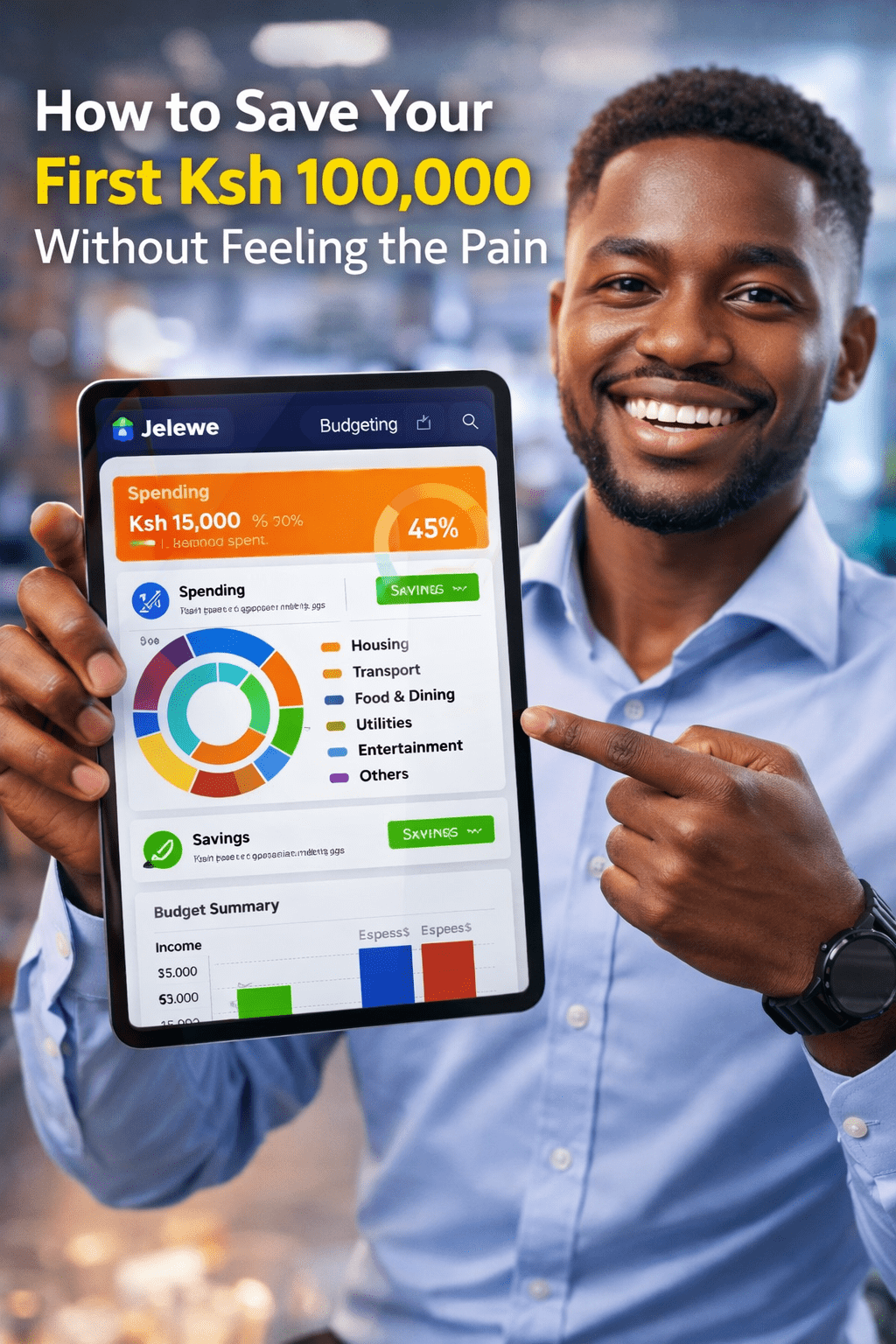

How to Save Your First Ksh 100,000 Without Feeling the Pain

Saving money might feel impossible, especially when your salary barely covers monthly expenses. But reaching your first Ksh 100,000 in savings doesn’t have to hurt. With the right habits, tools, and mindset, even young professionals in Kenya can hit this milestone without sacrificing their lifestyle. In this post, we’ll break down actionable steps, budgeting tips, … Read more