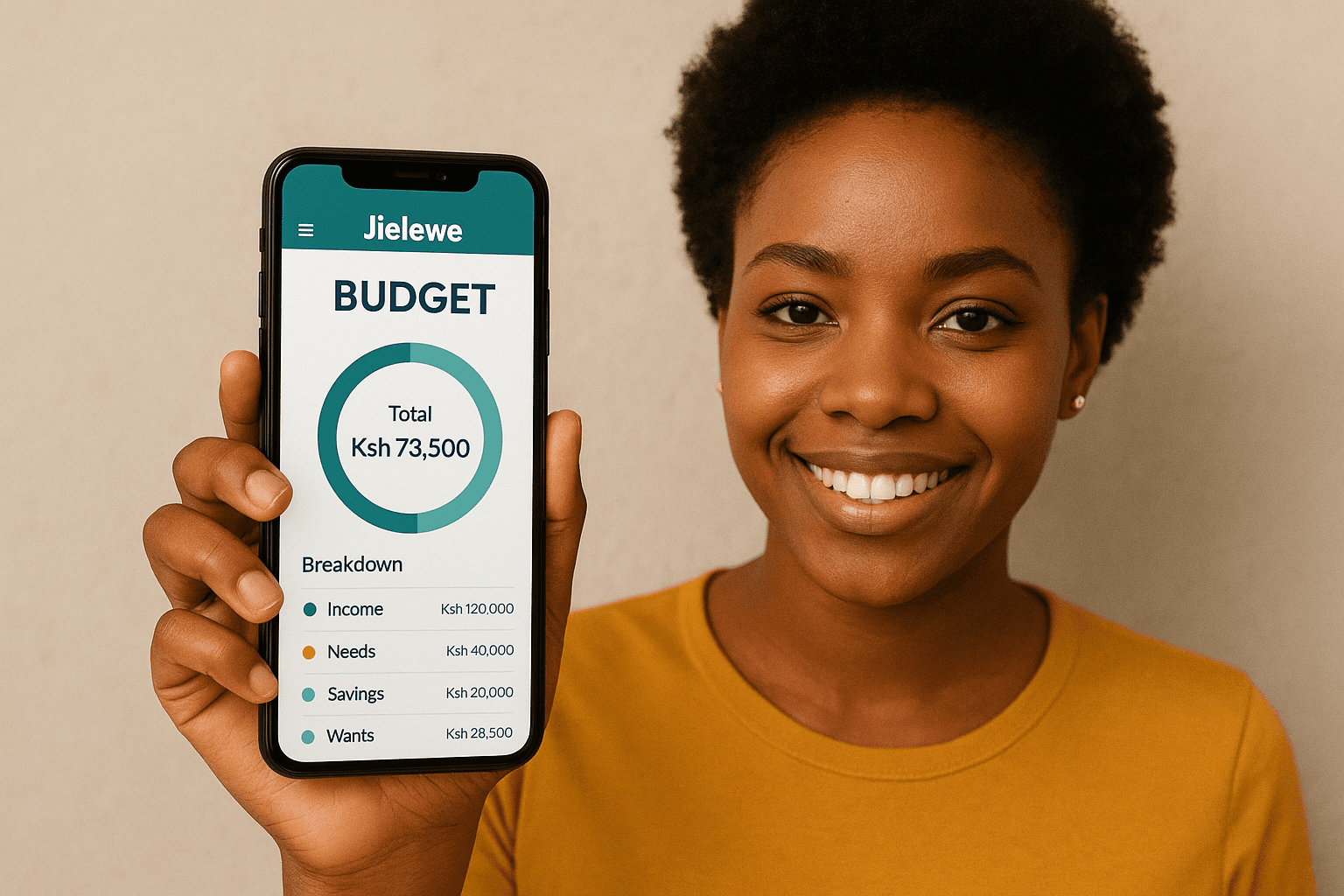

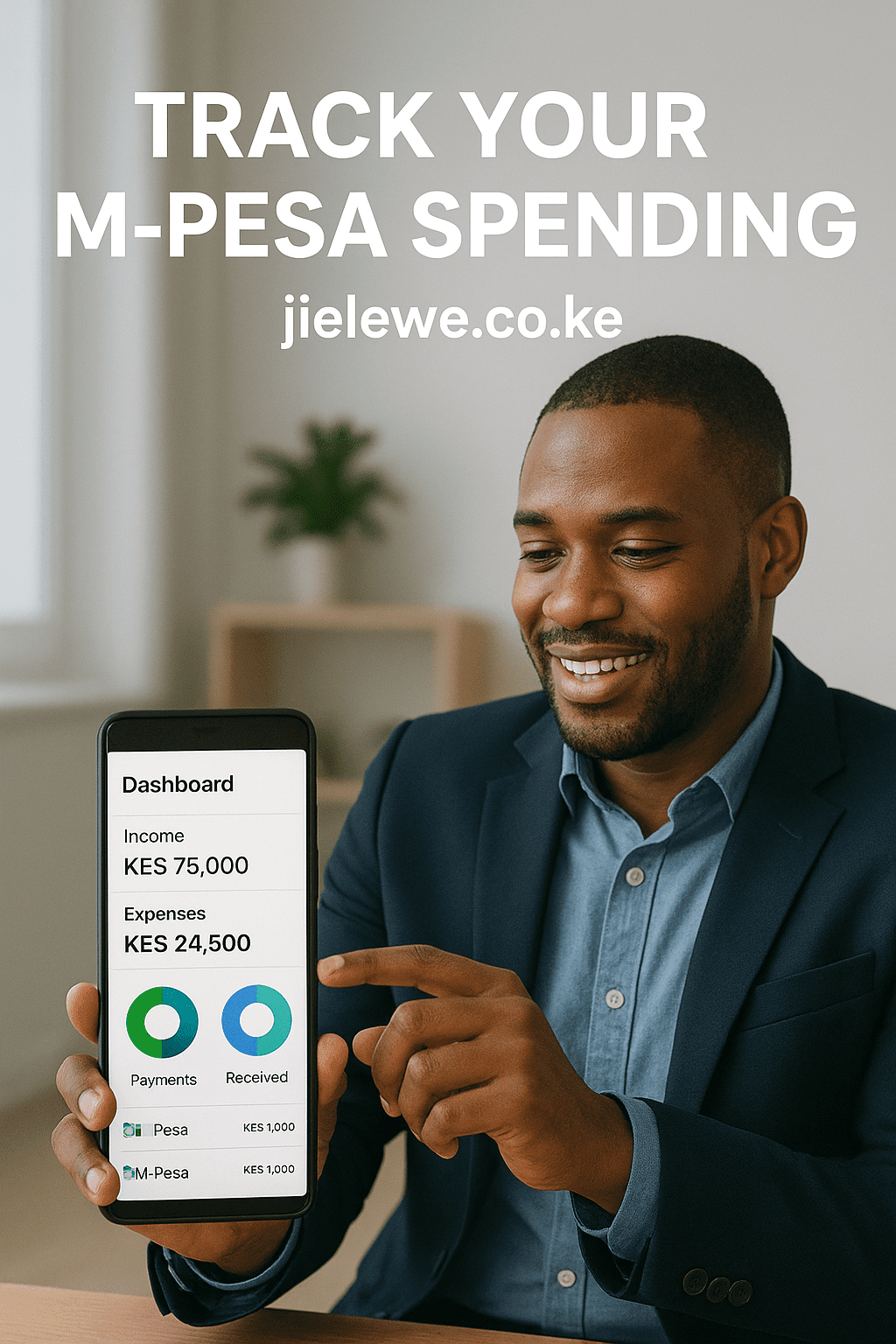

Why Use Saving and Budgeting Apps in Kenya? In Kenya, with M-Pesa’s ubiquity and heavily digital lifestyles, managing finances manually has become outdated and error-prone. Apps offer benefits such as: Top Saving & Budgeting Apps in Kenya 1. Money254 A Kenyan-made app ideal for hustlers and daily earners. It integrates with M-Pesa (via SMS), offers … Read more