Saving & Emergency Funds FAQs | Jielewe Kenya

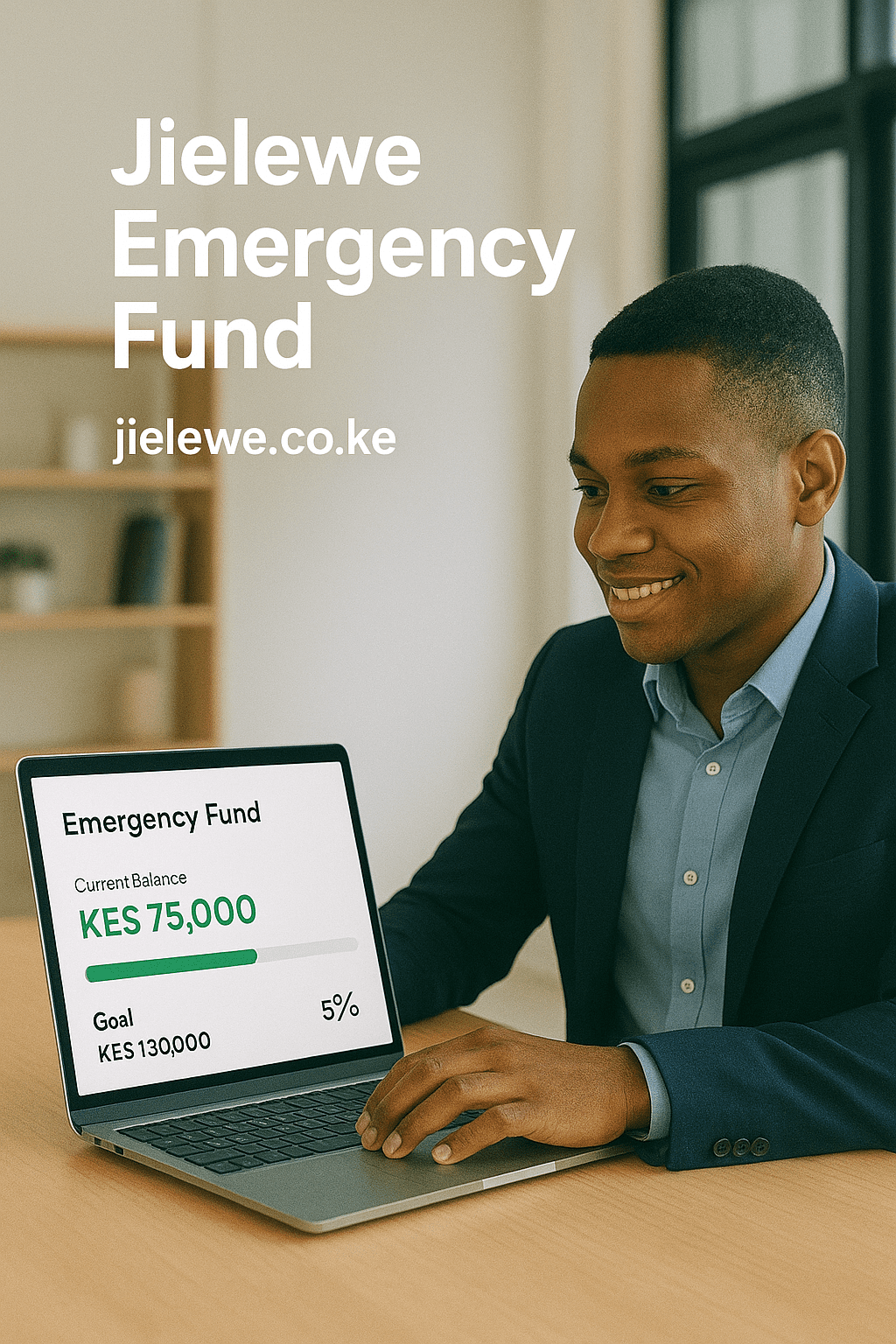

Saving money is one of the most important steps toward financial security. Whether you’re putting money aside for a long-term goal or preparing for unexpected emergencies, having a savings plan and an emergency fund ensures peace of mind. At Jielewe, we empower Kenyans to make smarter financial choices by providing tools and knowledge that make … Read more