How to Track Your Expenses in Kenya and Save More with Jielewe

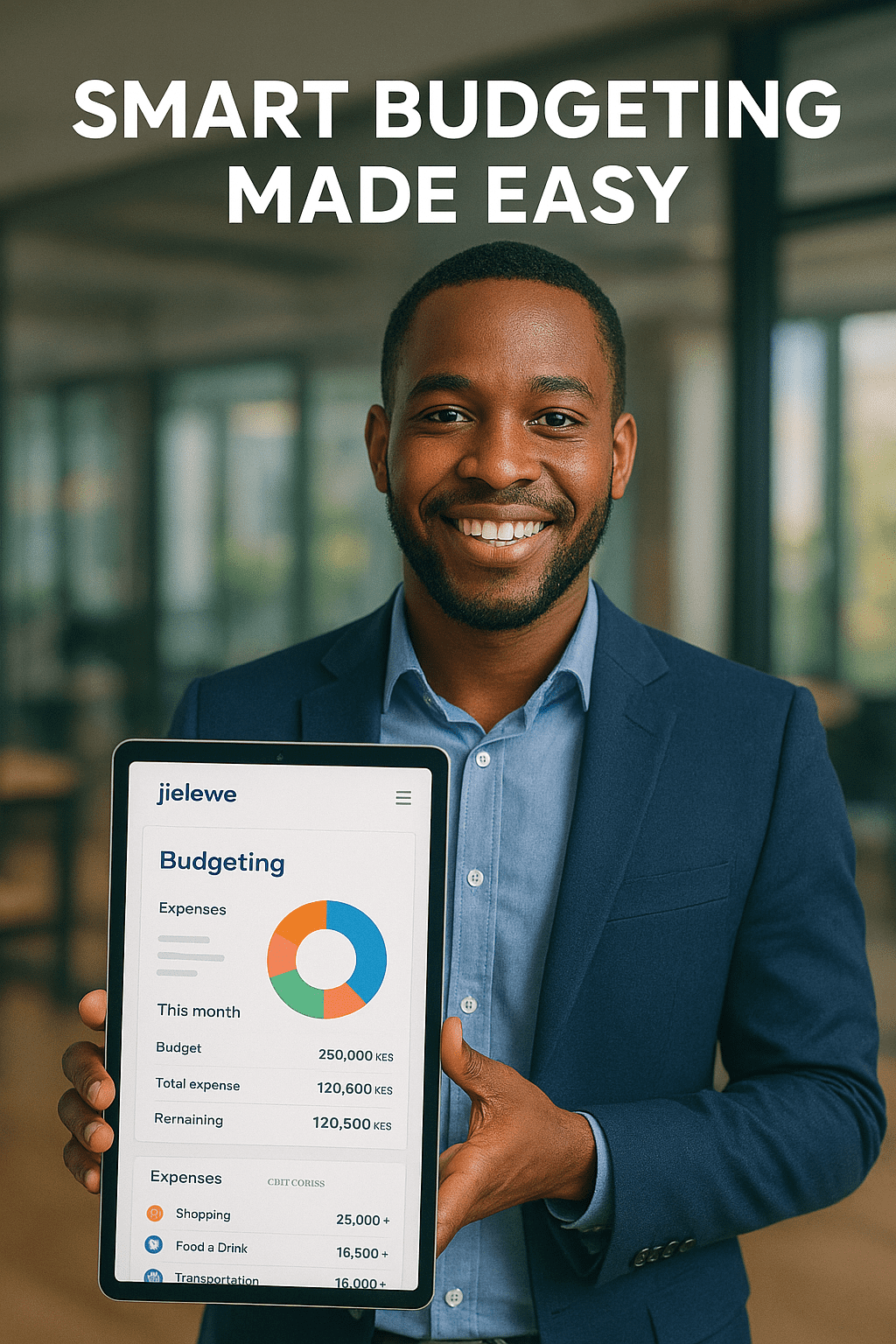

Introduction Have you ever reached the middle of the month and wondered, “Where did all my money go?” You’re not alone. Many Kenyans struggle with managing daily expenses, especially with rising costs of food, transport, and utilities. Between M-Pesa charges, impulse spending, and unexpected bills, money tends to “disappear.” The good news is that with … Read more