M-Pesa Loans, Fuliza, and Debt: How to Break Free and Regain Control

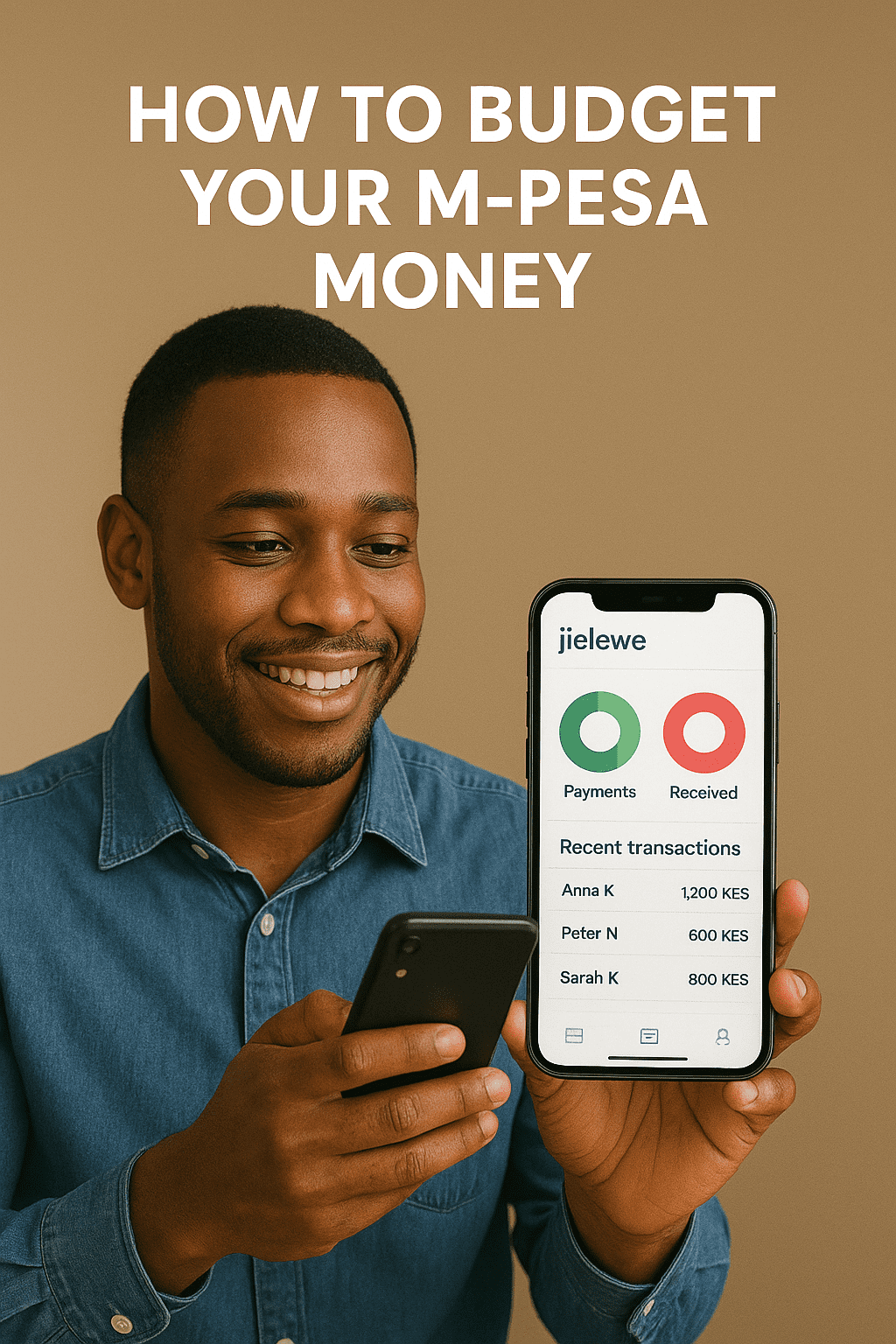

For many Kenyans, M-Pesa is more than just a mobile wallet—it’s a lifeline. From buying groceries to paying bills, M-Pesa has made money more accessible than ever. But with features like Fuliza, M-Shwari, and other M-Pesa loans, millions of people have slipped into a cycle of debt that feels impossible to escape. The truth is, … Read more