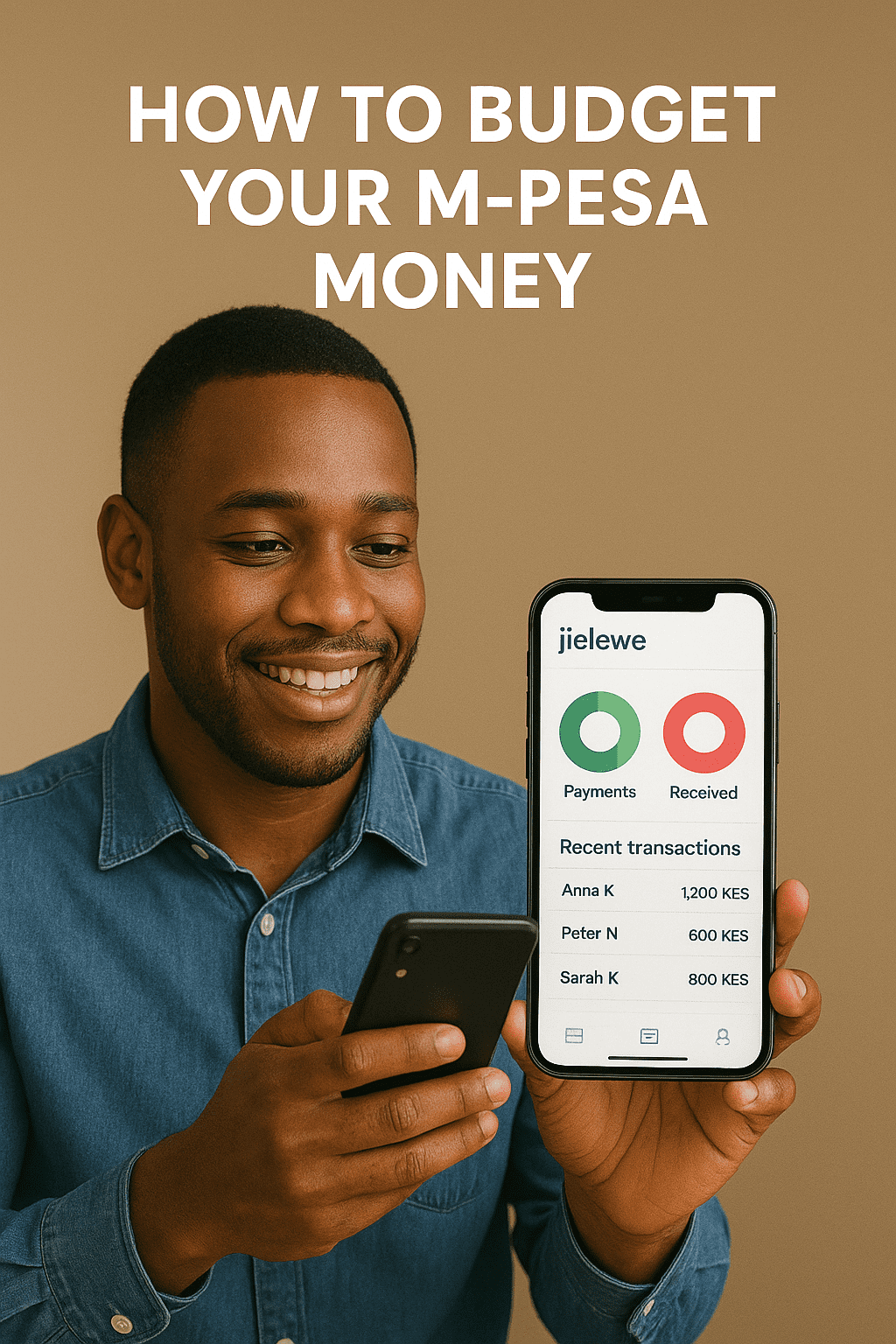

How to Manage Business and Personal Finances Separately

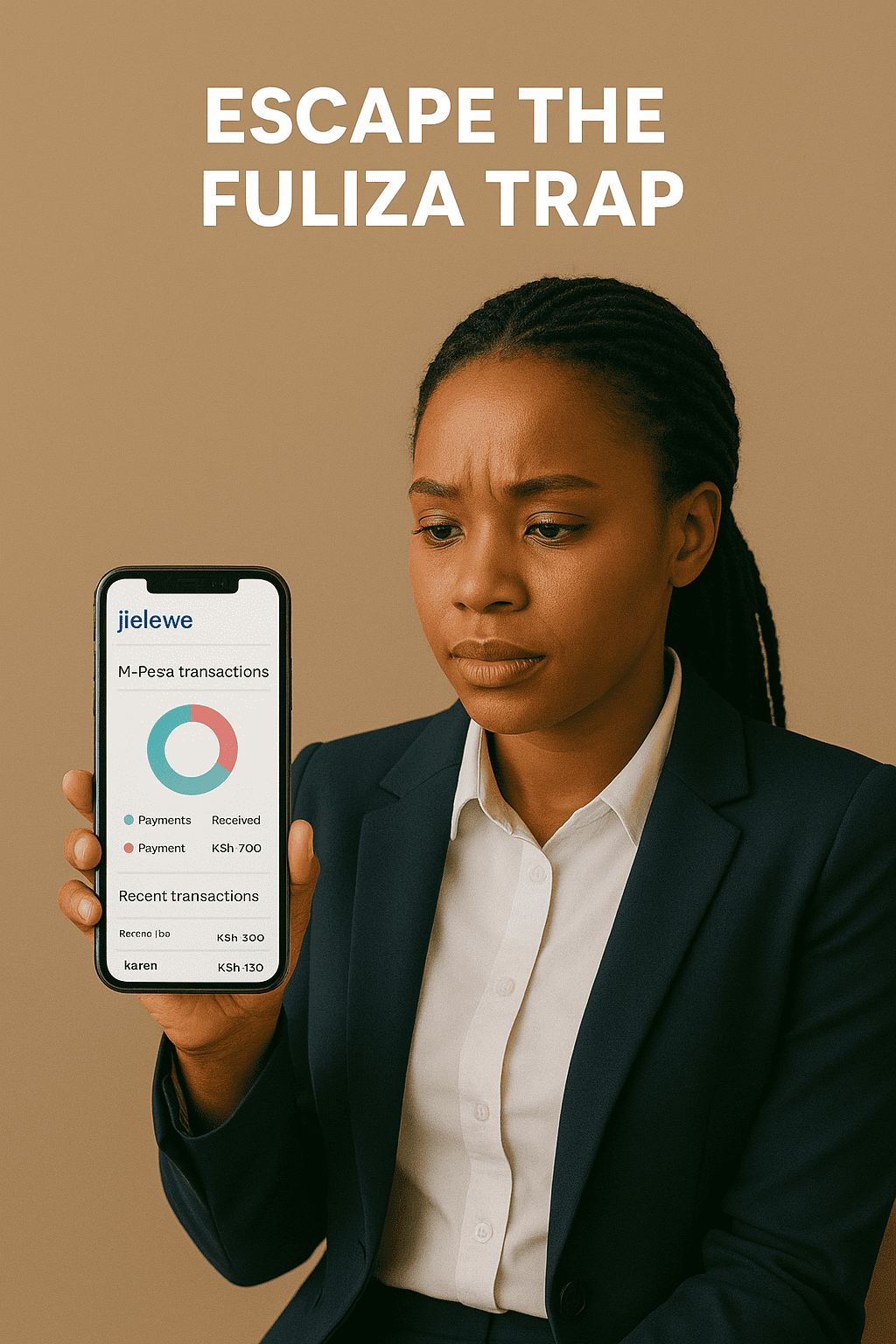

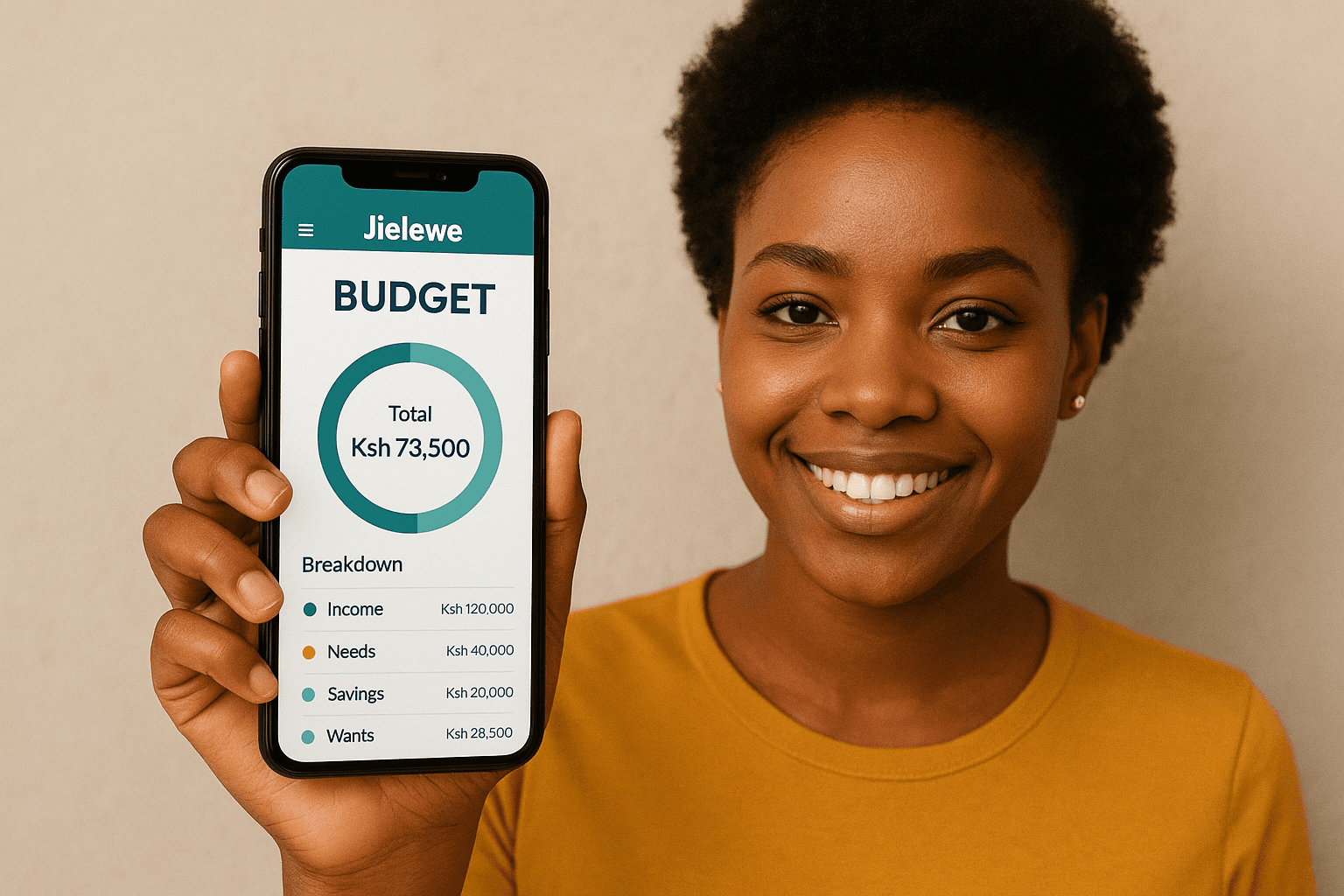

Introduction Many Kenyan entrepreneurs struggle to manage their business and personal finances separately. From the mama mboga at the roadside kiosk to the tech startup founder in Nairobi, one common mistake is mixing business revenue with personal expenses. While it may feel convenient to use the same M-Pesa or bank account, it leads to confusion, … Read more