FAQs on Personal Finance, Budgeting, Investments, and Money Management

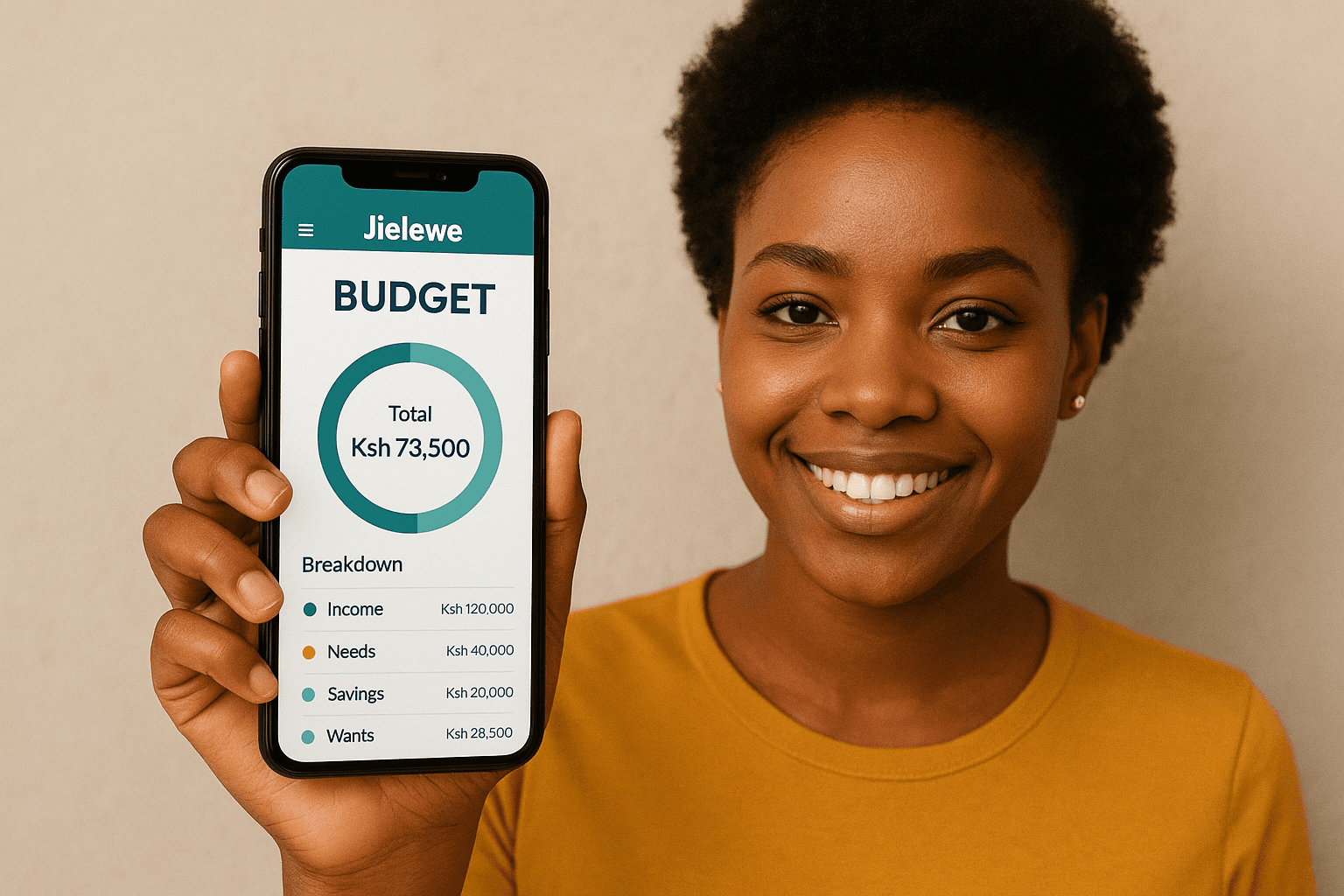

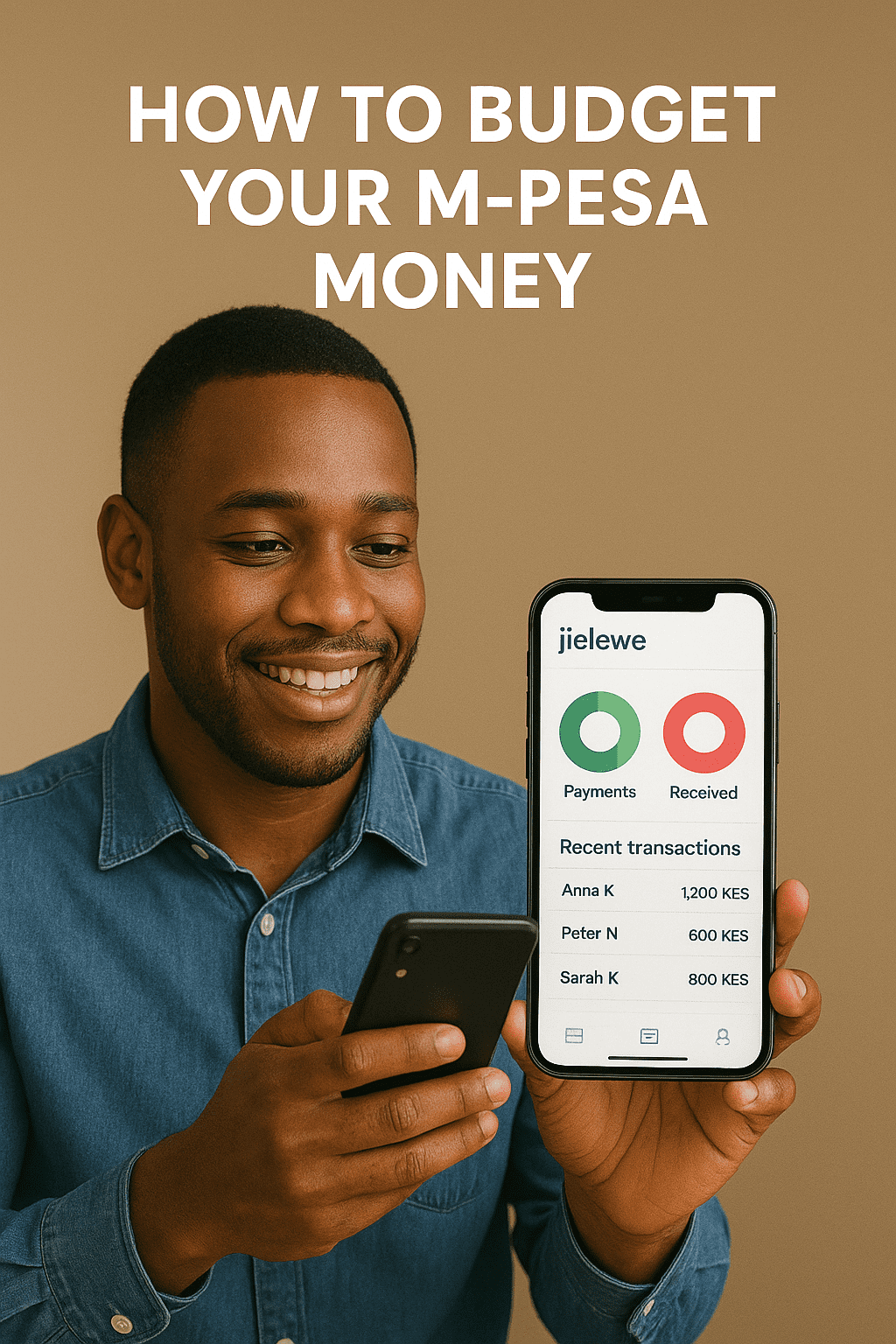

