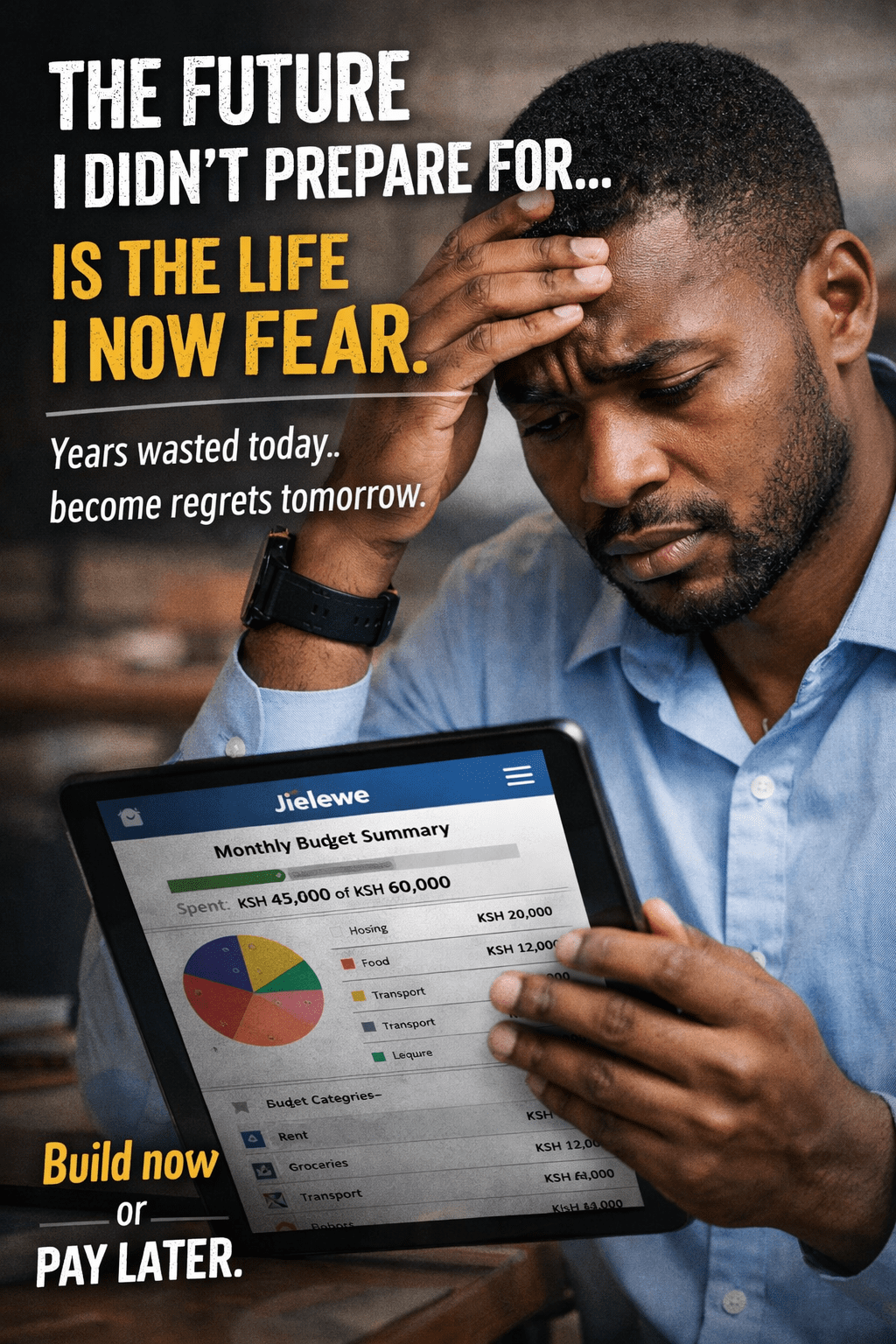

The Future You Should Fear: The Price You Will Pay for Every Year You Waste

Most people say they fear poverty, enemies, bad luck, or the economy. But the truth is simpler — the future you should fear most is the one you didn’t prepare for. This idea sits at the heart of The Future You Should Fear: The Price You Will Pay for Every Year You Waste. It’s a … Read more