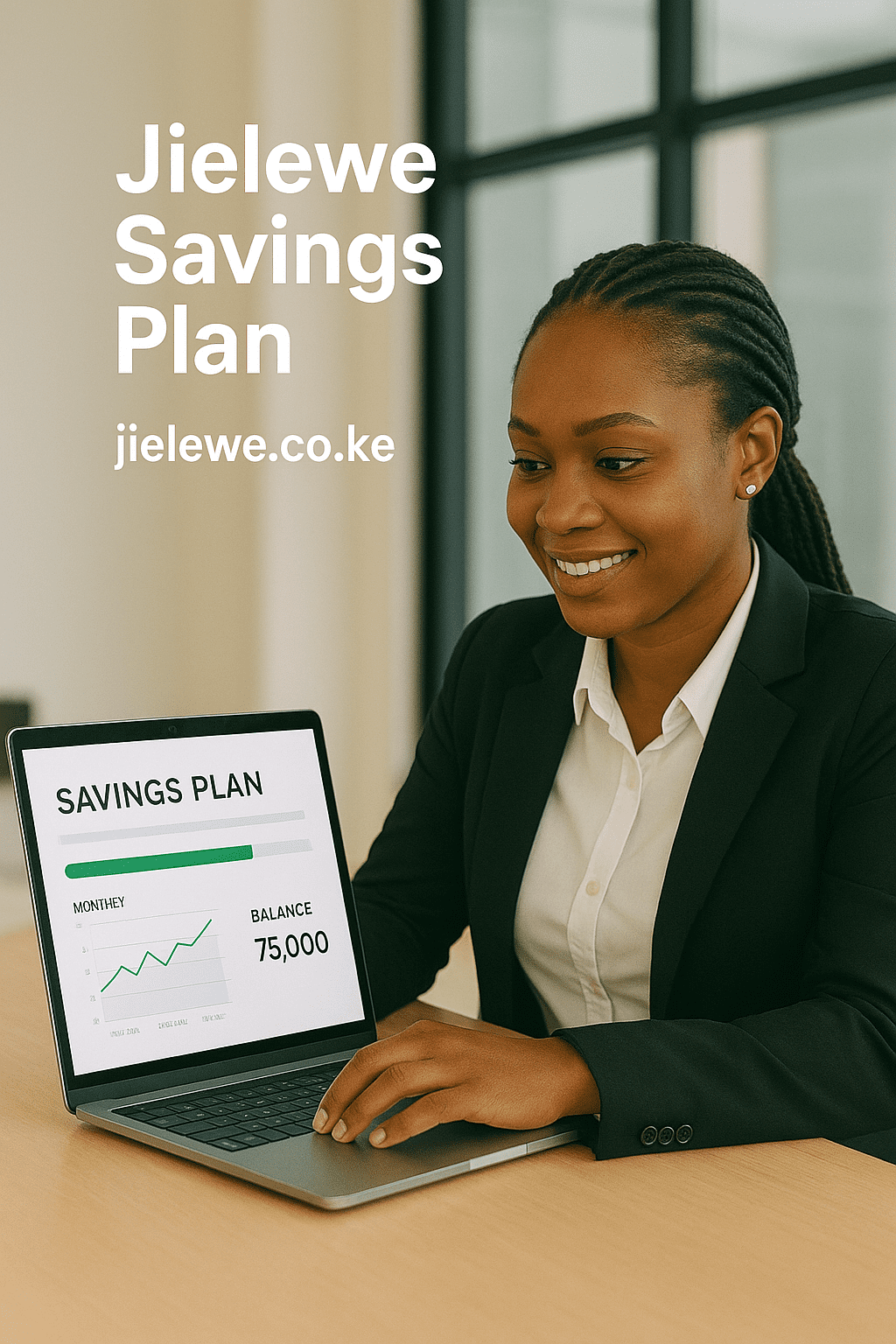

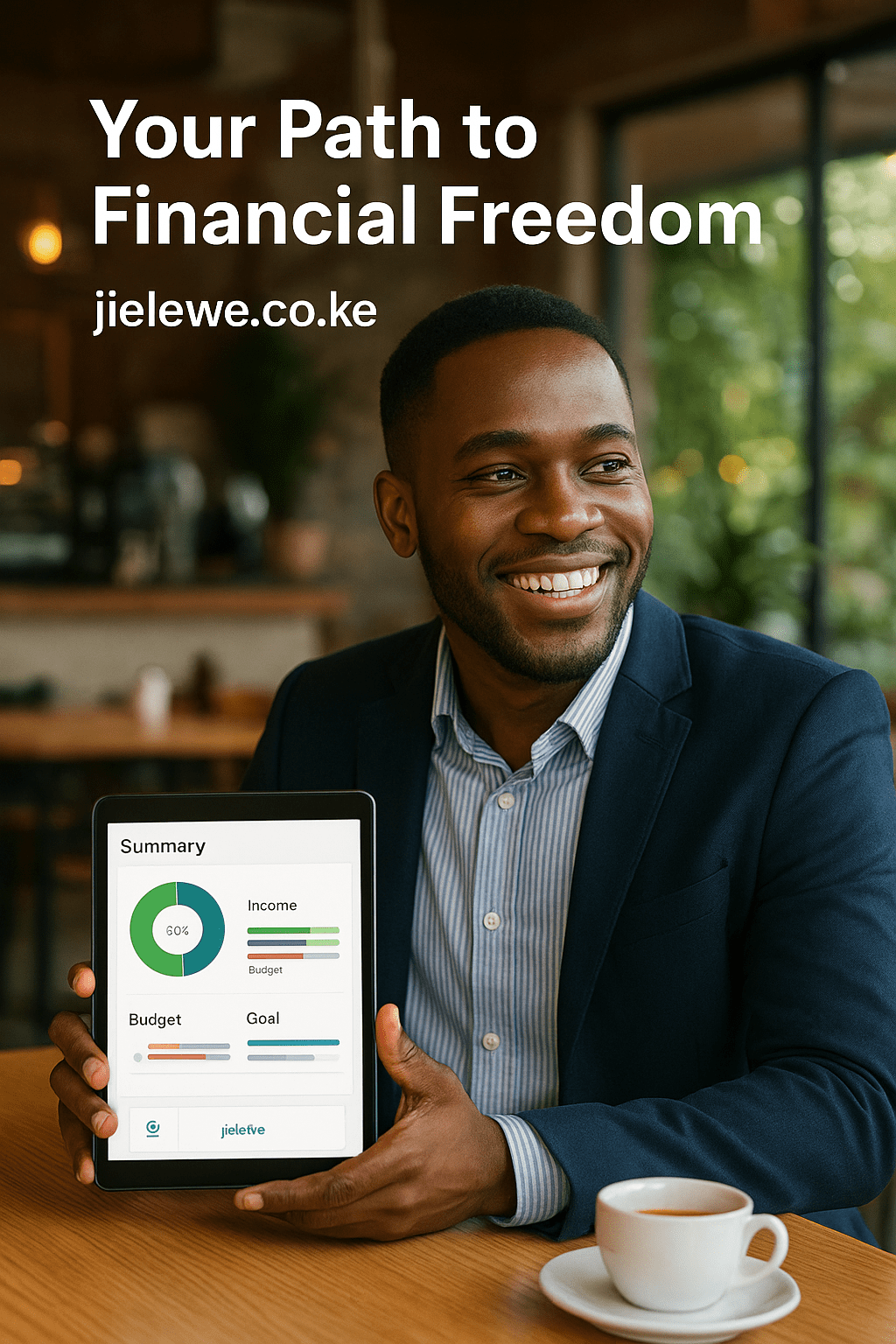

Financial freedom starts here – Jielewe.co.ke Budgeting & Expense Tracking Saving & Emergency Funds Investments & Wealth Building Debt Management Financial Goal Setting Lifestyle & Money Habits Taxes & Legal Financial Tips Money Mindset & Motivation Banking & Accounts Debt Management Financial Planning & Goal Prioritization Retirement & Long-Term Planning Insurance & Risk Management Side … Read more